How to Negotiate a Short Sale When the BPO Comes in Too High

BPO too high? Learn how to negotiate a short sale when the bank's price opinion is unrealistic and keep your deal alive.

# How to Negotiate a Short Sale When the BPO Comes in Too High If you’ve been in the short sale world long enough, you’ve seen it happen. You submit a clean file. The hardship is solid. The buyer is qualified. The offer makes sense. Then the bank orders a BPO… and it comes back $40,000 too high. Suddenly your short sale approval is “under review,” your buyer is nervous, and everyone is looking at you for answers. Here’s the good news: a high BPO does not kill a deal. It just changes the strategy. Let’s walk through how to negotiate a short sale when the valuation comes in above reality — and how an experienced short sale negotiator handles it. ## Step 1: Understand What the BPO Really Is A Broker Price Opinion is **not** an appraisal. It’s a quick, often surface-level valuation done by a local agent who may or may not understand distressed property value, short sale urgency, or market conditions. Common problems include: - Using retail comps instead of distressed comps - Ignoring condition issues - Overlooking neighborhood declines - Not entering the property This is where professional short sale processing makes a difference. Instead of arguing emotionally, you respond strategically. ## Step 2: Audit the BPO Like a Prosecutor When a BPO comes in high, the first move is not panic. It’s analysis. An experienced short sale specialist will: - Request a copy of the BPO - Compare every comp used - Check for square footage mismatches - Verify sale dates - Confirm condition adjustments - Identify superior vs. inferior properties If the BPO agent used renovated comps while your seller’s home needs a roof and HVAC, that’s leverage. If they used sales from six months ago while prices have softened, that’s leverage. Every error becomes negotiation material. ## Step 3: Submit a Proper Rebuttal Package This is where most deals fall apart. A short sale rebuttal is not a casual email saying, “We disagree.” It is a structured package that includes: - 3–5 better comps (with detailed adjustments) - A revised net sheet - Repair estimates - Updated photos documenting condition - Market trend commentary - Days-on-market data - Active competition analysis You are not just negotiating price. You are building a case. When we handle short sale approval assistance, we format rebuttals the way asset managers expect to see them. Clean. Organized. Data-backed. Banks respond to numbers, not frustration. ## Step 4: Escalate the Right Way If the negotiator refuses to adjust value, escalation may be necessary. But escalation is delicate. Push too hard and you stall the file. Push too soft and nothing changes. An experienced short sale coordinator knows: - When to request a second valuation - When to escalate to a supervisor - When to wait for updated comps - When to reposition the buyer Sometimes the solution is requesting a new BPO. Sometimes it’s asking for a formal appraisal review. Sometimes it’s adjusting the offer slightly while preserving buyer incentives. Negotiating a short sale is part art, part math. ## Step 5: Protect the Buyer While You Negotiate Here’s the real danger of a high BPO: The buyer walks. This is why communication matters. When we provide short sale assistance for realtors, we make sure: - Buyers understand the timeline - Agents understand strategy - Everyone knows we have a plan Transparency prevents panic. If you can confidently explain how you’re challenging the valuation, buyers are far more likely to stay in the deal. ## Step 6: Know When the Bank Is Bluffing Sometimes the bank pushes back hard on price simply to test the file. If there’s only one offer and it’s market-supported, lenders often adjust after sufficient documentation. But if there are multiple offers close to the BPO value? That’s different. A true short sale negotiator understands lender psychology. Some asset managers anchor high expecting pushback. Others genuinely rely on the BPO as gospel. Reading the room matters. ## Why This Is Where Deals Are Won or Lost Most short sales don’t die because the seller doesn’t qualify. They die because valuation disputes drag on too long or are handled poorly. When you’re helping real estate agents close short sales faster, you have to anticipate the valuation battle before it happens. That means: - Pre-pulling comps before submission - Preparing condition documentation early - Pricing strategically from day one This is exactly how we approach files inside our short sale processing system. We assume scrutiny. We prepare for it. If you’re an agent managing this alone, you’re juggling listing duties, buyer communication, and lender negotiation simultaneously. That’s a lot. That’s why many agents choose to outsource the negotiation side entirely. If you want to see exactly how we structure our approach, you can review how we handle valuation challenges and approvals here: 👉 [How We Help](https://www.crispshortsales.com/how-we-help) If you’re an investor or brokerage looking for structured short sale support, you can see who we typically work with here: 👉 [Who We Serve](https://www.crispshortsales.com/who-we-serve) And if you have a file right now that’s stuck because of a high BPO, you can start the short sale process here: 👉 [Start Short Sale](https://www.crispshortsales.com/start-short-sale) ## Final Thought A high BPO is not a rejection. It’s an invitation to negotiate. Handled correctly, it becomes leverage. Handled incorrectly, it becomes a dead deal. Short sale negotiation is not about arguing with the bank. It’s about presenting better data, controlling the narrative, and staying persistent without being reckless. That’s the difference between a file that sits… and a file that closes.

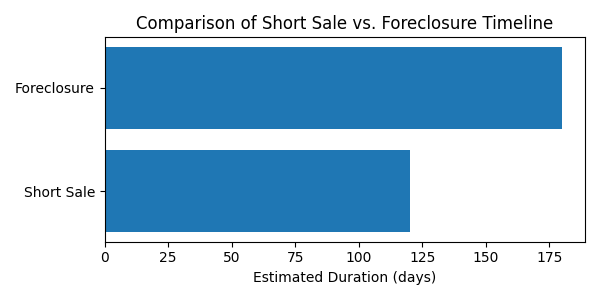

Short Sale vs. Foreclosure Timeline: What Homeowners Don’t Realize Until It’s Too Late

A breakdown of short sale vs. foreclosure timelines explaining how early short sale assistance helps homeowners maintain control, avoid delays, and minimize credit damage.

When homeowners fall behind on their mortgage, the conversation almost always centers on one question:

“How much time do I have?”

Unfortunately, that’s the wrong question.

The real difference between a short sale and a foreclosure isn’t just the final outcome—it’s who controls the timeline, the decisions, and the damage along the way. And most homeowners don’t realize how fast control slips away once foreclosure momentum starts.

Let’s break down what actually happens in each scenario, and why early short sale assistance can completely change the outcome.

The Foreclosure Timeline: Faster Than You Think

Foreclosure feels slow—until it isn’t.

Most homeowners assume they’ll receive plenty of warning before anything serious happens. In reality, the foreclosure timeline accelerates quickly once key deadlines pass.

Here’s what typically unfolds:

- Missed payments trigger default notices

- Legal filings begin (often before homeowners fully understand their options)

- Fees, legal costs, and interest stack up

- Decision-making shifts from homeowner to lender

- Sale dates get scheduled—even while homeowners are still “figuring things out”

Once foreclosure is in motion, options narrow fast. Loan modifications get denied. Buyers hesitate. And homeowners often discover too late that a short sale is still technically possible—but now much harder to execute cleanly.

This is where many deals fail: not because a short sale wasn’t allowed, but because it was started too late and without structure.

The Short Sale Timeline: Slower, but Strategic

A short sale doesn’t stop time—it replaces panic with process.

When started early and handled correctly, a short sale gives homeowners breathing room while maintaining control over key decisions like:

- Who buys the home

- When the sale closes

- How relocation is handled

- What the final credit impact looks like

Unlike foreclosure, a short sale timeline is driven by documentation, valuation, and lender review—not court schedules.

But here’s the catch: banks don’t wait forever.

Delays, missing documents, or sloppy communication can quietly push a short sale past the point of no return. That’s why experienced short sale processing matters far more than most homeowners realize.

What Homeowners Don’t Realize Until It’s Too Late

This is where timelines collide—and mistakes become permanent.

1. Waiting Does Not Buy Time

Many homeowners delay action because they’re overwhelmed or hopeful something will change. Unfortunately, waiting usually reduces options instead of preserving them.

By the time foreclosure notices feel “real,” lenders may already be less flexible.

2. Short Sales Are Front-Loaded

The most important work in a short sale happens early:

authorizations, hardship review, document accuracy, and valuation strategy.

If those pieces aren’t handled properly from the start, approvals stall—or get denied outright.

This is where a dedicated short sale coordinator or short sale negotiator makes a measurable difference.

3. Foreclosure Narrows Buyer Interest

Buyers get nervous when foreclosure timelines tighten. They worry about auctions, title issues, and approval risk.

That reduces leverage and limits offers—exactly the opposite of what homeowners need.

4. Relocation Help Is Time-Sensitive

Relocation assistance (often called “cash for keys”) is far more likely when a short sale is organized early and presented correctly. Once foreclosure progresses, those opportunities often disappear.

At Crisp, this kind of homeowner support is built directly into how we help distressed sellers navigate the process.

Control Is the Real Difference

A short sale isn’t just about avoiding foreclosure—it’s about preserving agency.

Foreclosure is something that happens to homeowners.

A short sale is something homeowners participate in.

When structured correctly, a short sale allows families to:

- Exit with dignity

- Avoid last-minute chaos

- Minimize long-term credit damage

- Move forward on their own timeline

That’s why we focus on short sale assistance that starts early, stays proactive, and doesn’t rely on hope or guesswork.

Whether we’re helping homeowners directly or supporting agents through the process, our role is to keep files moving, lenders engaged, and deadlines under control. You can see exactly who we work with on our who we serve page.

The Right Question to Ask

Instead of asking, “How much time do I have?” Homeowners should be asking:

“How much control do I want to keep?”

If foreclosure is already on the horizon, the window for a successful short sale hasn’t necessarily closed—but it is narrowing.

Starting the short sale process early, with experienced guidance, is often the difference between an orderly transition and a forced one. If you’re considering next steps, this is the moment to start the short sale process before decisions get made for you.

The Role of HOA Dues in Short Sales: What Realtors Need to Know

When it comes to short sales, most agents focus on the lender approval process—and for good reason. Banks and servicers ultimately determine whether the deal can close. But there’s another player that often gets overlooked until it’s too late: the homeowner’s association (HOA).

Unpaid HOA dues, special assessments and even HOA legal fees can derail a short sale just as quickly as a slow lender. Understanding how to identify and handle these issues up front can make the difference between a smooth closing and a deal that falls apart at the eleventh hour.

Why HOA Dues Matter in a Short Sale

When a homeowner falls behind on their mortgage, chances are they’ve also fallen behind on their HOA dues. Those dues don’t just disappear – they become a lien against the property, sitting in line with the mortgage lender, county taxes and any other encumbrances. Unlike property taxes or mortgages, HOAs usually don’t foreclose quickly. But they do have legal rights to collect. And in many states, HOA liens can take priority over mortgages for a portion of the unpaid balance. That means lenders will require the HOA to be dealt with before approving the short sale.

Types of HOA Charges You Might See

HOA balances often include more than just the monthly dues. Watch for these categories:

- **Regular assessments** – the monthly or quarterly fees every homeowner pays.

- **Late fees & interest** – penalties that accumulate after missed payments.

- **Special assessments** – one‑time charges for major repairs such as roof replacements, pool renovations or structural upgrades.

- **Attorney’s fees & court costs** – if the HOA has hired a lawyer or filed suit, the costs can quickly balloon.

It’s not unusual to see a $2,000 unpaid balance snowball into $10,000 or more once legal fees and assessments are added.

How HOA Liens Impact the Approval Process

Mortgage lenders want to know their lien is being satisfied – or at least partially resolved – in the short sale. If the HOA lien isn’t addressed, title can’t transfer cleanly. That’s why most short sale approval letters specifically list HOA dues and assessments as part of the settlement. But here’s the tricky part: banks don’t always agree to pay the full HOA balance. Some lenders cap what they’ll allow at $1,500 or $2,500, regardless of what’s owed. If the HOA demands more, someone has to make up the difference – either the buyer, the seller or, in rare cases, the realtor’s commission.

The Realtor’s Role in Managing HOA Payoffs

This is where proactive communication comes in. As the agent, you’re often the one coordinating between the lender, HOA and closing attorney. Here’s how you can stay ahead of problems:

1. **Ask early about HOA dues.** At listing, find out if the property is in an HOA and whether dues are current. A quick call to the management company can prevent ugly surprises later.

2. **Request an HOA estoppel or statement of account.** In many states, HOAs are required to provide a payoff figure upon request. This document outlines exactly what’s owed—including late fees, assessments and attorney’s costs.

3. **Communicate with the lender.** Submit the HOA payoff request with your short sale package. This allows the lender to address it in their approval terms.

4. **Negotiate where needed.** Sometimes the HOA will agree to reduce fees if they know a foreclosure is the alternative. Other times, the buyer may need to cover part of the balance as a condition of sale.

Real-World Example: The $12,000 Roadblock

We once worked on a Florida condo short sale where the HOA balance had grown to nearly $12,000 due to a $7,000 special assessment plus years of unpaid dues. The bank was only willing to pay $2,500 toward it. At first glance, it looked like the deal was dead. But after presenting the HOA with the reality—that a foreclosure would likely leave them with nothing—we negotiated the balance down to $5,000. The buyer agreed to cover the difference at closing, and the sale went through. Without addressing the HOA head‑on, the deal would have collapsed.

State Variations and "Super Liens"

Realtors should also be aware of state‑specific laws. Some states, like Florida and Nevada, give HOAs “super lien” status—meaning they can claim priority over mortgages for up to six months (or more) of unpaid dues. In these states, banks are particularly motivated to resolve HOA claims, but the process can be strict. Always check your local laws or lean on your closing attorney for guidance.

Best Practices for Realtors Handling HOA Short Sales

- **Don’t wait until title review.** By then, it’s often too late to negotiate or adjust contracts.

- **Educate your seller.** Many homeowners assume the bank will pay everything. Be upfront that HOA balances can complicate the deal.

- **Prepare your buyer.** If HOA balances exceed lender limits, buyers may need to contribute. Set that expectation early.

- **Work with an experienced short sale expert.** Having a negotiator who knows the ins and outs of HOA payoffs can save weeks of stress.

Final Thoughts

HOA dues may not be the first thing you think of when listing a short sale, but they can absolutely make or break a deal. By identifying the issue early, securing payoff statements and setting proper expectations with all parties, you’ll prevent last‑minute surprises and keep your deals moving smoothly. As with most things in short sales, the key is communication—between seller, lender, buyer, HOA and closing attorney. When everyone understands the stakes, you’re far more likely to get that approval letter and see your short sale cross the finish line. And if you ever find yourself facing an HOA hurdle, remember: there are always options. Foreclosure benefits no one—so with the right approach, most HOAs are willing to compromise to ensure a deal gets done.

Explore More Resources

For additional tips on navigating short sales, check out our pages on **How We Help**, **Who We Serve** and **Start a Short Sale**. With the right guidance, you can turn seemingly complex HOA situations into smooth closings.

Short Sale vs. Loan Modification: Helping Homeowners Choose the Right Path

Discover how short sales and loan modifications compare and learn which option can help homeowners avoid foreclosure and move forward with confidence.

When homeowners fall behind on their mortgage, the stress can feel overwhelming. Collection calls, past-due notices, and the looming threat of foreclosure create a sense of panic that makes it hard to see the options clearly. Two of the most common paths forward are a short sale and a loan modification. Both are designed to provide relief, but they work in very different ways.

So which is the right path? The answer depends on the homeowner’s situation, their goals, and the lender’s willingness to cooperate. Let’s break it down in plain English.

What Is a Loan Modification?

A loan modification is exactly what it sounds like: a permanent change to the terms of your existing mortgage. The lender may lower your interest rate, extend the length of the loan, or roll missed payments back into the balance. The goal is to make the monthly payment affordable so the homeowner can stay in the property.

Common features of loan modifications include:

– Interest rate reduction – dropping the rate to lower the payment.

– Extended term – stretching the loan out over more years.

– Forbearance of arrears – adding missed payments to the end of the loan.

– Principal reduction – rare, but sometimes lenders forgive part of the balance.

For homeowners who want to keep their house and have stable income going forward, a loan modification can be a lifesaver.

What Is a Short Sale?

A short sale happens when a homeowner owes more on the mortgage than the property is worth and negotiates with the bank to accept a sale for less than the balance due. The lender agrees to release the lien and forgive the deficiency (or at least not pursue it), allowing the homeowner to walk away from the property without foreclosure on their record.

Key features of short sales:

– The property is listed and sold on the open market.

– The lender must approve the contract before closing.

– Homeowners typically pay no out-of-pocket costs (commissions and closing fees are covered by the bank).

– Short sales usually take 60–120 days to process.

For homeowners who can’t afford the house anymore—or simply want a fresh start—a short sale provides closure and a path forward without the damage of foreclosure.

Comparing the Two

Factor | Loan Modification | Short Sale

--- | --- | ---

Goal | Keep the home | Transition out

Eligibility | Must show ability to pay going forward | Must show hardship and negative equity

Timeline | Usually 30–90 days | Usually 60–120 days

Impact on Credit | Negative, but less than foreclosure or short sale | Negative, but often less severe than foreclosure

Future Buying Power | Can usually refinance or buy again in 1–2 years | Can buy again in 2–3 years (Fannie/Freddie guidelines)

Emotional Factor | Relief of staying in the home | Relief of moving on cleanly

How to Decide

Choose loan modification if:

– You want to keep the property.

– You have steady income to support a reduced payment.

– You’re only behind due to a temporary setback (job loss, medical bills, etc.).

Choose short sale if:

– The house is too expensive even with lower payments.

– You’ve relocated, or the home is vacant.

– The property is worth significantly less than what you owe.

– You’re ready for a clean break and to move on.

The Role of the Lender

One thing homeowners don’t always realize: lenders don’t have to approve either option. A modification has to make financial sense for the bank, and a short sale has to net them at least as much—or more—than they’d get at foreclosure auction.

That’s where having an experienced negotiator makes all the difference. A strong package, clean documentation, and clear communication with the bank can mean the difference between approval and denial.

Where We Come In

At Crisp Short Sales, we specialize in making sure short sales actually close. Too many homeowners and agents try to go it alone, only to watch deals drag on for months or collapse completely. We streamline the process, deal directly with the lender, and make sure everything moves toward closing.

Whether you’re an agent representing a seller or a homeowner exploring your options, the first step is understanding which path fits your situation best. Sometimes a loan modification makes sense. Other times, a short sale is the smartest move.

Either way, the most important thing is not waiting until foreclosure is just days away. The earlier you take action, the more options you have—and the better the outcome.

Final Thoughts

A loan modification can give you breathing room and let you stay in your home. A short sale can help you avoid foreclosure and start fresh. Both are valuable tools, but the right one depends on your goals and your finances.

If you’re unsure which path is best, don’t try to figure it out alone. Talk to a trusted advisor who understands both processes and can guide you toward the solution that makes the most sense for you.

At Crisp Short Sales, we’re here to help homeowners and agents find that path—and get to the closing table with less stress and more certainty.

Why Cash Buyers Love Short Sales (and How Sellers Benefit)

When a homeowner is facing foreclosure, a short sale can feel like the only light at the end of a very long tunnel. But here’s a little secret: cash buyers—especially seasoned investors—absolutely love short sales. And that’s not a bad thing. In fact, when investors jump in, sellers often benefit in ways they didn’t expect.

Cash Buyers Thrive on Distress Deals

Investors make their living finding properties with built-in equity opportunities. A short sale is exactly that: a home being sold for less than what’s owed. Since banks are motivated to cut their losses rather than deal with foreclosure, these homes often hit the market below typical pricing.

For a cash buyer, it’s like walking into a clearance aisle. For a seller, this means your listing is far more attractive to investors, which increases the chances of getting an actual buyer under contract quickly. For more tips on keeping your short sale moving, check out our advice on why some short sales stall and how to keep yours moving.

Speed is the Name of the Game

Traditional buyers often need weeks (sometimes months) for loan approvals, appraisals, and underwriting. In a short sale, where every day counts, that delay can be deadly.

Cash buyers eliminate that problem. They don’t need mortgage approvals, so they can close faster once the bank issues its short sale approval. For homeowners, this can mean shaving weeks off the timeline—sometimes the difference between approval and foreclosure.

Banks Prefer Cash Buyers Too

Here’s something many agents and homeowners don’t realize: banks reviewing short sales love to see a cash offer. Why? Less risk.

Financing contingencies mean more opportunities for deals to fall apart. If a buyer’s loan is denied, the bank is back at square one. A cash buyer signals certainty—the deal is almost guaranteed to close once approved. That assurance can help push the file across the finish line, as explained in what happens after you accept a short sale offer.

Sellers Don’t Pay the Investor’s Discount

One common misconception is that if an investor gets a “deal,” the seller somehow loses out. Not true in a short sale.

Remember, the seller isn’t pocketing any money in the transaction—the lender is the one taking the loss. So when an investor buys at a discount, it doesn’t harm the homeowner’s bottom line. In fact, sellers still get the same benefits: avoiding foreclosure, wiping out debt, and potentially qualifying for relocation assistance.

Relocation Assistance is Still on the Table

Cash buyers don’t interfere with relocation incentive programs. In fact, a strong cash offer may make it more likely that the deal closes, which means the homeowner actually receives the relocation funds (instead of losing them if the short sale collapses).

The Win-Win Dynamic

At first glance, it might feel like investors are just hunting for bargains at a seller’s expense. But in reality, their motivation to buy fast and close reliably is exactly what makes short sales succeed.•.

• Investors win by securing a property below retail.

Homeowners win by avoiding foreclosure, protecting their credit, and moving forward with dignity.•

That’s the essence of a short sale: everyone gives a little, but everyone gains something too.

Final Thoughts

Cash buyers aren’t the enemy in short sales—their ability to pay cash and move quickly often turns them into the heroes. If you’re a homeowner considering a short sale, don’t shy away from investors. Their ability to pay cash and move quickly could be the very thing that saves your home from foreclosure and gives you the fresh start you need.

At Crisp Short Sales, we specialize in bringing these pieces together—negotiating with banks, connecting with serious buyers, and ensuring sellers walk away with the best outcome possible.