Who Owns the Clock in a Short Sale? Agents, Lenders, or the Coordinator

One of the most common frustrations in a short sale is the feeling that time is slipping away — and no one seems fully in control of it. Agents blame lenders. Sellers blame agents. Buyers get impatient. And lenders just keep asking for "one more document."

So who actually owns the clock in a short sale?

The honest answer: no single party owns it outright — but one role usually controls whether the clock keeps moving or stalls completely. Understanding how time responsibility is divided (and where it breaks down) is the difference between a smooth closing and a deal that quietly dies.

Let’s break it down.

The Lender: Controls the Pace, Not the Progress

Lenders undeniably control approval authority. They decide when the file is reviewed, whether a valuation is acceptable, if the net meets investor guidelines, and when final approval is issued. But lenders are almost entirely reactive; they don’t move faster because a buyer is anxious. They don’t prioritize files because a listing agent calls every day. And they rarely flag problems proactively. If something is missing or outdated, the file often just sits — no alerts, no warnings, no urgency.

From a timing standpoint, lenders:

- Set internal review cycles

- Pause files without notice

- Reset clocks when documents expire

They own the decision, but not the day-to-day momentum.

The Agent: Manages Expectations, Not the File

A good real estate agent plays a critical role in a short sale, but that role is often misunderstood.

Agents are responsible for:

- Pricing strategy and offers

- Buyer communication

- Seller guidance and emotional support

- Keeping the transaction together publicly

What agents are not typically positioned to do is manage deep short sale processing:

- Tracking lender-specific document requirements

- Monitoring expiration dates on financials and authorizations

- Escalating stalled files through the correct lender channels

- Responding to valuation disputes with compliant rebuttals

Most agents are juggling multiple listings, buyers, showings, and contracts. Even very experienced agents can struggle to give a single short sale the daily attention it quietly demands.

Agents help set the clock, but they usually don’t control its movement.

The Seller: Starts the Clock, Then Waits

Sellers play an important early role:

- Completing financial packages

- Providing hardship documentation

- Signing authorizations

- Responding to questions

Once the file is submitted, though, the seller’s role becomes mostly passive. Delays after that point are rarely because the seller didn’t do something — unless no one is guiding them through updates and re-requests.

Without proper short sale assistance, sellers often assume:

- "No news is good news"

- "The bank will reach out if they need something"

Both assumptions are dangerous.

The Coordinator: Owns the Clock by Protecting Momentum

This is where the real answer lives. A dedicated short sale coordinator or short sale processor is the only role focused entirely on time management inside the lender system.

What that means in practice:

- Documents are submitted before they expire, not after

- Valuations are tracked and challenged quickly when needed

- Status updates are requested strategically, not randomly

- Escalations happen with context, not desperation

- The file never goes cold inside the lender’s queue

A professional short sale negotiator understands that time isn’t lost in big chunks — it’s lost in small, silent gaps:

- A paystub that’s 2 days too old

- A bank statement missing one page

- A valuation that sat unreviewed for 10 days

Preventing those gaps is what keeps the clock moving forward.

Why Most Short Sales Feel Slow (Even When They Don’t Have to Be)

When a short sale drags on, it’s rarely because the lender is unusually slow. It’s usually because:

- No one is monitoring the file daily

- No one notices when the lender stops touching it

- No one escalates until weeks are already lost

This is why deals with professional short sale processing often close faster — even with the same lender, same investor, and same pricing. It’s not about forcing speed. It’s about eliminating unnecessary pauses.

So… Who Really Owns the Clock?

Here’s the simple breakdown:

- Lender: Owns approval authority

- Agent: Owns client communication

- Seller: Owns initial documentation

- Coordinator: Owns momentum

If no one owns momentum, the clock wins.

That’s exactly why Crisp Short Sales is structured the way it is. Our entire role is built around keeping files active, compliant, and moving — so agents can focus on selling, sellers can breathe easier, and buyers don’t walk away wondering what went wrong.

If you want to understand how we support agents and sellers behind the scenes, here’s a quick overview of how we help keep short sales moving forward: /how-we-help

And if you’re an agent or investor wondering whether a dedicated coordinator makes sense for your deal, you can see exactly who we serve and how we fit into your transaction: /who-we-serve

When you’re ready to take control of the timeline instead of reacting to it, you can also start the short sale process here: /start-short-sale

How Long Does a Short Sale Really Take in 2026? A Realistic Timeline

A realistic timeline for how long short sales take in 2026, plus tips to avoid delays and close deals faster with proper short sale processing.

One of the most common questions homeowners and real estate agents ask about short sales is also the most frustrating to answer:

“How long is this going to take?”

If you’ve been around short sales long enough, you know the honest answer isn’t “30 days” or “90 days.” It’s “it depends”—but that doesn’t mean the process has to feel unpredictable or endless.

In 2026, short sales are moving differently than they did even a few years ago. Lenders are more automated, investors are stricter, and tolerance for sloppy files is basically gone. The good news? When a short sale is handled correctly, timelines are far more controllable than most people think.

Below is a realistic, experience-based timeline of how long a short sale actually takes today—and what determines whether it moves fast or drags on.

## Phase 1: Pre-Listing & File Setup (1–2 Weeks)

This phase is invisible to most buyers but critical to the outcome.

Before a property is even listed (or immediately after), the seller’s financial package should be built correctly. This includes:

- Hardship documentation

- Income and expense verification

- Authorization forms

- Mortgage statements

- HOA info, if applicable

This is where many deals start going sideways. Agents often wait until there’s an offer to begin this work, which almost guarantees delays later.

When a short sale processor or short sale coordinator is involved early, this phase can be completed quickly and cleanly—setting the entire file up for success.

Timeline:

✔ Efficient setup: ~7 days

✘ Delayed or incomplete setup: 3+ weeks

## Phase 2: Listing & Offer Acceptance (2–4 Weeks)

Once listed, the goal isn’t just any offer—it’s a bank-approvable offer.

That means:

- Correct net to lender

- Clean buyer terms

- Realistic closing timeline

- No red flags that trigger re-review

In 2026, lenders are heavily focused on net proceeds, not just sales price. A strong short sale negotiator will often review offers before acceptance to avoid choosing one that looks good on paper but dies in underwriting.

Timeline:

✔ Strong pricing + correct buyer: 2–3 weeks

✘ Overpriced or weak offer: 30+ days

## Phase 3: Lender Review & Valuation (30–60 Days)

This is the phase most people fear—and where myths come from.

After submission, the lender will:

- Order a BPO or appraisal

- Review the seller’s hardship

- Analyze the net sheet

- Apply investor guidelines

In 2026, most lenders move faster if the file is complete and correctly packaged. Files that are missing documents or submitted incorrectly often get stuck in review loops.

This is where professional short sale processing makes the biggest difference. Banks prioritize clean files. Period.

Timeline:

✔ Clean file: 30–45 days

✘ Disorganized file: 60–90+ days

## Phase 4: Negotiation & Approval (2–4 Weeks)

Contrary to popular belief, approval delays usually aren’t about price; they’re about structure.

Common sticking points:

- Closing costs

- Commission structure

- Settlement or third-party fees

- HOA balances

A seasoned short sale specialist knows how to position these items so they’re approved without triggering denials or escalations.

This is also where many DIY short sales collapse. Without someone who knows how to negotiate a short sale properly, approvals stall or come back with unworkable terms.

Timeline:

✔ Experienced negotiation: ~14 days

✘ Back-and-forth resubmissions: 30+ days

## Phase 5: Closing (2–3 Weeks)

Once approval is issued, the clock finally becomes predictable.

At this stage:

- Buyer financing is finalized

- Title clears

- Closing is scheduled

The key risk here isn’t the lender—it’s buyer fatigue. Deals that took too long earlier are more likely to fall apart now.

That’s why early speed matters. The faster and cleaner the front half of the process, the smoother the finish.

Timeline:

✔ Cash or strong financing: 10–14 days

✘ Buyer delays: 21+ days

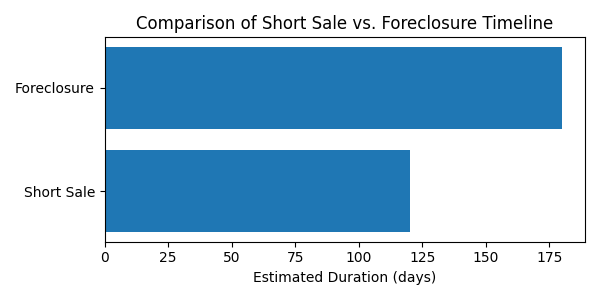

## The Real 2026 Short Sale Timeline (Start to Finish)

Here’s the realistic big picture:

- Best-case scenario: 75–90 days

- Typical well-managed file: 90–120 days

- Poorly managed file: 6+ months (or fails entirely)

Short sales don’t fail because they take time.

They fail because time is wasted early.

## Why Some Short Sales Close Faster Than Others

The difference almost always comes down to one thing: who is running the process.

Agents who rely on lenders to “tell them what’s needed” end up reacting instead of controlling the file. Teams that use dedicated short sale assistance move proactively, anticipate objections, and keep momentum.

That’s exactly why Crisp Short Sales exists.

We step in behind the scenes to handle lender communication, document flow, and negotiation—helping agents close short sales faster and helping homeowners move on without foreclosure. You can learn more about how we help homeowners and agents navigate this process smoothly by visiting our guide on the site.

We also work with a wide range of professionals, from listing agents to investors, as outlined on our who we serve page. And if you’re ready to move forward now, you can start the short sale process directly with our team.

## Final Takeaway

In 2026, short sales are no longer slow because of banks.

They’re slow because of preventable mistakes.

With proper setup, experienced negotiation, and professional short sale help, timelines are predictable—and closings are realistic.

If you want a short sale to close, don’t ask how long it takes.

Ask who’s running it.

Short Sale vs. Foreclosure Timeline: What Homeowners Don’t Realize Until It’s Too Late

A breakdown of short sale vs. foreclosure timelines explaining how early short sale assistance helps homeowners maintain control, avoid delays, and minimize credit damage.

When homeowners fall behind on their mortgage, the conversation almost always centers on one question:

“How much time do I have?”

Unfortunately, that’s the wrong question.

The real difference between a short sale and a foreclosure isn’t just the final outcome—it’s who controls the timeline, the decisions, and the damage along the way. And most homeowners don’t realize how fast control slips away once foreclosure momentum starts.

Let’s break down what actually happens in each scenario, and why early short sale assistance can completely change the outcome.

The Foreclosure Timeline: Faster Than You Think

Foreclosure feels slow—until it isn’t.

Most homeowners assume they’ll receive plenty of warning before anything serious happens. In reality, the foreclosure timeline accelerates quickly once key deadlines pass.

Here’s what typically unfolds:

- Missed payments trigger default notices

- Legal filings begin (often before homeowners fully understand their options)

- Fees, legal costs, and interest stack up

- Decision-making shifts from homeowner to lender

- Sale dates get scheduled—even while homeowners are still “figuring things out”

Once foreclosure is in motion, options narrow fast. Loan modifications get denied. Buyers hesitate. And homeowners often discover too late that a short sale is still technically possible—but now much harder to execute cleanly.

This is where many deals fail: not because a short sale wasn’t allowed, but because it was started too late and without structure.

The Short Sale Timeline: Slower, but Strategic

A short sale doesn’t stop time—it replaces panic with process.

When started early and handled correctly, a short sale gives homeowners breathing room while maintaining control over key decisions like:

- Who buys the home

- When the sale closes

- How relocation is handled

- What the final credit impact looks like

Unlike foreclosure, a short sale timeline is driven by documentation, valuation, and lender review—not court schedules.

But here’s the catch: banks don’t wait forever.

Delays, missing documents, or sloppy communication can quietly push a short sale past the point of no return. That’s why experienced short sale processing matters far more than most homeowners realize.

What Homeowners Don’t Realize Until It’s Too Late

This is where timelines collide—and mistakes become permanent.

1. Waiting Does Not Buy Time

Many homeowners delay action because they’re overwhelmed or hopeful something will change. Unfortunately, waiting usually reduces options instead of preserving them.

By the time foreclosure notices feel “real,” lenders may already be less flexible.

2. Short Sales Are Front-Loaded

The most important work in a short sale happens early:

authorizations, hardship review, document accuracy, and valuation strategy.

If those pieces aren’t handled properly from the start, approvals stall—or get denied outright.

This is where a dedicated short sale coordinator or short sale negotiator makes a measurable difference.

3. Foreclosure Narrows Buyer Interest

Buyers get nervous when foreclosure timelines tighten. They worry about auctions, title issues, and approval risk.

That reduces leverage and limits offers—exactly the opposite of what homeowners need.

4. Relocation Help Is Time-Sensitive

Relocation assistance (often called “cash for keys”) is far more likely when a short sale is organized early and presented correctly. Once foreclosure progresses, those opportunities often disappear.

At Crisp, this kind of homeowner support is built directly into how we help distressed sellers navigate the process.

Control Is the Real Difference

A short sale isn’t just about avoiding foreclosure—it’s about preserving agency.

Foreclosure is something that happens to homeowners.

A short sale is something homeowners participate in.

When structured correctly, a short sale allows families to:

- Exit with dignity

- Avoid last-minute chaos

- Minimize long-term credit damage

- Move forward on their own timeline

That’s why we focus on short sale assistance that starts early, stays proactive, and doesn’t rely on hope or guesswork.

Whether we’re helping homeowners directly or supporting agents through the process, our role is to keep files moving, lenders engaged, and deadlines under control. You can see exactly who we work with on our who we serve page.

The Right Question to Ask

Instead of asking, “How much time do I have?” Homeowners should be asking:

“How much control do I want to keep?”

If foreclosure is already on the horizon, the window for a successful short sale hasn’t necessarily closed—but it is narrowing.

Starting the short sale process early, with experienced guidance, is often the difference between an orderly transition and a forced one. If you’re considering next steps, this is the moment to start the short sale process before decisions get made for you.

Why “Approved Price” Doesn’t Mean “Approved Deal” in Short Sales

An approved price doesn’t guarantee a closed short sale. Learn why deals fall apart after approval and how to prevent it.

One of the most common short sale misconceptions I hear from agents, buyers, and even some sellers is this:

> "The bank approved the price, so we’re good to go."

If only it were that simple.

In short sales, an **approved price is not the same thing as an approved deal**. Confusing the two is one of the biggest reasons transactions fall apart weeks or even months after everyone thinks they’re “done.” Understanding the difference is critical—and it’s where experienced short sale processing makes all the difference.

Let’s break down what’s really happening behind the scenes.

### What a Short Sale ‘Price Approval’ Actually Means

When a lender issues a short sale approval letter, the first thing most people look for is the approved purchase price. That number matters—but it’s only one piece of a much larger puzzle.

A price approval simply means the lender agrees that the **gross sale price** is acceptable based on their valuation (BPO, appraisal, or internal review). It does *not* automatically mean:

- The HUD is approved

- All fees are acceptable

- The buyer structure is compliant

- The timeline is locked

- The deal is guaranteed to close

This is why experienced agents rely on a short sale specialist who understands how lenders evaluate the *entire transaction*, not just the headline number.

### Conditional Approvals: The Fine Print That Kills Deals

Almost every short sale approval comes with **conditions**. These are not suggestions — they’re requirements. Miss one, and the approval can be withdrawn.

Common conditions include:

- Approved net to lender (not just price)

- Limits on buyer-paid fees or credits

- Restrictions on commissions

- Deadlines for closing

- Requirements for arms-length affidavits

- Seller contribution rules

- Buyer identity disclosures

A short sale coordinator knows that these conditions must line up perfectly with the final HUD. This is where many “approved” deals quietly die.

### Net Proceeds Matter More Than Price

Lenders don’t approve short sales based on emotion. They approve them based on **net recovery**.

Two offers at the same price can produce very different results for the bank:

- One may include excess credits

- Another may have unapproved buyer fees

- One may violate investor guidelines

- Another may push timelines too far

From the lender’s perspective, the higher-priced offer is irrelevant if the net proceeds are lower. This is why clean HUDs and accurate short sale processing are so important.

If you’ve ever watched a bank reject a “better” offer, this is usually why.

### Buyer Fees and Credits: The Silent Deal Breakers

Buyer-paid fees are one of the most misunderstood aspects of short sales.

Some lenders allow them. Some don’t. Some allow them only if disclosed and capped. Others allow them but adjust the net accordingly. And some investors prohibit them entirely.

If buyer fees are added after approval — or structured incorrectly — the lender can revoke the approval outright.

This is where working with a short sale negotiator who knows what’s allowed *before* submission prevents last-minute chaos and keeps everyone aligned from day one.

### Timeline Conditions Are Real (And Enforced)

Approval letters almost always include a strict closing window. Miss it, and you may need:

- An extension request

- A re-review

- A new valuation

- Or a full resubmission

None of those are guaranteed.

A proper short sale coordinator tracks timelines aggressively, communicates with all parties, and resolves issues *before* the lender’s clock runs out. Waiting until the deadline is how approved deals quietly expire.

### Why Deals Fall Apart After ‘Approval’

When short sales collapse post-approval, it’s usually because:

- The HUD changed without lender consent

- A buyer switched loan programs

- Fees were added late

- A condition was misunderstood

- No one was monitoring compliance

These aren’t dramatic mistakes. They’re small, technical issues that compound quickly without proper oversight.

This is exactly why Crisp Short Sales exists—to manage these details so agents can focus on selling, not firefighting.

### How Crisp Short Sales Keeps Approved Deals Closing

At Crisp Short Sales, we don’t just help get price approvals—we help get deals to the closing table.

Our team handles:

- Full short sale processing and lender coordination

- HUD and net sheet compliance

- Buyer fee review and structuring

- Timeline tracking and extensions

- Investor and insurer guidelines

- Clear communication with agents and buyers

If you’re an agent or investor looking for **short sale assistance**, we step in behind the scenes and manage the lender process end-to-end. You stay in control of your listing. We handle the heavy lifting.

Learn more about how we help agents protect their deals, or see who we serve.

If you're ready to start the short sale process the right way, visit /start-short-sale.

An approved price is just the beginning.

Short sales close when **every condition, dollar, and deadline** is handled correctly. That’s not luck—that’s experience, structure, and disciplined short sale processing.

If you want fewer surprises and more closings, make sure someone is watching the details the bank actually cares about.

What Lenders Actually Look for Before Assigning a Short Sale Negotiator

Most agents assume that once a short sale package is submitted, the lender automatically assigns a negotiator and the clock starts ticking. In reality, there’s a quiet but critical evaluation phase that happens before a short sale negotiator is ever assigned. And if a file fails this initial review, it can sit untouched for weeks or even months.

Understanding what lenders look for at this stage is one of the biggest advantages a seasoned short sale processor or short sale coordinator brings to the table. It’s also where many well‑intentioned DIY short sales start to unravel.

Let’s pull back the curtain.

Step One: Is This File “Assignable” at All?

Before a lender assigns a negotiator, the file must pass an internal intake screen. This is not a negotiation phase. It’s a compliance and completeness check.

Lenders are asking very basic but very strict questions:

- Is the hardship clearly documented and credible?

- Are all required borrower authorizations signed correctly?

- Is the package internally consistent?

- Does this file meet investor and insurer rules on its face?

If the answer to any of those is no or unclear, the file doesn’t move forward. It doesn’t get denied either. It just stalls.

This is why experienced short sale processing matters so much. The goal isn’t just to submit documents. The goal is to submit a file that clears intake cleanly the first time.

Hardship Is About Logic, Not Emotion

One of the biggest misconceptions is that hardship letters need to be emotional. From a lender’s perspective, emotion is irrelevant. What they care about is logic.

A strong hardship explanation answers three questions:

1. Why can’t the borrower afford the home now?

2. Why is this situation unlikely to improve?

3. Why is foreclosure not a better financial outcome for the lender?

When these points aren’t clearly connected, lenders hesitate to assign a negotiator because the file looks weak. A skilled short sale specialist knows how to frame hardship in a way that aligns with lender review standards, not sympathy.

Financials Must Match the Story

Lenders cross‑check everything. If the hardship claims loss of income, the financials must show it. If the borrower claims increased expenses, the numbers need to support that.

Common red flags that delay negotiator assignment include:

- Bank statements that contradict stated income

- Expense totals that don’t match monthly cash flow

- Missing explanations for large deposits or withdrawals

- Incomplete or outdated financial forms

These issues don’t always trigger a denial. Instead, they trigger silence. The file stays unassigned until someone fixes it, often without the agent even realizing there’s a problem.

This is where dedicated short sale assistance makes a measurable difference.

Net Sheet Accuracy Is Non‑Negotiable

Even before there’s an offer to evaluate, lenders want to know that the deal can make sense financially. That means the estimated net sheet needs to be realistic, compliant, and internally accurate.

Lenders look for:

- Correct commission structures

- Allowable fees only

- No prohibited credits or incentives

- Consistency with investor guidelines

A sloppy or overly optimistic net sheet signals risk. Lenders are far more likely to delay assigning a short sale negotiator than to reject the file outright. Clean numbers move files forward.

This is one reason many agents partner with professionals who focus exclusively on short sale processing rather than trying to juggle it alongside active listings.

Title and Property Basics Still Matter

Even early in the process, lenders want to know whether the property itself presents complications.

They quietly assess things like:

- Obvious title issues

- Multiple liens without a clear path forward

- HOA balances with no documentation

- Red flags suggesting litigation or probate delays

None of these automatically kill a deal, but they do affect whether a negotiator is assigned quickly. A short sale coordinator who spots these issues early can address them proactively instead of letting the file stall.

Why Some Files Get Negotiators in Days (and Others Don’t)

When lenders assign negotiators quickly, it’s rarely luck. It’s usually because the file:

- Is complete and consistent

- Tells a clear financial story

- Meets investor rules at first glance

- Signals a realistic chance of closing

Files that don’t meet those standards aren’t rejected. They’re deprioritized.

That’s why agents who rely on experienced short sale help often see faster movement and fewer unexplained delays. The work done before submission determines how the lender treats the file afterward.

The Strategic Advantage for Agents

Agents don’t need to become short sale experts themselves. But understanding this intake phase helps explain why partnering with the right team matters.

If your goal is to:

- Reduce time to negotiator assignment

- Avoid silent delays

- Increase approval odds

- Protect your listing time

Then working with a dedicated short sale negotiator and processing team isn’t an extra step. It’s a strategic one.

At Crisp Short Sales, this is exactly where we focus our energy—making sure files are intake‑ready, investor‑compliant, and positioned to move quickly through lender review. That’s part of how we help agents close more short sales with less frustration through our approach to short sale processing and coordination. You can see how we support agents and homeowners throughout the process on our site, including how we help structure files correctly from day one and who we serve across different short sale scenarios.

Multiple Offers on a Short Sale: What Lenders Expect From the Submitted Offer

Have you ever had multiple offers on a short sale listing and watched the strongest-looking deal fall apart? The uncomfortable truth is that the highest offer does not always lead to approval.

In a short sale, the listing agent reviews the offers and selects the strongest one to submit to the lender. The bank does not compare multiple offers side by side. Instead, the lender evaluates the submitted offer to determine whether it meets valuation requirements, investor guidelines, and approval criteria. Understanding how that evaluation works is critical to getting deals approved and closed.

Price is only step one, and often not the most important one. Yes, lenders care about price, but they care even more about net proceeds and certainty of closing. When a lender reviews a submitted short sale offer, they typically focus on factors such as:

Net to lender after commissions, fees, and credits

Buyer strength and financing reliability

Timeline to close

Risk of retrades or fallout

Compliance with investor and insurer guidelines

A clean, well-structured offer that nets more to the lender often beats a higher purchase price loaded with credits, repair requests, or shaky financing. Small errors on the HUD or net sheet can quietly derail an otherwise solid deal.

Why the highest price offer often loses

Credits kill deals

A higher offer that requests closing cost credits, repairs, or concessions frequently nets less to the bank than a cleaner offer.Financing risk matters

Conventional financing with strong down payment terms often beats FHA or VA, even at a slightly lower price. Cash offers are strong, but only when proof of funds is realistic and verifiable.Unrealistic timelines raise red flags

Extended escrows or layered contingencies increase the odds of cancellation. Lenders want fewer moving parts, not more.Early fallout is remembered

Buyers who submit aggressively and retrade during inspections create friction. That history can influence how future offers from that buyer are viewed.

How lenders evaluate a submitted short sale offer

Once the agent submits an offer, lenders typically evaluate it internally based on:

Offer price

Estimated net proceeds

Buyer type and financing

Closing timeline

Notes on risk factors

They are not emotionally attached to any buyer. The goal is the highest likelihood of closing with the least friction. That’s why clean documentation, accurate net sheets, and realistic terms matter more than headline numbers.

The role of a short sale negotiator when multiple offers exist

When multiple offers are involved at the listing level, lenders often request:

Revised HUDs or net sheets

Updated buyer documentation

Clarification on credits or fees

Confirmation of financing terms

A seasoned short sale negotiator knows how to respond quickly and accurately without triggering unnecessary delays or denials. At Crisp Short Sales, this is where we support agents by handling lender communication, submitting clean packages, and keeping the selected offer strong through approval.

Learn more about how we help throughout the process:

short sale support and lender coordination

https://www.crispshortsales.com/how-we-help

What agents should do when multiple offers come in

Don’t chase the highest number blindly. Focus on net proceeds and clean terms.

Pre-screen buyers carefully. Financing strength and expectations matter.

Structure the offer cleanly from day one. Avoid unnecessary credits or vague terms.

Get short sale assistance early. Waiting until after submission often costs weeks.

Agents who work with a short sale coordinator from the start tend to see faster approvals and fewer surprises. This is who we serve every day:

helping real estate agents close short sales faster

https://www.crispshortsales.com/who-we-serve

What buyers need to understand

Buyers lose short sales not because their price is too low, but because their offer introduces risk. To win in a multiple-offer short sale situation, buyers should:

Keep terms simple

Avoid aggressive credits

Show strong financials

Commit to realistic closing timelines

When buyers understand the lender’s perspective, approvals move faster and deals actually close.

The bottom line

In short sales, the winning offer is the one the lender trusts most, not the one with the biggest headline number. When agents submit a clean, well-structured offer and understand how lenders evaluate it, approvals come faster and deals close with fewer headaches.

If you’re facing a short sale with multiple offers and want help structuring it correctly from the start, you can begin here:

start the short sale process

https://www.crispshortsales.com/start-short-sale

Why "As-Is" Matters More in Short Sales Than Any Other Deal Type

Learn why "as-is" matters more in short sales, how repairs derail approvals, and how to set expectations that actually get deals closed.

If there’s one phrase that causes more confusion in short sales than any other, it’s "as-is."\nEveryone thinks they know what it means. Very few people actually treat it correctly.\n\nIn a traditional sale, “as-is” is often negotiable. In a short sale, it’s not just a preference — it’s a deal survival requirement. And when agents, buyers, or sellers misunderstand that, short sales stall, reopen, or quietly die somewhere inside a lender’s loss mitigation department.\n\nLet’s break down why “as-is” matters more in short sales than in any other transaction type, and how setting expectations early protects everyone involved.\n\n### “As-Is” in a Short Sale Is Not a Suggestion\n\nIn a short sale, the lender is already agreeing to take a loss. That means one thing above all else: they want certainty.\n\nThe bank is approving a net number based on:\n- Current condition\n- Market comps\n- Repair assumptions\n- Risk of delay or fallout\n\nOnce that approval is issued, the lender is not budgeting for surprises.\n\nWhen a buyer submits repair requests, credits, or price reductions after approval, the lender doesn’t see it as negotiation — they see it as deal instability. That’s when approvals get reopened, escalated, or revoked entirely.\n\nThis is why “as-is” in a short sale must be treated as:\n- No repair credits\n- No post-approval renegotiation\n- No expectations of seller contributions beyond what’s already approved\n\nAnything else puts the approval at risk.\n\n### Why Repairs Are Especially Dangerous in Short Sales\n\nIn a normal deal, repairs are a buyer-seller issue. \nIn a short sale, repairs become a bank issue, whether you want them to or not.\n\nHere’s why:\n- The seller has no money\n- The lender is not funding repairs\n- Any change to net proceeds requires lender re-approval\n\nEven small repair requests can trigger:\n- New BPOs or valuations\n- Updated HUD reviews\n- Additional internal sign-offs\n- Weeks of lost momentum\n\nThis is why experienced short sale teams focus on pricing the condition upfront, not fixing it later.\n\nIf a buyer wants perfection, a short sale is usually the wrong deal.\n\n### Inspections Still Matter — Just for Different Reasons\n\nThere’s a common misconception that “as-is” means no inspection. That’s not true.\n\nInspections are still critical in short sales, but for information, not negotiation.\n\nBuyers should use inspections to:\n- Understand the property’s condition\n- Confirm they’re comfortable with the risk\n- Decide whether to move forward or walk away\n\nWhat inspections should not be used for:\n- Asking the seller to repair items\n- Requesting credits\n- Attempting post-approval price reductions\n\nWhen inspections are framed correctly, they actually strengthen short sales by reducing fallout later in the process.\n\n### How “As-Is” Protects the Seller\n\nFor sellers, “as-is” is often misunderstood as unfair. In reality, it’s one of their strongest protections.\n\nMost short sale sellers are dealing with:\n- Financial hardship\n- Limited or no cash\n- Emotional stress tied to the property\n\n“As-is” ensures:\n- No surprise repair demands\n- No last-minute financial obligations\n- A clean, predictable path to closing\n\nThis clarity allows sellers to focus on the outcome — avoiding foreclosure — instead of worrying about issues they can’t afford to fix.\n\nThis is also where services like relocation assistance and closing support, which we explain on our [How We Help](/how-we-help) page, can make a meaningful difference for sellers who need a clean exit without added pressure.\n\n### Why Buyers Benefit From Strict “As-Is” Rules\n\nBuyers who understand short sales often prefer strong “as-is” language because it:\n- Reduces approval risk\n- Prevents re-negotiations\n- Speeds up lender review timelines\n\nClear expectations upfront mean fewer moving parts later.\n\nBuyers who want certainty should work with agents and teams experienced in structuring clean short sale offers, not ones who plan to renegotiate after approval.\n\nThis is especially important for agents and investors we work with through our [Who We Serve](/who-we-serve) partnerships, where repeat closings depend on consistency and lender trust.\n\n### Where Most Short Sales Go Wrong\n\nThe most common mistake we see is not pricing “as-is” properly at the start.\n\nProblems happen when:\n- Listings are priced as if repairs will be negotiated later\n- Buyers assume credits are coming\n- Agents treat the deal like a traditional sale\n\nShort sales succeed when:\n- Condition is reflected in the offer\n- Buyers accept the risk knowingly\n- Everyone agrees the approval is final once issued\n\nWhen those boxes are checked, lenders are far more likely to move efficiently — and closings actually happen.\n\n### Setting Expectations Early Is Everything\n\nThe strongest short sale files we handle are the ones where:\n- “As-is” is explained clearly on day one\n- Buyers are educated before offers are written\n- Sellers know exactly what to expect at closing\n\nThat upfront clarity prevents 90% of the issues that derail short sales later.\n\nIf you’re unsure how to structure an offer, explain condition, or manage expectations with buyers and sellers, starting the process correctly through our [Start Your Short Sale](/start-short-sale) intake is the fastest way to avoid costly mistakes.\n\n### Final Thought\n\n“As-is” isn’t about being rigid — it’s about being realistic.\n\nShort sales are already complex. When everyone respects what “as-is” truly means, these deals become far more predictable, far less stressful, and far more likely to close.\n\nAnd in short sales, closing is the only thing that matters.

Why Some Short Sales Close in 90 Days—and Others Never Close at All

If you’ve worked even one short sale, you’ve seen both extremes.

One file gets approved quickly, closes cleanly, and everyone walks away relieved. Another drags on for months, buyers get frustrated, extensions pile up, and eventually the deal dies quietly.

The difference usually isn’t the property, the seller, or even the lender.

It’s the process behind the scenes.

After handling short sales for more than 15 years, I can tell you with confidence: short sales that close fast all have a few things in common. And the ones that never close almost always break down in the same predictable ways.

Let’s walk through what separates the 90-day success stories from the deals that never make it to the closing table.

1. Complete Files Get Reviewed Faster. Incomplete Files Get Ignored.

Lenders don’t deny most short sales outright. They stall them.

When a file is missing documents, improperly labeled, or submitted out of order, it doesn’t get flagged as urgent. It gets pushed to the bottom of the queue.

Fast-closing short sales usually have:

- A complete seller financial package

- Clear hardship documentation

- Clean third-party authorizations

- Accurate HUD or net sheets submitted early

Deals that fail often involve repeated “please resend” requests, outdated documents, or mismatched numbers that cause lenders to re-review the file over and over again.

This is exactly why many agents choose to partner with a dedicated short sale processor instead of trying to juggle lender requirements themselves. When files are packaged correctly the first time, approvals move faster.

2. The Lender Is Actually Being Followed Up With*

Here’s an uncomfortable truth: Most short sales don’t stall because the bank said no. They stall because no one followed up properly.

Successful short sales involve:

- Weekly lender check-ins

- Escalations when timelines slip

- Confirmation that documents were received and logged correctly

Failed short sales often rely on portal uploads alone and hope for the best.

Short sale departments are understaffed, overworked, and constantly rotating personnel. If no one is actively managing communication, files sit untouched for weeks.

This is where professional short sale coordination makes a measurable difference. Consistent follow-up keeps files alive and moving, instead of disappearing into a lender black hole.

3. Buyer Expectations Are Set Early (and Managed Often)

Buyers don’t usually walk away because of the price. They walk away because of silence and uncertainty.

Short sales that close quickly typically involve:

- Buyers who understand realistic timelines

- Regular status updates

- Honest communication when delays occur

Deals that fall apart often leave buyers in the dark. When weeks go by without updates, confidence erodes and buyers move on to easier deals.

Agents who succeed with short sales tend to rely on backend support that keeps all parties informed. That transparency is a huge reason agents trust services like ours to help them close short sales faster and with fewer surprises.

4. Negotiation Happens Before the Approval Letter, Not After

One of the biggest myths in short sales is that negotiation starts when the bank sends an approval.

In reality, strong files:

- Anticipate lender objections early

- Address valuation issues proactively

- Resolve contribution requests before final approval

Weak files wait until the approval letter arrives, then scramble to renegotiate terms. By that point, buyers are frustrated, contracts are expiring, and leverage is gone.

Experienced short sale negotiators work these issues upfront so approvals come back clean and executable, not loaded with deal-killing conditions.

5. Roles Are Clear—And No One Is Overextended

The fastest short sales usually have a clean division of labor:

- The agent focuses on marketing, buyers, and contracts

- A specialist handles lender communication and document flow

- The seller knows exactly what’s expected and when

Deals that die often involve one person trying to do everything—or worse, assuming someone else is handling it.

That’s why many agents rely on third-party short sale help that works quietly behind the scenes. If you’ve ever wondered whether outsourcing makes sense, take a look at how we help agents and sellers navigate the process on our short sale assistance page.

Why Crisp Short Sales Files Close Fast

At Crisp Short Sales, we don’t dabble in short sales. This is all we do.

We focus on:

- Clean file packaging

- Persistent lender follow-up

- Clear communication with agents and sellers

- Problem-solving before issues derail deals

Whether you’re an agent with one short sale or several, our role is to remove friction so deals move forward instead of stalling out. If you’re curious about who we work with, you can learn more on our Who We Serve page.

And if you have a short sale that’s already slowing down, you don’t have to wait for it to fall apart. You can get started anytime through our short sale intake.

Final Thought

Short sales don’t fail randomly.

They fail because of missed details, slow follow-up, poor communication, and unrealistic expectations. When those issues are addressed early, 90-day approvals are not the exception — they’re achievable.

If you want your next short sale to be one that actually closes, focus on the process, not just the listing.

Why “We’ll Figure It Out Later” Is the Most Expensive Short Sale Strategy

Delaying short sale coordination is the fastest way to lose deals. Learn why early structure saves time, money, and listings.

In real estate, optimism is usually a good thing. But when it comes to short sales, optimism without a plan is one of the fastest ways to blow up a deal.

I’ve heard it hundreds of times over the years:

“We’ll figure out the short sale part later.”

“The bank hasn’t even assigned a negotiator yet.”

“It’s early, let’s not complicate things.”

And almost every time, that mindset ends the same way: lost time, frustrated clients, angry buyers, and a deal that quietly dies.

Short sales don’t fail because of banks. They fail because of timing.

The Cost of Waiting Always Shows Up Later

Short sales are not linear. You don’t list, accept an offer, then casually deal with the lender when it’s convenient. The lender clock starts ticking long before anyone realizes it.

When agents delay bringing in short sale help, a few predictable things happen:

• Authorization forms are missing or incorrect

• Financials go stale before review even begins

• Buyer patience wears thin

• BPO values come back higher than expected

• Foreclosure timelines quietly advance in the background

By the time someone says, “We should probably get help,” the lender is already controlling the pace.

That’s when short sales get labeled as “impossible,” when in reality they were just mishandled early.

Short Sales Punish Late Starts

Unlike traditional sales, short sales don’t reward hustle at the end. They reward preparation at the beginning.

Lenders want a complete, clean, and defensible file from day one. If documents trickle in over weeks, or get re-requested because something was missed, the file sinks to the bottom of the pile.

This is where many deals quietly lose leverage.

When a short sale is positioned properly from the start, it allows for:

• Cleaner valuations

• Faster escalation when needed

• Stronger approval arguments

• Fewer “reset” moments with new negotiators

Waiting removes all of that.

The Hidden Damage Agents Don’t See

One of the biggest misconceptions is that “nothing bad is happening yet.” But behind the scenes, plenty is happening.

Foreclosure referrals may already be scheduled. Internal lender notes are being created based on incomplete data. Valuations may be ordered before hardship or financials are clearly documented.

Once that information exists inside the lender system, it’s very difficult to undo.

That’s why short sales should be structured, not improvised.

Agents who involve experienced short sale coordination early consistently protect their listings, their sellers, and their own reputations.

This is exactly where short sale processing and negotiation support becomes critical. A coordinated approach doesn’t add friction. It removes it.

If you’ve ever wondered what it looks like when a third party steps in early to stabilize a deal, this is precisely how we help behind the scenes through our short sale support and approval assistance workflow: https://crispshortsales.com/how-we-help

Early Structure Creates Late Flexibility

The irony of short sales is this: the earlier you lock things down, the more flexibility you have later.

When lenders trust the file, they’re more willing to:

• Re-evaluate pricing

• Extend timelines

• Approve buyer concessions

• Allow relocation assistance at closing

That flexibility doesn’t exist when the file looks rushed or reactive.

Early coordination also protects agents from the dreaded “radio silence” period that causes buyers to walk. Clear timelines and expectations keep everyone engaged.

This is especially important for agents who want to keep control of the client relationship while outsourcing the lender-heavy work. That’s why many agents rely on short sale assistance built specifically for real estate professionals, rather than trying to juggle negotiations themselves: https://crispshortsales.com/who-we-serve

“Later” Is Almost Always Too Late

I’ve stepped into files where everything looked fine on the surface. Accepted offer. Cooperative seller. Motivated buyer.

But the lender file? Barely started.

By the time I’m brought in, foreclosure dates are looming, documents are outdated, and negotiators are rotating weekly. At that point, the best possible outcome is often just damage control.

Compare that to deals where I’m involved from the moment the listing goes live. Those files move faster, face fewer surprises, and close far more often.

Short sales don’t need to be scary. They just need to be handled intentionally.

If you’re listing or writing offers on short sales and want to avoid the “we’ll figure it out later” trap entirely, the smartest move is to structure the deal correctly from day one: https://crispshortsales.com/start-short-sale

Final Thought

Short sales aren’t hard because they’re complicated. They’re hard because people underestimate them.

The most expensive mistakes don’t show up on the first day. They show up months later when everyone’s exhausted and out of options.

If there’s one lesson to take away, it’s this:

Early action isn’t extra work. It’s insurance.

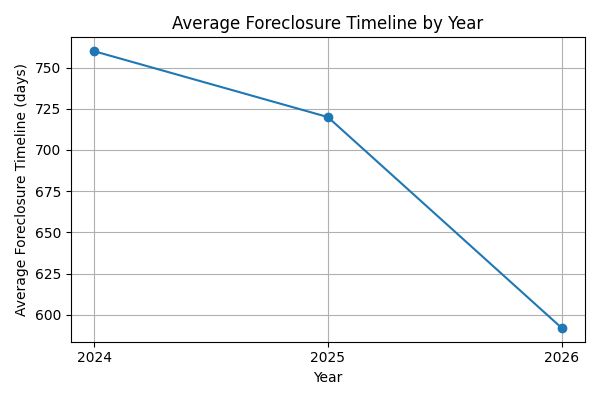

Foreclosures Are Moving Faster in 2026 — Why Short Sale Timing Matters More Than Ever

For years, short sales benefited from one thing above all else: time.

Long foreclosure timelines gave homeowners, agents, and buyers enough runway to submit offers, negotiate with lenders, and get approvals before an auction date forced everyone’s hand.

That runway is shrinking.

Recent foreclosure data shows that lenders are moving properties through the system faster than they have in years — and that shift has real consequences for anyone relying on short sales as a solution.

If you wait too long, the option may disappear entirely.

Foreclosure Timelines Are Compressing

According to ATTOM’s latest year-end foreclosure data, properties that completed foreclosure in Q4 spent about 592 days in the foreclosure process.

That’s a 22% reduction compared to the prior year and continues a steady downward trend seen throughout 2025.

At the same time:

- Foreclosure filings increased year-over-year

- Starts and completed REOs rose in late 2025

- Overall activity remains below pre-pandemic peaks, but momentum is clearly accelerating

The takeaway is simple: banks are no longer sitting on distressed files as long as they used to.

Why This Changes the Short Sale Playbook

Short sales don’t fail because they’re impossible.

They fail because they’re started too late.

When foreclosure timelines shorten, the margin for error narrows. That means:

- Less time to gather documents

- Less patience from lenders

- Fewer extensions granted once a sale date is scheduled

Homeowners who once had months to decide now have weeks. Agents who delay packaging a file risk losing the deal entirely.

This is why having a clear, early-action process matters more now than ever.

At Crisp, we see this shift firsthand — files that used to allow for delays now require precision and urgency from day one.

Early Action Is No Longer Optional

The most successful short sales today share one thing in common: they start early.

That doesn’t mean panic. It means preparation.

As soon as hardship becomes clear or a notice is issued, the short sale strategy needs to be in motion. That includes:

- Confirming lender status and timelines

- Submitting complete documentation up front

- Setting realistic expectations with all parties

This is where experienced short sale coordination and negotiation makes a real difference. When lenders are moving faster, incomplete or disorganized files simply get pushed aside.

Our role is to keep the file moving, anticipate lender requests, and protect the timeline before foreclosure pressure takes over. That’s exactly how we help homeowners avoid foreclosure with a short sale when time is tight.

What Agents Need to Know Right Now

For real estate agents, the message is clear: waiting is riskier than it used to be.

If you’re listing or receiving offers on a short sale:

- Don’t assume you have months to figure it out

- Don’t wait for a buyer to “get serious” before engaging help

- Don’t underestimate how quickly a sale date can lock in

Agents who bring in experienced support early are far more likely to close — especially in a market where lenders are accelerating timelines.

That’s why so many agents rely on us for helping real estate agents close short sales faster, without taking control away from the listing agent or charging the seller.

The Window Is Smaller — But Still Open

Short sales are not going away. In fact, rising foreclosure activity means more short sale opportunities, not fewer.

But the rules have changed.

The window between hardship and foreclosure is tightening, and success now depends on:

- Speed

- Accuracy

- Experience

When the process starts early and is handled correctly, short sales still protect credit, avoid auctions, and create cleaner exits for homeowners.

When it starts late, foreclosure often wins.

If you’re navigating a potential short sale and want to understand your options before time runs out, the best next step is to start a short sale the right way, with a plan built for today’s faster timelines.

The Hidden Work Agents Don’t See in a Successful Short Sale

Discover the behind-the-scenes work that keeps short sales moving, from document management to lender negotiations.

Most real estate agents only see two moments in a short sale transaction: when the offer is submitted, and when the approval letter finally arrives.

Everything in between often feels like a black box.

From the outside, it can look like nothing is happening. Weeks go by. There are no updates from the bank. The buyer gets impatient. The seller starts to panic. And the agent is left wondering whether the deal is stuck or silently dying.

But the truth is this: a successful short sale is rarely quiet behind the scenes. The real work is constant, detailed, and invisible to anyone not directly managing the file.

Let’s pull back the curtain.

Short Sales Don’t “Process Themselves”

Once an offer is accepted, many people assume the hard part is over. In reality, that’s when the most critical phase begins.

Banks do not move files forward simply because paperwork was submitted. Every short sale requires active management. That means:

- Repeated follow-ups with the lender

- Clarifying inconsistent conditions

- Re-submitting documents that were “lost”

- Correcting internal bank errors

- Escalating stalled files before deadlines expire

Without someone driving the process, files don’t just slow down. They quietly fall to the bottom of the pile. This is exactly why short sale processing and negotiation is its own specialty, not an add-on task.

Document Management Is a Living Process

One of the biggest misconceptions is that short sale paperwork is “submit once and wait.”

In reality, documents are constantly expiring, changing, or being re-requested.

Examples include:

- Paystubs and bank statements aging out

- Hardship letters needing clarification

- Third-party authorizations being rejected

- Seller financials not matching lender calculations

Each time this happens, the file can be paused or pushed backward without notice. Behind the scenes, someone must continuously audit the file, update documents, and confirm that the lender’s internal system reflects the most current information. This is a major part of how we support homeowners through our short sale assistance services and keep files moving instead of stalling.

Negotiations Happen Long Before Approval

When agents think of negotiation, they usually picture the final approval numbers. But most of the negotiation happens quietly, weeks earlier.

This includes:

- Explaining unusual repair credits or concessions

- Addressing junior liens or HOA balances

- Justifying net proceeds to align with investor guidelines

- Preventing unnecessary revaluations

Banks rarely explain why they say “no.” They just do. Someone experienced in short sale negotiation knows how to present the file so those objections never arise in the first place. That work is rarely visible—but it’s the difference between a clean approval and months of back-and-forth.

Weekly Follow-Ups Are Not Optional

Lenders do not proactively update agents. Ever.

If no one calls or emails, nothing happens.

A properly managed short sale includes consistent, documented follow-ups—often weekly or more—confirming:

- The file is still assigned

- No new conditions were added

- No internal transfers occurred

- The negotiator hasn’t changed

This kind of persistence is what prevents files from being reassigned or quietly closed due to inactivity. It’s also why agents who partner with professionals focused on short sale coordination see far fewer surprises late in the deal.

Post-Approval Is a Risk Zone Most Agents Underestimate

Even after approval, deals can still fall apart.

Common issues include:

- Approval letters expiring before closing

- Title issues surfacing too late

- Buyer timelines not aligning with bank conditions

- Missing final lender sign-offs

This phase requires just as much attention as the negotiation itself. Without someone monitoring deadlines and communicating across all parties, approvals can lapse and deals can collapse days before closing. That’s why many agents rely on dedicated support focused on helping real estate agents close short sales faster rather than trying to juggle these details themselves.

Why This Work Is Largely Invisible

If everything is done correctly, agents don’t hear about most of this.

There are no emergencies. No frantic calls. No last-minute disasters.

And that’s exactly the point.

The goal of professional short sale management is not to create noise—it’s to eliminate it. When files are handled properly, agents can focus on listing, marketing, and closing deals while knowing the backend is being actively protected.

If you’ve ever wondered why some short sales feel smooth while others feel impossible, this hidden work is the difference.

Final Thought

Short sales don’t fail because the bank said no. They fail because no one was managing the process when it mattered most. The more invisible the work, the more valuable it usually is.

Why “As-Is” Doesn’t Mean “Hands-Off” in a Short Sale

In a short sale, "as-is" doesn't mean hands-off. Learn why banks still expect access, utilities on, and basic maintenance during the process, plus why inspections and seller cooperation matter to avoid delays.

One of the most common phrases you’ll hear in short sale listings is “sold as-is.” On the surface, it sounds simple. No repairs. No credits. No seller involvement after the offer is accepted.

But here’s the reality most homeowners and even some agents don’t realize:

**“As-is” in a short sale does not mean hands-off.**

In fact, misunderstanding this single phrase is one of the fastest ways to delay approvals, lose buyers, or derail a deal entirely. Let’s clear up what “as-is” actually means in a short sale—and what responsibilities still remain firmly on the seller’s plate.

## What “As-Is” Really Means in a Short Sale

In a short sale, **“as-is” simply means the lender is not agreeing to pay for repairs or concessions** as part of the approval. The bank is already taking a loss, so they’re not interested in funding upgrades, credits, or post-inspection negotiations.

That’s it.

It does **not** mean:

- The seller can walk away completely

- The property can be neglected

- Utilities can be shut off

- Inspections don’t matter

- The lender won’t care about condition

Banks still expect the home to be **marketable, accessible, and reasonably maintained** throughout the process.

## Seller Responsibilities Don’t Disappear

Even when a property is listed as-is, sellers still have several ongoing obligations during a short sale.

**Access is non-negotiable.**

The lender will order a Broker Price Opinion (BPO) or appraisal. If the agent or appraiser can’t access the home, the file stalls. Missed appointments often lead to weeks of delays—or worse, the file being closed.

**Utilities usually need to stay on.**

Water, electricity, and sometimes gas are required for inspections and valuations. A house with no utilities raises red flags and can result in a lower valuation or rejection altogether.

**Basic maintenance still matters.**

We’re not talking renovations. But trash removal, securing the property, and preventing obvious damage are critical. A boarded-up, debris-filled home signals neglect and can negatively impact the lender’s decision.

This is where many sellers benefit from understanding **how we help manage short sale requirements behind the scenes**, making sure nothing small turns into a big delay. (Learn more about our approach to keeping files moving at **/how-we-help**.)

## Inspections Still Happen—Even “As-Is”

Buyers will almost always inspect, even if they know they can’t ask for repairs.

**Why?**

- To understand the scope of issues

- To confirm no undisclosed hazards

- To decide if the deal still makes sense

Problems arise when sellers think inspections are optional and deny access, or when agents assume inspection issues don’t matter because it’s a short sale.

Here’s the truth:

If a buyer walks after inspection, **you’re starting the short sale process over** with a new offer. That can mean new valuations, new negotiators, and months of lost time.

## The Lender Is Always Watching

Unlike a traditional sale, a short sale lender stays actively involved from start to finish. They monitor:

- Occupancy status

- Property condition

- Listing activity

- Buyer strength

- Timeline compliance

If a home deteriorates during the process, the bank can:

- Reduce approval terms

- Require updated valuations

- Cancel the short sale entirely

That’s why proactive coordination—especially between the seller, agent, and negotiator—is critical. This is also where **helping real estate agents close short sales faster** becomes less about paperwork and more about keeping the deal alive. (Details on our agent-focused support are at **/who-we-serve**.)

## “As-Is” Doesn’t Mean Emotionally Detached Either

Short sales are stressful. Sellers are often juggling financial strain, relocation, or major life changes. It’s easy to mentally check out once the listing goes live.

But staying engaged—even minimally—can be the difference between:

- A successful approval and clean exit

- Or foreclosure, judgment, and long-term credit damage

The good news is sellers don’t have to handle this alone. With the right guidance, most responsibilities are **light, manageable, and clearly defined**.

## The Right Way to Think About “As-Is”

A better way to frame an as-is short sale is this:

> **“No repairs required—but cooperation required.”**

When sellers understand that distinction early, expectations are clearer, timelines are smoother, and approvals come faster.

If you’re considering a short sale and want to know exactly what will be expected—before surprises pop up—**we walk sellers through every step from day one**. You can start the process or ask questions anytime at **/start-short-sale**.

What Listing Agents Should Ask Before Accepting a Short Sale Listing

Use this checklist to vet short sale listings and avoid hidden pitfalls. It covers questions about the seller’s delinquency, liens, documentation readiness, emotional preparedness, lender communications, buyer strategy, and backup support.

Short sale listings can be career-makers or career-frustrators for real estate agents. The difference usually comes down to what happens before the listing agreement is signed.

Too often, agents accept a short sale based on price, motivation, or urgency, only to discover weeks later that the file is unworkable, the lender is unresponsive, or the seller was never truly prepared. By that point, you're already deep into unpaid work, uncomfortable conversations, and a listing that refuses to move forward.

The good news? Most short sale problems are predictable. And they can be avoided by asking the right questions upfront.

Below is a practical, experience-driven checklist of what listing agents should ask before taking on a short sale — and why each question matters.

1. Is the Seller Actually Behind on Payments — or Just Underwater?

This is the first and most important distinction.

Many homeowners assume they qualify for a short sale simply because they owe more than the home is worth. But most lenders require some level of financial distress, not just negative equity.

Key things to clarify:

- Are payments current, late, or in default?

- Has a Notice of Default or foreclosure action started?

- Are there hardship events that explain the situation?

This information determines whether a short sale is realistic, how aggressive the timeline may be, and how cooperative the lender is likely to be. It also affects how you price and market the home.

2. How Many Loans Are on the Property — and Who Owns Them?

One mortgage is rarely the full story.

Before accepting the listing, confirm:

- First mortgage

- Second mortgage or HELOC

- Any private notes or seller financing

- HOA or municipal liens

Multiple lienholders mean multiple approvals, separate negotiations, and more room for delays. If the seller doesn't know what's recorded, that's a red flag you'll need help sorting it out early.

This is one of the areas where working with a team experienced in short sale negotiation and coordination can prevent months of avoidable back-and-forth. Many agents lean on partners who handle lien discovery and lender communication as part of how they help agents close short sales faster and with less stress.

3. Has the Seller Completed Financial Documents Before — and Can They Do It Again?

Short sales are paperwork-heavy. There's no way around it.

Ask directly:

- Have you ever submitted financials to a lender before?

- Do you have access to pay stubs, bank statements, tax returns?

- Are you comfortable signing documents electronically and responding quickly?

If the seller is overwhelmed, disorganized, or resistant to documentation, the short sale will stall. Knowing this early helps you decide whether additional support is needed — or whether the listing should be declined.

Experienced short sale processors often step in here to prepare, organize, and submit lender-ready packages, freeing agents to focus on marketing and negotiations instead of chasing documents.

4. Is the Seller Emotionally Prepared for the Process?

This question is rarely asked — and frequently ignored.

Short sales are not quick. They involve uncertainty, lender silence, price opinions that feel unfair, and repeated requests for information. Sellers who are emotionally unprepared often:

- Panic when timelines stretch

- Lose trust mid-process

- Blame the agent for lender delays

Have an honest conversation about expectations:

- Timeline ranges (not promises)

- The lender's control over approvals

- The need for patience and responsiveness

A calm, informed seller is one of the strongest predictors of a successful short sale.

5. Do You Have a Dedicated Plan for Lender Communication?

This is where many short sales quietly fail.

Ask yourself:

- Who will call the lender weekly?

- Who tracks submissions, escalations, and negotiator changes?

- Who ensures nothing gets "lost" in the lender's system?

If the answer is "I'll try to stay on top of it," that's risky. Lenders don't reward passive follow-up. Short sales require consistent, knowledgeable pressure — and a clear communication trail.

That's why many listing agents choose to involve a short sale coordinator or transaction manager before the listing even goes live. It creates structure, accountability, and momentum from day one.

6. Is the Buyer Strategy Clear From the Start?

Not all buyers are short-sale-friendly.

Before accepting the listing, consider:

- Are you targeting owner-occupants or investors?

- Are buyers aware of lender approval timelines?

- Do you have language ready to set expectations upfront?

Educated buyers reduce fallout. Confused buyers cancel contracts. This isn't just a marketing decision — it's a deal-survival decision.

7. Do You Have Backup Support If the File Gets Complicated?

Even clean short sales can get messy:

- New negotiators

- Conflicting valuations

- Junior lien surprises

- Sudden foreclosure deadlines

Smart agents plan for complexity, not perfection.

Having a reliable short sale expert behind the scenes gives you a safety net when things go sideways — without requiring you to become a full-time negotiator yourself.

The Bottom Line

Accepting a short sale listing isn't about bravery — it's about preparation.

Agents who ask the right questions upfront:

- Avoid unworkable listings

- Protect their time and reputation

- Close more short sales with fewer surprises

And agents who pair strong listing skills with experienced short sale support don't just survive these transactions — they turn them into a repeatable, profitable niche.

If you're seeing more short sale opportunities in your market and want a cleaner way to manage them, having the right process in place before the listing goes live makes all the difference.

Short Sale vs Foreclosure in 2026: What Homeowners Still Get Wrong

Short sale or foreclosure? Learn the key differences in 2026, credit impact, timelines, and why acting early can protect your future.

If you’re a homeowner behind on payments in 2026, you’ve probably heard the same advice over and over again: “Just let it go to foreclosure” or “Short sales take forever and never work.”

Both statements are wrong — and believing them can cost homeowners tens of thousands of dollars, years of credit damage, and control over their future.

The reality is that short sales and foreclosures are very different outcomes, and the gap between them has actually widened in recent years. Yet many homeowners still misunderstand how short sales work, what’s changed, and why waiting too long can eliminate good options entirely.

Let’s clear up what people still get wrong.

Misconception #1: A Short Sale Is Basically the Same as a Foreclosure

This is the biggest and most dangerous myth.

A foreclosure is a legal action taken by the lender. Once it’s complete, the homeowner loses the property through a forced sale, often with little notice or control.

A short sale, on the other hand, is a voluntary transaction initiated by the homeowner. You choose the buyer, you negotiate the terms, and you stay involved all the way through closing.

In a short sale, the lender agrees to accept less than what’s owed in order to avoid the time, cost, and risk of foreclosure. That agreement only happens if the file is properly positioned and negotiated — which is where expert short sale negotiation and coordination matter most.

This is exactly why many homeowners seek professional help early through services like short sale assistance and structured lender communication found on /how-we-help.

Misconception #2: Foreclosure Is Faster and Less Stressful

On paper, foreclosure might look “faster.” In reality, it’s often the most stressful route.

Foreclosures in 2026 can still drag on for months — sometimes longer — while fees, penalties, and legal costs continue to pile up. Homeowners deal with uncertainty, court notices, and last-minute surprises.

Short sales are predictable when handled correctly. Timelines are clearer, expectations are managed, and there’s a defined path from offer to approval. With proper short sale processing and lender follow-up, delays can often be minimized instead of multiplied.

Stress usually comes from confusion, not time — and confusion thrives when no one is managing the process.

Misconception #3: Short Sales Destroy Your Credit Just Like Foreclosure

This one still trips people up.

Both outcomes impact credit, but not equally.

A foreclosure is one of the most damaging events that can appear on a credit report. It can affect borrowing ability for years and limit options for housing, financing, and even employment.

A short sale typically causes less severe and shorter-term credit damage, especially when the homeowner works with professionals who ensure the file is coded and reported properly by the lender.

In many cases, homeowners are able to qualify for new housing sooner after a short sale than after a foreclosure. That difference alone can be life-changing.

Misconception #4: If You’re Behind, It’s Already Too Late for a Short Sale

Timing matters — but “too late” comes much later than most people think.

Even homeowners who:

- Have missed multiple payments

- Received default notices

- Are facing an upcoming foreclosure sale

may still qualify for a short sale if action is taken quickly.

The key is knowing how to initiate a short sale properly, gather the correct documentation, and communicate with the lender in a way that pauses foreclosure activity while the file is under review.

This is why early outreach through a short sale expert is so important. Waiting doesn’t help — it only reduces leverage.

If a homeowner wants to understand whether a short sale is still viable, starting the process through /start-short-sale is often the smartest first step.

Misconception #5: Banks Don’t Approve Short Sales Anymore

Short sales never disappeared — they just became more technical.

In 2026, lenders are still approving short sales every day, but they are stricter about:

- File completeness

- Pricing support

- Buyer strength

- Communication cadence

What’s changed is that incomplete or poorly managed files die quietly. The bank doesn’t always say “no” — it just stops responding.

That’s why agents and homeowners increasingly rely on short sale coordination services that stay on top of valuations, BPOs, negotiator follow-ups, and escalation paths.

This behind-the-scenes work is exactly what Crisp Short Sales provides for homeowners and for agents who need help navigating lender requirements. Learn more about how we support agents through /who-we-serve.

The Real Difference Comes Down to Control

At the end of the day, tthe short sale vs foreclosure decision isn’t just about money or timelines.

It’s about control.

A foreclosure removes control entirely. A short sale preserves it.

Homeowners who understand the difference — and act early — usually walk away with:

- Less credit damage

- More dignity

- Better housing options afterward

- Fewer surprises

The problem isn’t that short sales don’t work. It’s that too many people wait until foreclosure is already deciding for them.

Short Sale Burnout Is Real: Why Agents Quit These Deals (And How to Make Them Profitable Again)

If you’ve been in real estate long enough, you’ve probably said it out loud at least once:

“I don’t do short sales anymore.”

Not because you don’t understand them.

Not because you don’t want to help distressed sellers.

But because short sales are exhausting.

They drag on forever.

Banks don’t return calls.

Documents get “lost.”

Buyers walk.

Sellers panic.

And after months of work, the deal dies… or closes for the same commission you could have earned on a clean retail sale that took 30 days.

That’s not a failure on your part. That’s short sale burnout—and it’s very real.

The good news? Agents don’t quit short sales because they’re unprofitable by nature. They quit because the workload is misaligned with how agents are paid. Fix that imbalance, and short sales become manageable, predictable, and yes—worth it again.

Let’s break it down.

## Why Short Sales Burn Agents Out

### 1. The Workload Is Invisible (Until It’s Overwhelming)

On paper, a short sale looks like “just another listing.”

In reality, it’s a second full-time job layered on top of your actual business.

• Constant lender follow-ups

• Endless document requests

• BPO coordination

• Valuation disputes

• Buyer patience management

• Seller emotional support

None of this shows up in MLS. None of it feels productive. And none of it stops just because you have other listings.