South Carolina Short Sales & Foreclosures: What the 2025 Spike Means for Agents, Homeowners, and Attorneys

South Carolina has been on every serious foreclosure watcher’s radar in 2025—and for good reason. In September 2025, the state posted 1 foreclosure filing for every 2,883 housing units (833 filings), landing South Carolina in the top five worst foreclosure rates nationwide and marking a 17.82% year-over-year increase in activity.

That September snapshot isn’t a blip. Mid-year data shows the surge started earlier: in June 2025, South Carolina ranked #1 in the country, with 1 in every 2,426 housing units receiving a filing. The Columbia metro was especially hard-hit in Q2 with 1 in every 694 housing units—one of the worst rates among large metros.

Zooming out, national Q3 2025 reporting confirms the pressure is real: foreclosure filings rose 17% year-over-year, with starts and REOs both up—and South Carolina remained among the worst-performing states.

What’s driving the spike—and why it matters locally

Rising distress reflects a cocktail of factors: rate resets, stubborn insurance and tax costs, and stretched household budgets. When borrowers miss early resolution windows, files advance toward auction faster—especially in hot metros like Columbia. For agents and attorneys, this means more inbound “problem files,” tighter timelines, and higher odds that a deal falls apart if you don’t have a short-sale game plan.

Why short sales are surging back into relevance

A properly structured short sale can beat foreclosure to the finish line and preserve value for everyone involved:

- Homeowners avoid the long-tail damage of a completed foreclosure and can often access relocation assistance at closing (sometimes called “cash for keys”) when the lender approves—money intended to help them move, not to vacate for the bank. See how we structure it in our short sale help & incentives.

- Agents keep the listing and the relationship, while handing off the lender grind. If you’re focused on pricing, showings, and negotiations, we’re focused on timelines, escalations, BPO challenges, HUDs, and lien releases—helping agents close short sales faster.

- Attorneys & Title get a cleaner, fully documented file: clear approvals, settlement statements that match lender conditions, and coordination for tricky items (HOAs, judgments, seconds, solar/UCCs).

South Carolina signals you can’t ignore

1) Sustained elevation, not a one-off

September’s top-five ranking (1 in 2,883) confirms elevated activity late in the year, even after the June spike. Expect more filings to hit MLS as owners face sale dates, NODs, or resumed loss-mitigation timelines.

2) Metro concentration—Columbia as a bellwether

With Columbia’s Q2 rate at 1 in 694, agents in Richland and Lexington counties are likely to see repeat short-sale scenarios: deferred maintenance, rate resets, and payment shocks. Files in these corridors benefit from early short-sale intake—before the auction clock forces fire-sale pricing.

3) Worsening quarterly undercurrents

Q3 reporting shows starts and bank repossessions up year-over-year, which means more first touches and second looks from lender investors—and more opportunities to overturn low BPOs or mis-graded condition.

Tactics that win approvals in today’s SC files

- Beat the BPO with evidence, not emotions. Provide dated, line-item repair estimates (roof, HVAC, structural, moisture, sewer, electrical) plus as-is comps that truly match condition. This is where files get approved or stalled.

- Price with the end in mind. If your BPO target needs a 10–15% haircut for condition and “time-to-close,” list accordingly. Price reductions in week 1‑2 are more persuasive when paired with a buyer already in underwriting.

- Neutralize HOA/second liens early. Pre-clear payoff expectations; for stubborn UCCs (solar), request a written release pathway or assumption options before you submit the final HUD.

- Escalate on timelines. If valuation stales at day 90 or negotiator responsiveness dips, escalate to investor or supervisory channels with a documented timeline of unanswered requests.

- Stay buyer-ready. Clean purchase agreements, verified funds, and title-cleared HUD drafts shorten the investor’s risk horizon. Approvals follow certainty.

How we partner with South Carolina pros (and keep deals alive)

- Agents: You sell; we negotiate. We sequence the milestones—intake, valuation, BPO rebuttal, HOA/UCC clearances, and investor conditions—so you stay in front of the client while we do the lender work. Here’s how we’re helping agents close short sales faster.

- Attorneys & Title: We align early on vesting, judgments, and payoff logistics so your HUD meets investor conditions the first time—reducing redraws and last-minute denials.

- Homeowners: If you’re behind on payments or have a sale date set, a short sale may keep you in control and even provide relocation assistance at closing. Start here: avoid foreclosure with a short sale.

Given South Carolina’s late-2025 trajectory, proactive short-sale execution is the difference between a listing that languishes and a file that closes.

Ready to move a file today?

- Agents: Send the MLS link and any repair notes—we’ll do a same-day file review and outline your BPO target.

- Attorneys/Title: Email open liens and HOA contacts—we’ll prep the payoff/settlement roadmap.

- Homeowners: Use our secure intake to see if you qualify for a lender-approved short sale with possible relocation assistance.

Start here → avoid foreclosure with a short sale

The State of Foreclosures and Short Sales in Pennsylvania — Spring 2025

Foreclosure rates in Pennsylvania rose from one in every 4,304 homes in April 2025 to one in 4,093 in May, with 1,985 foreclosure starts in the Philadelphia metro. See what this means for homeowners, agents, and title companies and why short sales remain a smart option.

When it comes to distressed property trends in Pennsylvania, the spring 2025 data paints a story of gradual but steady change. After several years of relatively low foreclosure activity, filings have been creeping upward across much of the state — and that movement is starting to ripple into the short‑sale market.

The Numbers Behind the Headlines

Let’s start with the hard facts:

- **April 2025:** Pennsylvania saw one foreclosure for every 4,304 housing units, according to Safeguard Properties.

- **May 2025:** That figure tightened to one in every 4,093 homes, or about 1,412 filings statewide out of 5.78 million units (*ATTOM Data Solutions*).

- **Philadelphia Metro:** During Q1 2025, there were 1,985 foreclosure starts, marking one of the highest quarterly totals since 2022.

While these numbers don’t represent a full‑blown crisis, they do confirm a slow normalization of foreclosure activity following years of artificially low delinquency rates during and immediately after the pandemic.

Regional Hot Spots

Most new filings continue to concentrate around **Philadelphia**, **Allegheny County (Pittsburgh)**, and pockets of **Lehigh Valley**. Rising insurance premiums, higher interest rates, and the expiration of COVID‑era forbearance plans have all contributed to renewed distress in these markets.

Rural and smaller‑metro counties — such as **Luzerne, Berks, and Erie** — have seen smaller but notable upticks as well, suggesting that economic strain is broadening beyond the major metros.

What It Means for Homeowners

For homeowners facing mortgage delinquency or looming foreclosure notices, **time is now the most valuable resource**. The earlier a homeowner acts, the more options remain available — including a short sale, which allows the property to be sold for less than the mortgage balance **before** foreclosure completes.

Unlike foreclosure, a short sale can:

- Limit long‑term credit damage.

- Prevent deficiency judgments in many cases.

- Offer relocation assistance at closing (sometimes thousands of dollars).

If handled correctly, a short sale can bring real relief to a homeowner while still allowing the lender to avoid a lengthy, costly foreclosure process.

Learn more about how we help homeowners complete short sales and move with cash in hand.

What It Means for Real Estate Agents and Title Companies

Agents and title teams are often the first professionals to hear from a distressed homeowner — but these files can quickly stall without specialized guidance. Lenders’ approval processes remain unpredictable in 2025, and missing one document or deadline can mean weeks of lost progress.

That’s where experienced negotiators come in. At **Crisp Short Sales**, we focus exclusively on short‑sale processing — helping real estate agents close short sales faster and with fewer delays. Our team handles lender communication, document collection, and closing coordination from start to finish.

For title companies, partnering early ensures clear title, faster HUD approvals, and consistent communication throughout the transaction.

Looking Ahead

If current trends continue, Pennsylvania’s foreclosure rate could rise modestly through the second half of 2025 — especially in metro areas where adjustable‑rate mortgages are resetting. This uptick will likely drive more homeowners to consider pre‑foreclosure alternatives like short sales.

That means opportunity for proactive agents and title partners who understand the process, build trust with distressed sellers, and collaborate with experienced short‑sale processors.

For homeowners and professionals alike, early action remains the key to smoother outcomes — and that’s exactly what we’re here to facilitate.

Ready to explore your options? Start a short sale today and we’ll walk you through the next steps.

Short Sales & Foreclosures in Arizona 2025: What Title Companies, Agents, and Homeowners Should Know

Arizona’s housing market has long been a bellwether for national real estate trends — and in 2025, the data show a clear rise in distressed sales. Whether you’re a title company preparing files, a real estate agent juggling short sale listings, or a homeowner exploring your options, understanding what’s happening across the state can help you navigate this changing market more effectively.

Rising Distress Levels Across Arizona

According to the ATTOM Mid-Year 2025 Foreclosure Report, Arizona saw roughly 4,191 foreclosure filings between January and June 2025. That represents about 0.13% of all housing units — roughly one filing for every 750 homes statewide.

What’s more striking is the year-over-year jump: foreclosure activity is up 37.3% compared to the same period in 2024. While these numbers are far below the peaks seen after 2008, they indicate that more homeowners are beginning to struggle with higher mortgage rates, cost-of-living pressures, and post-pandemic financial resets.

In April 2025, data from Safeguard Properties show 675 Arizona properties entered foreclosure — translating to one filing for every 4,655 housing units. Counties like Maricopa, Pima, and Pinal have seen the largest concentration of new filings, reflecting both population density and home price growth that outpaced income in recent years.

Short Sales Are Quietly Returning

While foreclosure filings make headlines, short sales often tell the more nuanced story behind them. A short sale allows a homeowner to sell their property for less than what’s owed on the mortgage, with lender approval, avoiding foreclosure and its long‑term credit damage.

In Arizona, many lenders are again open to these negotiations — especially when there’s a cooperative borrower and a clean, well-managed file. For agents and title professionals, this means that short sale coordination is once again becoming a critical skill.

At Crisp Short Sales (https://www.crispshortsales.com/), we specialize in short sale negotiation and processing for homeowners and agents throughout Arizona and across the U.S. From document prep to approval, we manage the entire lender process so closings stay on track and stress stays low.

For Title Companies

If you’re a title or escrow professional, rising short sales can create added complexity in your closing pipeline — extra lien releases, payoff statements, and layered approvals. That’s where having a dedicated short sale partner can save days (and headaches).

Learn more about how we help title companies streamline short sale closings (https://www.crispshortsales.com/how-we-help) and reduce risk when files hit your desk.

For Agents

Agents facing new short sale listings need confidence that the deal will close. Working with a short sale processor like Crisp allows you to focus on marketing and negotiation while we handle the lender side.

We’re already helping real estate agents close short sales faster across Arizona — and because our service is paid by the buyer at closing, there’s no cost to the agent or seller. See who we serve here: https://www.crispshortsales.com/who-we-serve.

For Homeowners

If you’re a homeowner in financial distress, the best move is to act before foreclosure starts. A short sale can help you avoid foreclosure, protect your credit, and even receive relocation assistance at closing. Learn how our process works and what programs might apply to your situation here: https://www.crispshortsales.com/start-short-sale.

The Takeaway

Arizona’s uptick in foreclosure filings doesn’t necessarily mean another housing crisis — but it does signal that distressed sales are back on the radar. For title companies, agents, and homeowners, understanding and preparing for these scenarios is key.

By partnering with an experienced short sale processor, stakeholders can turn distressed deals into closed transactions — keeping clients protected, lenders satisfied, and communities stable.

Sources:

- ATTOM Mid-Year 2025 Foreclosure Report

- Safeguard Properties State‑by‑State Foreclosure Rankings (April 2025)

Short Sales in Nevada 2025: What Rising Foreclosures Mean for Agents, Title Companies & Investors

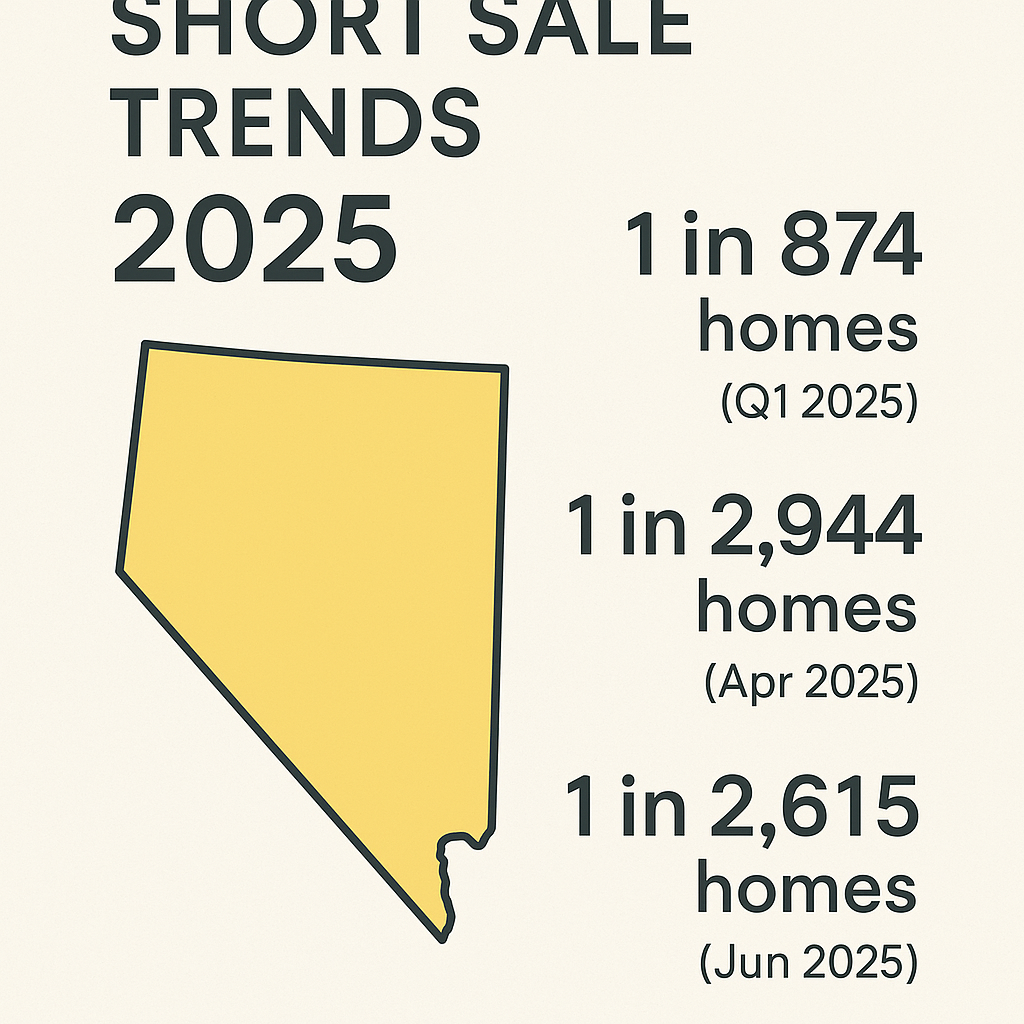

Nevada foreclosure rates are climbing in 2025, with one in 874 homes receiving filings in Q1 and continued distress through April and June. Learn how rising defaults create short sale opportunities for agents, title companies, and investors.

The Nevada real estate market is flashing early warning signs of distress in 2025. While home prices remain stable in many parts of the state, foreclosure filings are on the rise—creating both challenges and opportunities for agents, title companies, and investors who understand how to navigate short sales effectively.

According to ATTOM and The Mortgage Reports, roughly one in every 874 housing units in Nevada had a foreclosure filing in Q1 2025—the equivalent of a 0.114% foreclosure rate, one of the highest in the country. And by April 2025, Nevada still ranked 5th-worst nationally, with one foreclosure for every 2,944 housing units (Safeguard Properties review). Even by June 2025, the state continued to appear on national “worst-performing” lists, averaging one filing per 2,615 homes, according to PR Newswire.

A Rising Need for Short Sale Expertise

These numbers suggest a clear pattern: homeowners are starting to fall behind on payments again, and many may not have the equity cushion they once did. As property values level off and mortgage rates remain elevated, distressed owners who purchased during recent market highs are finding themselves upside-down.

That’s where short sales become critical. A properly managed short sale allows a homeowner to sell for less than what’s owed while avoiding foreclosure—a win for the seller, the lender, and the community at large. For real estate agents, it’s an opportunity to help clients preserve their dignity (and often their credit) while still earning a commission. For title companies, it’s about ensuring a complex closing gets done right, on time, and without last-minute surprises.

At Crisp Short Sales, we specialize in coordinating these transactions nationwide, working behind the scenes so that agents can focus on selling, not lender negotiations.

How Foreclosures and Short Sales Differ in Nevada

Nevada is a non-judicial foreclosure state, meaning lenders can foreclose without going through the courts as long as they follow statutory notice requirements. This often means the timeline from default to sale can move quickly—sometimes within 120 days after the Notice of Default is recorded.

That speed makes early intervention essential. Once a Notice of Default is filed, homeowners and their agents have limited time to pursue a short sale before the property heads to auction. In contrast to foreclosure, a short sale:

- Allows the seller to remain in control of the process.

- May qualify them for relocation assistance or cash incentives at closing.

- Minimizes damage to credit compared to foreclosure.

- Reduces the lender’s losses and keeps neighborhoods stable.

When handled correctly, short sales can prevent the ripple effects of foreclosure—abandoned homes, declining property values, and complicated title issues.

For Agents and Title Companies: Partner Early

The best results come when everyone involved acts early and communicates clearly. Listing agents who recognize signs of distress—such as mortgage delinquency or loan modification paperwork—should immediately reach out to an experienced short sale processor. Title companies can also play a proactive role by identifying encumbrances early and ensuring lien releases are coordinated before closing.

Crisp Short Sales partners with both groups to provide full short sale coordination, document management, and lender negotiation—ensuring a seamless closing for all parties. Learn more about how we help agents and title partners close short sales faster.

Investor Insight: Distressed Opportunities Ahead

For investors, Nevada’s foreclosure uptick may signal a renewed pipeline of short sale opportunities—properties where sellers need immediate solutions and lenders are motivated to approve discounted payoffs. However, working these deals successfully requires precision. Each servicer, investor, and insurer (FHA, VA, Fannie Mae, Freddie Mac, etc.) follows its own playbook. Delays or missteps in documentation can cost months—or worse, kill the deal entirely.

That’s why partnering with an expert short sale negotiator can mean the difference between a lost lead and a closed transaction. Our team at Crisp Short Sales ensures the process runs smoothly from start to finish, helping all parties avoid costly setbacks.

The Bottom Line

Nevada’s 2025 foreclosure data tells a clear story: default activity is climbing again. For real estate professionals who know how to respond, this isn’t just a warning—it’s an opportunity to serve clients better and grow business through short sales done right.

If you’re an agent, title company, or investor navigating distressed properties in Nevada, consider starting a short sale today. Acting early could mean the difference between a foreclosure on record and a fresh start at closing.

Short Sales in Washington (2025): What Agents, Title Companies & Investors Should Watch

Washington’s market is shifting in ways that matter for anyone working distressed real estate. Foreclosure activity is ticking, inventory is climbing, and transaction volume is cooling—conditions that historically set the table for more short‑sale opportunities. Here’s the state-of-play and what it means for your pipeline, negotiations, and timelines.

1) Foreclosure Distress Is Real—and Rising Pockets Mean Opportunity

In April 2025, Washington recorded 427 foreclosure filings across roughly 3.26 million housing units, a rate of 1 in every 7,641 homes. Why that matters: this is measurable distress—enough to generate a steady stream of upside-down homeowners, probate/estate sellers with liens, and investors who need a clean exit. For listing agents and title teams, the signal is clear: be short-sale ready.

If you’re not already lined up with a back-office partner for lender negotiations, valuations, and escalations, now’s the time. (We specialize in

—so you can stay focused on listings, showings, and closings while we do the heavy lifting with the bank.)

2) Transactions Down Sharply = More Pressure on Sellers

In Q1 2025, Washington saw 14,422 single-family transactions, down from 19,730 in the prior quarter and 18,710 in Q1 2024—declines of 26.9% and 22.9% respectively. Fewer closings + longer days on market means more sellers falling behind on payments, HOA dues, taxes, or junior liens. When equity is thin (or negative), owners start to consider options: price cuts, creative concessions, or a short sale.

For investors, this environment rewards speed and clarity. Clean offers with realistic timelines—and documented hardship support—help short-sale files move. For agents, tightening up your intake (hardship story, loan type, arrears, HOA, solar/UCCs, tax liens) before listing will save weeks later. For title companies, early lien discovery is gold—get HOA ledgers, municipal fines, and UCC filings on the table up front.

3) Supply Is Up Double-Digits—And That Tilts the Chessboard

As of September 2025, Washington had 34,199 homes for sale, up 16.9% year-over-year. More choices for buyers = more leverage on price and terms. Sellers who must move (job change, divorce, probate, investor debt stack) suddenly face a market that won’t forgive overpricing or deferred repairs.

Short-sale takeaway: When supply rises, lenders’ net-proceeds expectations get more realistic—especially once BPOs/appraisals reflect longer days on market and competitive price cuts. That’s your window to push for approvals that would have been tough a year ago.

Practical Plays for WA Short Sales Right Now

For Agents

- Pre-listing triage: Confirm loan type (FHA/VA/Conventional/USDA), investor (Fannie/Freddie/portfolio), arrears, forbearance history, HOA balances, solar/PACE/UCCs, and any municipal or tax liens.

- Price with precision: Use active competition, not just sold comps; DOM and price-cut velocity matter to bank BPOs.

- Contract hygiene: Clean offers, earnest money, and buyer commitment to short-sale timelines help you win approvals.

- Communication rhythm: Weekly cadence to lender, buyer, and seller avoids stalls. If you want us to run the lender side, start a file here: start a short sale.

For Title Companies

- Early lien sweeps: Order HOA estoppels, municipal/tax checks, and UCC searches as soon as a short-sale is contemplated. Surprises late = missed closings.

- Net sheet alignment: Sync the preliminary HUD with the lender’s required net (watch for investor minimums, MI contributions, and fee caps).

- Docs that de-friction: Get your short-payoff templates and authorization letters queued on day one. We’re happy to coordinate and handle the bank-side negotiation and document stack.

For Investors

- Underwrite the approval path, not just the ARV: Identify who truly calls the shots (servicer vs. investor vs. MI).

- Tighten timelines without being brittle: Offer flexibility at critical lender milestones: value dispute/BPO challenge, MI contribution asks, junior lien settlements.

- Junior liens: Have a plan (and budget) for small but stubborn seconds, HELOCs, solar liens, and HOA super-priority issues.

Washington-Specific Watchouts We’re Seeing

- Valuation disputes are winnable when you bring fresh comps that reflect current DOM and active inventory pressure. Include condition photos and repair bids—banks respond to specifics.

- HOA and municipal charges (utilities, code, fines) can derail the last mile. Surface them early and build them into the HUD so the investor guide rails aren’t surprised.

- MI contributions can be the hidden gatekeeper. Prepare the seller for hardship letters and supporting documentation that satisfies MI review.

- Escalations matter. When you hit a guideline wall, we escalate to investor or MI with a structured, data-forward case—often the difference between a declined file and a stamped approval.

How We Plug In (So You Don’t Lose Weeks to Phone Trees)

- Lender authorizations, intake, and document conditioning

- Valuation challenges (BPO/Appraisal rebuttals)

- Investor/MI escalations and junior lien settlements

- Weekly updates and HUD/fee alignment with title

Bottom Line for WA (Late 2025)

- Distress exists (documented filings)

- Transactions are down (sellers feel pressure)

- Inventory is up (buyers have options)

New Jersey Short Sales and Foreclosures 2025: What the Data Tells Us

NJ ranks among the top 10 states for foreclosures in 2025. Learn key stats, trends, and how short sales can help homeowners and agents.

New Jersey’s distressed property market is once again making headlines. As foreclosure filings rise nationwide, the Garden State remains among the hardest hit — and for homeowners, agents, and investors alike, that means opportunities and challenges ahead.

Foreclosures Rising Across New Jersey

According to ATTOM’s Mid-Year 2025 U.S. Foreclosure Market Report, 0.18% of all New Jersey housing units had a foreclosure filing in the first half of 2025 — placing the state among the ten highest in the nation.

While that number might seem small, it represents thousands of families and properties under financial stress. By September 2025, data from Safeguard Properties (via ATTOM) showed one in every 3,814 housing units statewide faced a foreclosure filing. The hardest-hit counties were Cumberland, Salem, and Sussex, where older housing stock and slower job growth have amplified economic pressure.

At the start of the year, New Jersey’s foreclosure rate was even higher — one in every 3,442 homes compared to the national average of one in every 4,618 (January 2025, ATTOM data via the New Jersey State Bar Association).

These figures show a steady pattern: New Jersey’s homeowners are experiencing distress at a faster pace than most of the country.

National Trends Help Explain Local Pressure

Nationwide, the third quarter of 2025 brought more concerning numbers. ATTOM’s Q3 2025 report showed foreclosure filings up 17% year-over-year, with foreclosure starts rising 16% and REO (bank-owned) repossessions jumping 33%.

This increase reflects a backlog of delinquent loans now moving through the system after several years of pandemic-era forbearance and legal slowdowns. For markets like New Jersey — where judicial foreclosures can take months or even years — those delayed cases are now catching up.

Short Sales as a Way Out

For homeowners facing default, a short sale remains one of the most effective alternatives to foreclosure. By selling for less than the loan balance (with lender approval), sellers can avoid the long-term damage of a foreclosure on their credit while often walking away debt-free.

Agents who understand this process can save deals that might otherwise fall apart. Working with a specialized short sale negotiation team can help ensure the lender approves the sale quickly and that all closing timelines are met.

At Crisp Short Sales, we handle the lender communications, document prep, and negotiation from start to finish — helping real estate agents close complex short sale transactions faster and with less stress.

For homeowners exploring their options, we also offer guidance on starting a short sale, including how to qualify, what paperwork is required, and how the approval process works.

Why This Matters for 2025

As foreclosure activity continues to climb, short sales are poised to make a comeback. Many lenders now prefer short sales over foreclosure because they minimize losses, keep properties occupied, and speed up recovery of non-performing loans.

New Jersey’s market — with its high home values, longer foreclosure timelines, and dense legal oversight — is uniquely positioned for this shift. That makes short sales not just a safety net for homeowners, but also a valuable strategy for agents and investors navigating a changing market.

For anyone seeing early signs of distress — missed payments, hardship letters, or default notices — acting early can make all the difference. Connecting with a trusted short sale expert before foreclosure proceedings begin can preserve more options and improve outcomes for everyone involved.

The Bottom Line

Foreclosure rates in New Jersey remain among the nation’s highest, but that also means opportunity — for homeowners to resolve debt with dignity, for agents to help clients through difficult transitions, and for investors to participate in rebuilding communities.

If you’re navigating any part of this process, reach out to Crisp Short Sales. Our team specializes in turning distressed situations into closed deals — with empathy, expertise, and proven results.

Maryland Short Sales & Foreclosures: Q2–Sep 2025 Update

Maryland’s distress market is shifting—filings up YoY, short sales rising from a low base, and county hot spots around Baltimore/PG. Here’s the data and what it means.

Maryland’s distress market is moving—but not spiraling. The newest reports show measured, data-driven shifts that buyers, sellers, and agents should understand as we head into year‑end.

Bottom line: filings are up year over year, short sales ticked higher off a small base, and county-level pressure remains concentrated around the Baltimore metro and Prince George’s County. If you’re deciding between loan mod, short sale, or riding it out, the facts below will help you choose the right lane.

The signal in the noise: five stats worth watching

1) Foreclosure filings are up YoY, but context matters. Maryland recorded 3,398 total foreclosure filings in Q2 2025, a +15.5% year-over-year increase. That’s meaningful, but it’s not a wave; it suggests a steady normalization from ultra-low pandemic levels rather than a sudden shock.

2) Monthly momentum nudged higher into summer. New foreclosure filings hit 565 in June 2025, up 10.8% month over month. Nearly half came from Prince George’s County, Baltimore County, and Baltimore City, reinforcing a long-standing geographic pattern: distress concentrates where affordability is stretched and household budgets are sensitive to rate and price changes.

3) Short sales rose—but remain a small share of sales. Maryland recorded 23 short sales in June 2025, up 53.3% from Q1. As a share of all sales, that’s around 0.34%—still a sliver of the market. Translation: short sales are increasing from very low levels, which creates opportunities in individual transactions without defining the overall market.

4) Mid-summer ranking looked elevated… In July 2025, ATTOM ranked Maryland 3rd‑worst foreclosure rate nationally, at 1 filing per 2,566 housing units. That put the state on watch lists and likely contributed to an uptick in investor and servicer activity.

5) …but early fall improved. By September 2025, Maryland’s rank improved to #11 with 768 filings (about 1 in 3,314 housing units). Top counties by rate were Caroline, Charles, and Baltimore City. That month-to-month drift reminds us not to over-read any single print; trends matter more than headlines.

What this means if you’re a homeowner

• If your monthly payment is unsustainable, start the conversation sooner rather than later. Lenders generally offer more options when you’re early. If selling makes more sense than modifying, a well-run short sale can cap losses and avoid a foreclosure mark. If you need a playbook for timelines, net sheets, BPO challenges, or escalation routes, here’s how we handle short sale approval assistance day-to-day.

• Expect more documentation, not less. Investor rules (FHA, VA, GSE, and portfolio guidelines) continue to evolve. Clean packages and clear hardship narratives still drive outcomes. If your file involves junior liens, HOA arrears, tax liens, or solar/UCC filings, plan your release strategy early—the first-lien approval window is not the time to start searching for contact info.

• A short sale is not a fire sale. The “discount” is determined by the investor’s net-proceeds math, property condition, and market comps—not by arbitrary percentages. Market-accurate pricing is the fastest way to approval.

What this means if you’re a real estate agent

• Pipeline planning: With filings up YoY and short sales inching higher off a small base, you’ll likely see more “maybe short” scenarios at listing appointments. Screening for hardship, reinstatement feasibility, and second-lien complexity saves weeks later.

• Time is the currency. Faster approvals come from clean, proactive files: complete packages, correct third-party auths, repair photos, and valuation notes prepared in advance of the BPO. If you’d rather keep your energy on pricing, showings, and offers, we specialize in helping real estate agents close short sales faster—handling lender calls, escalations, value disputes, and lien releases behind the scenes while you stay front-of-house with the client.

• Offer strategy: Buyers can account for third-party fees (including short-sale facilitation) in their offer price and, in some programs, request seller-paid closing costs. The goal is a bank-approved net that works—without killing the deal structure.

Direction of travel (not doom)

• Direction: Up modestly YoY on filings; monthly prints fluctuate, and rankings eased by September.

• Short sales: Increasing from a low base; still a small share of total transactions.

• Takeaway: Prepare, don’t panic. The best outcomes still come from early planning, accurate pricing, and organized packages.

If you’d like a candid look at timelines, approval odds, and net-to-lienholder math for a specific property, start your short sale with a quick intake (no obligation).

Source notes: Maryland DHCD “Housing Beat,” Q2 2025 (foreclosure totals, monthly new filings, short-sale counts). ATTOM Foreclosure Market Reports, July 2025 and September 2025 (state ranking, rate per housing unit, county leaders).

Colorado Short Sales 2025: Rising Foreclosures and Why Agents Should Prepare Now

Foreclosure filings in Colorado are rising. According to ATTOM’s September 2025 report, one in every 5,215 homes had a foreclosure filing. Learn why agents and title companies should prepare now for short sales and how Crisp Short Sales can help.

If you’ve been watching the numbers in Colorado lately, you’ve probably noticed a clear trend — foreclosure activity is climbing again. According to ATTOM’s U.S. Foreclosure Rates by State – September 2025 report, one in every 5,215 housing units in Colorado faced a foreclosure filing last month — that’s 488 filings statewide, with Washington, Rio Grande, and Lake Counties leading the way.

While Colorado’s overall rate is still below the national average, the trajectory is unmistakable. ATTOM’s Q3 2025 Foreclosure Market Report shows a 17% year-over-year increase in total U.S. foreclosure activity. Foreclosure starts are up 16%, and completed REO repossessions have jumped 33% compared to last year. Those national pressures are flowing directly into state-level markets like Colorado — and for real estate agents and title professionals, that means short sales are back on the radar.

A Shift That’s Already Visible in County Records

At the county level, activity is picking up. Weld County’s pre-sale lists for September show a growing slate of scheduled auctions. Arapahoe County’s October 8–14 postings include multiple Notices of Election and Demand (NEDs) — the first formal step in Colorado’s foreclosure process.

These data points align with the broader national trend: foreclosure filings nationwide rose roughly 20% year-over-year in September 2025, according to ATTOM’s monthly report.

So what does this mean for Colorado’s housing professionals? More homeowners are falling behind, lenders are restarting dormant default pipelines, and agents are again being asked the question:

“Can we sell this home before foreclosure hits?”

Why Agents and Title Companies Should Be Ready for Short Sales

For many distressed homeowners, a short sale — selling for less than what’s owed with lender approval — is the best possible outcome. It preserves dignity, prevents foreclosure, and often provides relocation assistance at closing.

But short sales require expertise and coordination — and that’s where agents and title partners can add tremendous value.

When handled correctly, a short sale can:

- Protect your seller from the long-term credit hit of foreclosure.

- Secure commission for the listing agent that would otherwise be lost.

- Allow the title company to facilitate a clean transfer instead of a messy REO process.

- Help buyers purchase at a fair price without the delays or risk of post-foreclosure title defects.

Yet, despite these benefits, many deals still fall apart due to missing documents, poor communication with the lender, or misunderstandings about investor guidelines.

How Crisp Short Sales Helps Agents Close

At Crisp Short Sales, we partner with real estate agents and title companies throughout Colorado and across the U.S. to manage the entire short sale process from start to finish — from document prep to lender negotiation to final approval.

Our team handles the complex, time-consuming parts — so you can focus on your clients and your next listing.

If you’re an agent helping a seller in default, or a title company looking to ensure your next distressed transaction closes smoothly, we’re here to help.

We manage every type of short sale, including those involving:

- FHA, VA, and conventional loans

- Second liens and HELOCs

- Solar liens, HOA judgments, and municipal code liens

Because we work directly with servicers and investors every day, we know how to navigate lender requirements, escalate valuation disputes, and move files efficiently toward closing.

Helping real estate agents close short sales faster is what we do.

Colorado Market Outlook: 2026 and Beyond

Given the national increase in delinquencies and foreclosure starts, we expect short sales to continue trending upward through early 2026. Rising rates, inflation pressure, and pandemic-era forbearance exits have created a mix of homeowners who are equity-thin or upside-down again.

Colorado’s strong appreciation since 2020 helped buffer the first wave, but as interest-rate resets and job market shifts hit households in Q4 2025, we’re likely to see more listings that simply can’t sell fast enough to cover what’s owed.

Agents who prepare now — and build a relationship with a trusted short sale negotiation team — will be in position to capture those listings and close them efficiently.

If you or your team are seeing early signs of distress in your pipeline, take a moment to learn more about how we help homeowners and agents through short sales or start a new short sale file here.

Key Takeaway for Agents and Title Companies

Short sales aren’t just coming back — they’re already here. And in Colorado, where foreclosures are climbing in both metro and rural counties, being ready now means you can serve more clients, protect more deals, and strengthen your reputation when other agents are still trying to catch up.

If you’ve got a file that looks like it’s heading toward foreclosure, reach out. We’ll help you turn it into a successful short sale closing.

Short Sales in New York: 2025 Market Shifts Every Agent Should Watch

Foreclosure filings in New York are ticking up again. Discover how agents and investors can benefit from short sale opportunities with Crisp Short Sales.

After years of relative calm, New York’s distressed property market is beginning to stir again—and agents and investors who understand short sales are already positioning themselves ahead of the curve.

Recent data reveals that while the state’s foreclosure activity remains moderate, the momentum is shifting fast.

- Metro New York Q1 2025: first-time foreclosure filings totaled 1,503, the quietest first quarter in five years (–7% YoY).

- Metro New York Q2 2025: filings rebounded, rising 6% YoY to 1,718, marking the most active quarter in nearly two years.

- NYC Q3 2025: first-time filings climbed another 16% YoY to 412, with Queens up 33%—the most active borough in the city.

- Statewide Q3 2025: 5,269 properties had foreclosure filings (1 in every 1,621 housing units).

- May 2025: 1,222 foreclosure starts statewide, with the NYC metro leading all major metros at 1,174 starts.

These aren’t catastrophic numbers—but they’re meaningful. For professionals who work in residential real estate, this shift signals that short sales are quietly coming back across New York.

Why the Numbers Matter

New York’s foreclosure pipeline has always lagged other states due to judicial timelines, but the pressure is building. After several years of pandemic-era protections and refinancing, many homeowners are now facing unaffordable resets on high-rate loans or past-due taxes.

For agents, this means:

- More listings with distressed sellers who still have strong motivation to sell before foreclosure.

- More opportunities to negotiate short sales before auction.

- And more buyers and investors looking for properties that can close below market but with less risk than at auction.

When handled correctly, a short sale can protect a homeowner’s credit, allow them to walk away without deficiency, and let the lender avoid a costly foreclosure. But for the agent or investor involved, the key is execution—and that’s where Crisp Short Sales steps in.

Helping New York Agents Close Short Sales Faster

At Crisp Short Sales, we specialize in helping real estate agents close short sales faster by handling the entire negotiation and approval process.

You keep your client. You keep your commission. We handle the lender.

Whether you’re an agent representing a homeowner in Queens or an investor making offers in Nassau County, our team ensures your file is packaged, submitted, and negotiated efficiently—with updates every step of the way.

Our process includes:

- Complete document prep and lender submission

- Weekly progress reports so you stay in control

- Direct communication with banks and servicers

- Faster approvals with our seasoned negotiators who understand Fannie, Freddie, FHA, and VA guidelines

If you’ve ever had a short sale stall or fall apart, you know how crucial it is to have an expert on your side. That’s why agents across the U.S. partner with us for short sale coordination and negotiation—so they can focus on what they do best: selling homes.

👉 Learn more about how we help real estate agents close short sales faster and what it means to have a partner who handles every lender conversation for you.

Investors: The New Window of Opportunity

For investors, these foreclosure metrics highlight a changing landscape. The increase in early-stage filings means more properties will hit the market where lenders are open to short payoffs—especially when repairs or valuation gaps make full repayment impossible.

By partnering with a professional short sale negotiator, investors can:

- Make stronger, cleaner offers banks are more likely to accept

- Get accurate lender feedback on required net proceeds before committing capital

- Close with fewer surprises and delays

Our platform streamlines everything from offer submission to final approval—so you can focus on finding the next deal, not chasing servicers for updates.

If you’re an investor or buyer’s agent seeking opportunities in New York’s evolving market, see how short sale negotiation support can give your offers an edge.

What’s Next for New York’s Market

Foreclosure filings in New York remain far below pre-pandemic highs, but the direction is clear. With rates holding steady and property values flattening, distressed sales will continue to rise through 2026. Agents and investors who can navigate these transactions—not avoid them—will win listings, clients, and profits others miss.

If you’re ready to get ahead of the next wave, now’s the time to strengthen your short sale network.

Start by seeing how Crisp Short Sales can help you start a new short sale file today and position your business for the next phase of the New York market.

Short Sales in Illinois: Why 2025 Is the Year Agents Should Be Paying Attention

Illinois homeowners and real estate agents are feeling the pressure in 2025. With foreclosure activity climbing for the third straight year, short sales are once again becoming a critical lifeline for homeowners — and a key opportunity for agents who know how to navigate them.

According to the ATTOM U.S. Foreclosure Market Report (Oct 2025), foreclosure filings in Illinois rose 11% year-over-year in Q3 2025, making the state #4 nationwide for total filings. That’s no small figure. Across Illinois, 1 in every 1,204 housing units had a foreclosure filing in Q3, compared to 1 in 1,286 just a year earlier.

In the Chicago metro area, the trend is even more pronounced. Filings are up 14% year-over-year, largely due to an uptick in FHA and VA loan delinquencies — the same loan types most commonly associated with successful short sales.

For agents, that’s a signal worth watching.

## Why Short Sales Are Back on the Table

While no one wants to see another wave of distressed homeowners, the numbers don’t lie. Bank repossessions (REOs) are up 9% statewide according to CoreLogic’s Distressed Market Update (Aug 2025). Lenders are clearly moving faster to resolve non-performing loans, and that creates opportunity for early intervention before foreclosure hits.

That’s where a well-executed short sale can make all the difference.

A short sale allows a homeowner to sell their property for less than the mortgage balance, with the lender’s approval — avoiding foreclosure, credit damage, and often qualifying for relocation assistanc at closing. (Learn more about how we help homeowners qualify for relocation incentives and cash-at-closing options.)

## Cook County Leads the State in Distress

With over 4,200 new foreclosure starts year-to-date, Cook County continues to lead Illinois in distressed property activity, according to the Illinois Housing Development Authority. The volume of files moving through lender pipelines signals an urgent need for trained professionals who can help borrowers before these homes become bank-owned.

That’s where real estate agents come in.

Many agents hesitate to take short sale listings, assuming they’re complicated or time-consuming. The truth is, with the right team handling negotiations and paperwork, agents can focus on marketing and selling while still earning their full commission.

Crisp Short Sales partners with agents throughout Illinois to handle the full lender negotiation process from start to finish — from file setup and offer submission to valuation disputes and final approval. (See how we help real estate agents close short sales faster.)

## What Makes Illinois a Unique Short Sale Market

Illinois has always been a judicial foreclosure state, meaning lenders must go through the court system to repossess a property. That process can take many months — and during that window, a well-timed short sale can often save the homeowner’s credit and give the bank a faster resolution.

Because of that, banks are more willing than ever to consider short sales on FHA, VA, Fannie Mae, and Freddie Mac loans, as long as the paperwork is complete and communication is handled properly.

That’s exactly what we specialize in at Crisp Short Sales — managing every stage of the process for both homeowners and agents, and ensuring lenders meet their own timelines. We’ve spent over 15 years perfecting our system so that Illinois agents can confidently take on short sale listings without the typical stress or delay.

If you’re a homeowner in Illinois facing missed payments, or an agent with a listing that’s underwater, it's never too early to start the conversation. You can start your short sale here and we'll handle the rest.

## What to Watch Heading Into 2026

As we move into the final quarter of 2025, all indicators point toward continued distress in Illinois’ housing market. Interest rates remain high, and many homeowners who bought in 2021–2022 with minimal equity now find themselves upside down as values soften.

Expect short sales to continue increasing into 2026 — especially across Cook, Will, Kane, and Lake Counties, where mortgage delinquencies are most concentrated.

For agents, that means now is the time to prepare. Short sales aren’t just “back” — they’re once again becoming a critical part of a balanced real estate business in Illinois. And the agents who understand how to navigate them (or who know who to call for help) will be the ones closing deals while others wait for the market to recover.

## In Summary

- Foreclosure filings up 11% statewide (ATTOM, Oct 2025)

- 1 in 1,204 homes affected by foreclosure in Illinois (RealtyTrac, Oct 2025)

- Chicago area filings up 14% (ATTOM, Sept 2025)

- Bank repossessions up 9% (CoreLogic, Aug 2025)

- Cook County leads with 4,200 foreclosure starts (IHDA, 2025)

The numbers make it clear: Illinois is entering another active short sale cycle. Agents and homeowners who take proactive steps now will have far better outcomes than those who wait for a foreclosure notice.

Ready to see what options are available? Start your short sale here and let’s get you on track for a smooth closing.

The Hidden Power of a Short Sale Pre-Approval: How It Speeds Up Closings

Did you know lenders can pre-approve a short sale before an offer? Getting a valuation early helps agents list with confidence and close faster. Learn how in our latest post.

Most agents think short sales can’t move forward until there’s a buyer on the line. But the truth is, many lenders will actually pre-approve a short sale even before an offer is received — and that small distinction can make all the difference between a smooth, 45-day closing and a six-month nightmare.

What Is a Short Sale Pre-Approval?

A short sale pre-approval means the lender has already reviewed a homeowner’s financial package and agreed — in principle — to accept a payoff below the loan balance once a qualified buyer comes along. This step can be done *before* the property ever hits the MLS.

If the loan type allows it (and most do), the lender can order a**appraisal or BPO** early in the process. Once the valuation comes back, the lender sets a **target approval price**. That gives you a massive advantage when marketing the home — because you’re no longer guessing what the bank will accept.

Why It’s a Game-Changer for Agents

Listing a short sale with a lender-approved price tag instantly builds confidence with buyers and their agents. It says:

✔️ The lender is engaged.

✔️ The price is realistic.

✔️ The approval process won’t drag on for months.

That transparency can generate stronger offers faster — and keep serious buyers at the table rather than walking away out of frustration.

For the listing agent, this also means fewer surprises after contract. You already know what value the lender will support, and you can negotiate confidently around that number.

**How to Get a Short Sale Pre-Approval**

To kick off a pre-approval, the lender just needs a **complete short sale application** — even if there’s no offer yet. That usually includes:

- A signed authorization form

- Financial documents (pay stubs, bank statements, hardship letter)

- A preliminary HUD or estimated net sheet

- Listing agreement and MLS printout

Once submitted, the lender can begin their internal review, order valuation, and issue a **pre-approved price range** or “acceptable payoff.”

**Which Loan Types Allow It**

Not all lenders advertise pre-approvals, but many major investors — including **Fannie Mae, Freddie Mac, FHA, and VA** — will accept short sale packages without an offer. FHA and VA programs, in particular, encourage early submission to speed up approvals.

That means instead of waiting 30–60 days after going under contract for a BPO, you could have that valuation in hand before showings even begin.

**How Crisp Short Sales Makes It Easy**

At **Crisp Short Sales**, we handle everything from the initial submission to lender communication, so agents can focus on selling. We know each investor’s rules, forms, and valuation timelines — and we prepare every package so it qualifies for pre-approval as fast as possible.

Whether you’re working with FHA, VA, or conventional loans, we help agents **secure a pre-approved value up front**, turning a stressful process into a predictable one.

If you want help gettingoved, learn more about how we **help agents close short sales faster**(/who-we-serv your next file pre-appre) and how we **handle the full short sale process from start to finish**(/how-we-help).

Or, if you’re ready to start a pre-approval right now, **submit your short sale here**(/start-short-sale).

Short Sale vs. Foreclosure: The Real Tax Story Homeowners Need to Know

Learn how a short sale can save you from foreclosure and IRS tax surprises. Discover key differences in forgiven debt, Form 1099-C, and more.

When a homeowner falls behind on mortgage payments, the stress goes far beyond just keeping the lights on — it can follow you into tax season. The difference between doing a short sale and letting the home go to foreclosure isn’t just about credit. It’s also about what the IRS might expect from you when it’s all over.

Let’s break down the real tax implications of each path — and why a properly handled short sale can save homeowners more than just their financial sanity.

Forgiven Debt and the IRS: What You Need to Know

When a lender forgives part of your mortgage balance (for example, if you owe $300,000 but the home sells for $250,000), that $50,000 difference is technically considered canceled debt. The IRS often treats canceled debt as taxable income, reported on a Form 1099‑C.

So in a foreclosure, that “forgiven” amount can come back as a tax surprise unless you qualify for an exclusion.

But here’s where a short sale helps — when done right, homeowners can often avoid being taxed on that forgiven balance.

How the Mortgage Forgiveness Debt Relief Act Helps

Congress passed the Mortgage Forgiveness Debt Relief Act (MFDRA) to protect struggling homeowners. It generally allows people to exclude up to $2 million of forgiven mortgage debt from taxable income, as long as:

- The debt was used to buy, build, or improve the home.

- The property was your primary residence.

- The loan was not a cash‑out refinance or second mortgage used for other purposes.

The act has expired and been renewed several times, so timing matters — but in many short sale cases, it still applies or sets a precedent for IRS exclusions.

That’s another reason it’s critical to handle the sale properly and document everything the lender agrees to forgive.

Why Foreclosure Can Be a Double Hit

In a foreclosure, the homeowner usually has no control over the sale price or the process. The lender may report a foreclosure sale price far below fair market value, increasing the “forgiven debt” amount on paper — and your potential taxable income.

Plus, the IRS doesn’t see foreclosure as an “arm’s‑length” transaction, so there’s less room to clarify what was actually forgiven versus what was just lost through market depreciation.

In contrast, a short sale is a negotiated, controlled process that allows you to:

- Get an approved sale price closer to market value.

- Confirm the lender’s written agreement to forgive the balance.

- Ensure no deficiency judgment or tax liability lingers afterward.

Alternatives: Deed‑in‑Lieu and Loan Modifications

Some homeowners consider a deed‑in‑lieu of foreclosure, where they voluntarily transfer the property back to the lender. While it may seem simpler, it’s often reported the same way as a foreclosure — meaning possible 1099‑C income.

A loan modification can also trigger taxable forgiven debt if the lender reduces your principal. It’s less likely to damage your credit as severely, but it may still carry tax implications.

That’s why working with a short sale expert ensures not just the closing, but also that the paperwork is worded correctly so you aren’t hit with surprise taxes down the line.

How a Short Sale Expert Protects You

When you partner with a team like Crisp Short Sales, we handle all the communication and documentation with the lender to make sure your short sale approval includes:

- Written debt forgiveness and deficiency waiver

- Correct reporting for IRS and state tax purposes

- No negotiator or third‑party junk fees that complicate your net proceeds

We’ve helped hundreds of homeowners avoid foreclosure — and avoid unnecessary tax bills — by getting the bank to agree to market‑value offers and close fast.

If you’re unsure where you stand, visit our page on how we help homeowners through the short sale process or get started right now by completing the short sale intake form.

Bottom Line

A foreclosure often leaves you with a credit hit and a tax headache.

A short sale, when structured and documented properly, can help you walk away without the IRS knocking on your door.

If your lender is already threatening foreclosure, now’s the time to explore your options — not after the auction notice arrives. The sooner you act, the more likely you are to protect both your finances and your peace of mind.

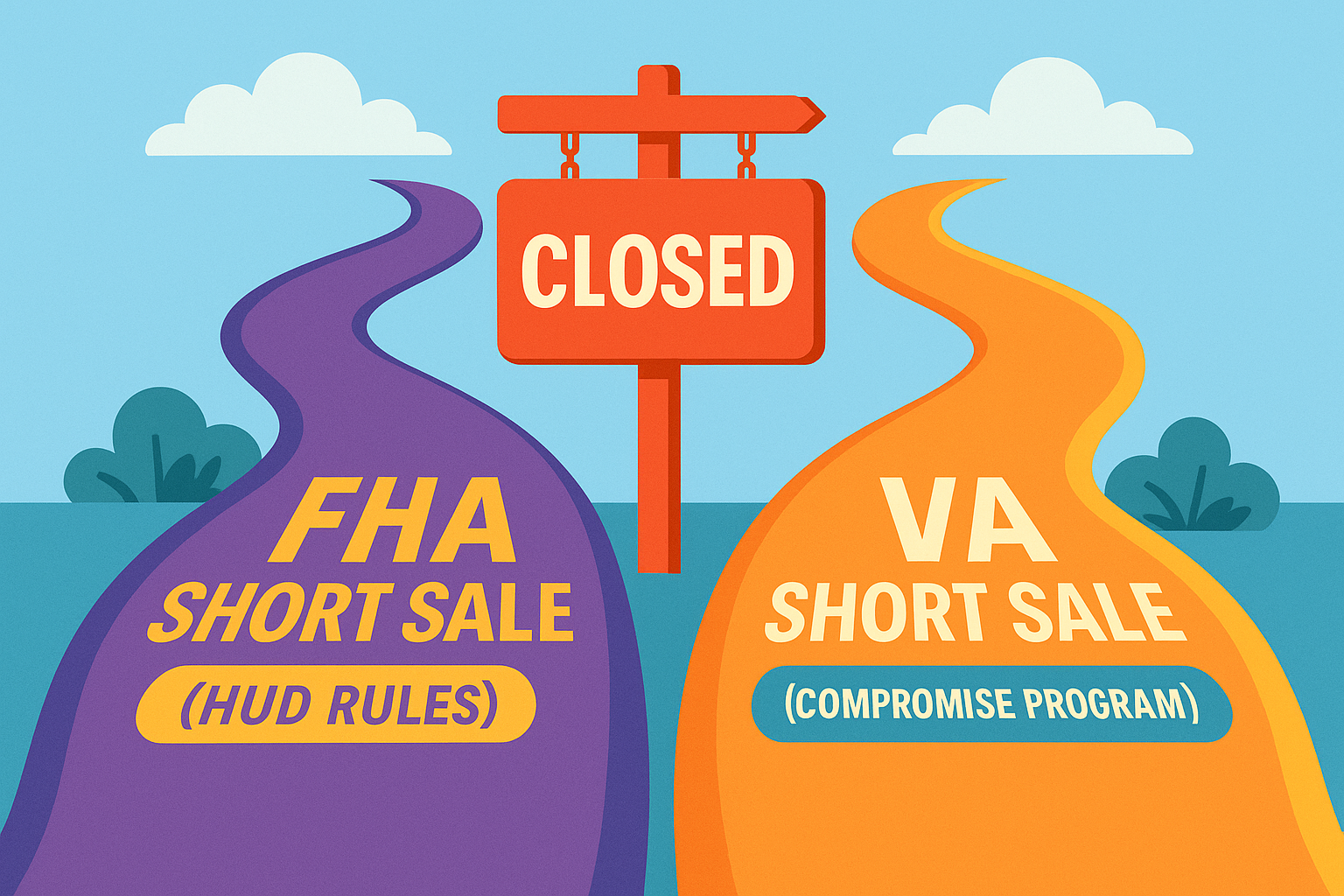

Inside the FHA & VA Short Sale Playbook: Timelines, Forms, and Traps to Avoid

For most agents, short sales already feel like an obstacle course. But when that loan is FHA or VA-backed, the game changes completely. You’re not just dealing with a lender anymore — you’re working within a federally regulated process that has its own rulebook, timelines, and forms. And if you miss a single step, your deal can grind to a halt before it ever reaches the closing table.

At Crisp Short Sales, we’ve handled hundreds of FHA and VA short sales nationwide. Here’s what every agent and homeowner should know before diving into one of these deals — and how to make the process smooth, fast, and predictable.

1. FHA Short Sales: The Pre-Foreclosure Sale Program

The FHA short sale process operates under HUD’s Pre-Foreclosure Sale (PFS) Program — a structured system that dictates nearly everything, from how the property is priced to when it can close.

Before a seller can even list the property, the servicer must determine eligibility and issue an Approval to Participate (ATP). Without that ATP letter, the sale can’t move forward.

Key differences from conventional short sales:

- The property must be owner-occupied (or recently vacated for hardship reasons).

- HUD requires its own independent as-is appraisal to establish value — not the lender’s opinion.

- There’s usually a 15- to 30-day marketing window before HUD will even review an offer.

- The net-to-HUD requirement is strict; there’s no negotiating below the minimum allowed.

If the offer doesn’t meet HUD’s formula, the servicer’s hands are tied. That’s where experienced short sale processors come in — we know how to dispute valuations, document condition issues, and get the right value accepted before the file stalls.

Learn more about how we handle these challenges on our short sale negotiation page.

2. VA Short Sales: The Compromise Sale Program

VA loans run under an entirely different system called the Compromise Sale Program, overseen by the Department of Veterans Affairs. The VA is generally more flexible about timelines but just as strict about documentation.

Here’s how it works:

- The servicer submits the offer to VA for final review — yes, VA must sign off before approval.

- The VA requires its own Net Value analysis based on an internal appraisal.

- The seller must show a clear financial hardship, and the file often requires verification of all assets and income.

- The VA may pay off certain title or lien costs to facilitate closing, which can actually make these short sales easier to close than conventional ones.

Still, delays can occur when servicers fail to forward complete packages or when VA’s Net Value formula changes midstream. That’s why having a team familiar with VA-specific guidelines and escalation channels makes all the difference.

3. Common Traps (and How to Avoid Them)

1. Missing the ATP or Net Value Expiration: These approvals have short shelf lives. If they expire, you’re starting over.

2. Incorrect buyer addendums: Both HUD and VA have their own short sale addendum forms, and lenders won’t substitute.

3. Assuming you can negotiate fees later: Neither HUD nor VA allows “side agreements” or last-minute fee adjustments. The HUD-1 or CD must match the approval exactly.

4. Not disputing value early enough: Once the government’s value is locked in, it’s nearly impossible to change it without a full re-review — which can take weeks.

4. Why Experience Matters

An FHA or VA short sale isn’t just about paperwork — it’s about precision. You’re dealing with multiple layers of oversight: the servicer, the investor (HUD or VA), and sometimes even an asset management company.

Our team at Crisp Short Sales handles all of this behind the scenes — from valuation disputes to escalation calls — so agents and homeowners can focus on the deal, not the red tape.

If you’ve got a government-backed listing that needs help, start here: Start Your Short Sale Today.

Final Thought

FHA and VA short sales might look intimidating, but when you know the playbook, they can actually be the most predictable of all. Follow the rules, stay ahead of deadlines, and let experienced hands guide the process — and you’ll be cashing commission checks instead of chasing approvals.

The Real Cost of Ignoring a Short Sale Option

The Misleading Word “Short”

Many homeowners think a “short sale” means a quick, simple transaction. In reality, the "short" refers to the amount the lender receives, not the time it takes. Short sales can take time and careful negotiation, but they’re far less painful than waiting for foreclosure.

What Foreclosure Really Costs You

If you ignore the short sale option and let a foreclosure happen, the costs are significant:

• A foreclosure can drop your credit score by 150–200 points and remain on your report for up to seven years.

• It can prevent you from qualifying for a new mortgage for three to seven years.

• You could still owe a deficiency judgment or face tax liabilities on the forgiven debt.

• The emotional toll of relentless collection calls and court filings can’t be overstated.

Why Acting Early Saves You Time, Money, and Stress

Starting a short sale process early puts you in control and reduces stress for everyone involved. Lenders often prefer a short sale to foreclosure because it saves them money too. Acting sooner can:

• Stop fees and interest from piling up.

• Show your lender that you’re cooperating, which helps preserve your credit standing.

• Qualify you for lender-funded relocation or cash-for-keys programs that can put money in your pocket at closing.

The Smarter Alternative to Waiting It Out

Ignoring your mortgage problem won’t make it go away. Every month you delay narrows your options and increases your liabilities. Acting quickly with a short sale can:

• Halt foreclosure proceedings before they spiral.

• Get you help from experts who help homeowners avoid foreclosure every day.

• Protect your ability to buy again sooner while limiting your financial liability.

Working with experienced negotiators makes the process smoother. At Crisp Short Sales, we handle negotiations, paperwork, and timelines at no cost to homeowners. We’ll even help you access lender relocation assistance and cash-for-keys programs that provide money at closing.

Final Thoughts

Waiting until the last minute can cost you tens of thousands of dollars and years of credit damage. A well-managed short sale gives you a fresh start without the scars of foreclosure. If you’re facing financial hardship, don’t wait—start your short sale now and protect your future.

What Every Homeowner Needs to Know About Short Sales

If you’re a homeowner facing financial hardship or a looming foreclosure, the term “short sale” might sound both confusing and intimidating. But understanding it could be the key to protecting your credit, your sanity, and even your future buying power.

Let’s break down what a short sale really means, how it works, and what homeowners need to know before deciding if it’s the right move.

What Is a Short Sale?

A short sale happens when your home sells for less than what you owe on the mortgage, and your lender agrees to accept that lower amount as full payment. Essentially, the bank says, “We’d rather take a small loss now than a bigger one later.”

It’s not the same as a foreclosure. With a short sale, you remain in control of the process — you list your home with an agent, review offers, and work with your lender for approval. The goal is to sell the home before the lender forecloses, which helps you avoid the long-term credit damage and public record of foreclosure.

Why Homeowners Choose a Short Sale

Most homeowners choose a short sale because it allows them to:

- Avoid foreclosure and its seven-year credit penalty.

- Stop the stress and embarrassment of a public foreclosure auction.

- Get relief from an unaffordable mortgage.

- Move on with dignity — and sometimes, even receive relocation assistance (often called cash for keys or money at closing).

That relocation assistance can make a huge difference. In many cases, programs allow you to walk away with up to $10,000 to help with moving costs and getting back on your feet. Learn more about how this works in our guide to relocation incentives.

How the Short Sale Process Works

Here’s a quick breakdown of what to expect:

1. Hire an experienced short sale specialist.

You’ll want someone who negotiates with lenders every day — not just an agent who’s done one or two. That’s where a dedicated short sale team like ours comes in. We handle all communication with the bank and make sure your file gets approved efficiently.

2. List your home for sale.

Your real estate agent will list the home at a market-supported price. You can still live there during the process.

3. Submit an offer to your lender.

Once an offer comes in, your short sale specialist will submit it to the lender along with your financial documentation./

4. Lender review and approval.

The lender reviews the offer, orders a valuation, and issues approval. A great negotiator can help close this gap faster — and make sure your net proceeds meet the bank’s requirements.

5.. Close and move forward.

Once approved, you’ll close the sale like any normal real estate transaction. The debt is settled, and you can move on with peace of mind.

If you’d like to see how this process would look foryour specific situation, you can start your short sale here

Common Misconceptions About Short Sales

Start your short sale here.

There’s a lot of misinformation floating around. Let’s clear a few things up:

- “I have to be behind on payments.” Not necessarily. Many lenders approve short sales for homeowners who are current but facing a verified hardship such as job loss, medical bills, or divorce.

- “I’ll owe the difference after the sale.” In most cases, that debt is forgiven at closing. Our negotiation team ensures your approval letter clearly states the deficiency is waived.

- “Short sales take forever.” They used to — but today, with experienced processing, approvals can happen in as little as 30-45 days once an offer is submitted.

- “It will ruin my credit.” It’s not perfect, but it’s far better than foreclosure. Many homeowners qualify for a new mortgage in as little as two years after completing a short sale.

The Benefits of Working With a Short Sale Expert

Most homeowners don’t realize the bank pays all of the costs — including agent commissions and short sale processing fees. That means our service is 100% free to you.

Our team at Crisp Short Sales works directly with your lender to manage every step, from document prep to final approval. You’ll never have to sit on hold with the bank or chase updates. We do all the heavy lifting so you can focus on your next move.

Final Thoughts

Short sales are not just a last resort — they’re often the most strategic way to protect your credit, your dignity, and your future.

If you’re wondering whether a short sale might be right for you, take a few minutes to get started with a free consultation. We’ll review your situation, explain your options, and guide you through the entire process — at no cost to you.

You don’t have to go through this alone. With the right help, a short sale can be your best path forward.

Winning the Value Battle: How to Dispute a Bank’s Short Sale Valuation (and Win)

If you’ve ever submitted a short sale only to have the bank come back with a sky-high value that kills your deal — you’re not alone. Disputing a bad valuation is one of the trickiest (and most important) parts of short sale negotiation. The good news? With the right comps, documentation, and a clear argument, you can often turn a denial into an approval — and keep your deal alive.

At **Crisp Short Sales**, we’ve seen hundreds of agents face this exact scenario. The key isn’t just disagreeing with the valuation — it’s **proving your case in a way the lender’s investor can’t ignore**.

## Why the Bank’s Value Is Often Wrong

Short sale valuations usually come from a **Broker Price Opinion (BPO)** or sometimes an **internal appraisal**. Unfortunately, these are often done by agents who’ve never seen the inside of the property — or who price it as if it were move-in ready. Common problems include:

- Using comps that are **too far away** or in **better condition**

- Ignoring **needed repairs or updates**

- Pricing based on **retail listings**, not closed sales

- Failing to account for **market shifts or interest rate impacts**

The result: the lender sets a target number that’s **10–20% too high**, and your buyer’s offer gets rejected for being “too low.”

## Step 1: Gather the Right Comparables (Your Strongest Weapon)

The most persuasive way to challenge a bad valuation is with **comps that reflect true market conditions**.

Here’s what you want to include in your dispute:

- **3–5 closed sales** within the past 90‑180 days

- **Within one mile** of the subject property (or as close as possible)

- **Same property type** (single-family, condo, etc.)

- **Similar size, age, and condition**

- **Photos or MLS printouts** showing interior condition if available

If your property needs work, include **repair estimates** or **contractor quotes** to support your argument for a lower value. When possible, show that other properties **in similar condition** sold for less — that’s what resonates with asset managers reviewing your dispute.

## Step 2: Write a Persuasive Dispute Letter

Numbers alone aren’t enough — you need to explain your reasoning clearly. A concise **valuation dispute letter** should:

1. **State your position early.** ("The valuation of $340,000 does not reflect the home’s current market value based on comparable sales.")

2. **List your supporting comps** in bullet format, including addresses, sale prices, and distances.

3. **Address the differences** between your comps and the ones the BPO agent used.

4. **Highlight condition issues** with brief, factual notes (e.g., "roof needs replacement," "kitchen outdated," "HVAC original").

5. **Close professionally** with your contact info and invitation for follow-up.

Think of it like a courtroom argument: short, fact-based, and supported by evidence. The goal isn’t to **argue** — it’s to **make it easy for the lender to justify your position internally**.

## Step 3: Support Your Case Visually

When possible, attach photos showing the home’s true condition. Pictures of peeling paint, dated kitchens, or foundation cracks carry weight — especially if the original BPO agent never went inside. The visual contrast between your subject and their comps often tells the story better than words can.

## Step 4: Submit the Package the Right Way

Every servicer has slightly different submission rules. Typically, your **valuation dispute package** should include:

- Dispute letter (PDF)

- Comparable sales (MLS printouts or screenshots)

- Repair estimates or inspection reports

- Photos (labeled)

Send everything in a single, clean email or upload file — don’t overwhelm the lender with multiple messages. Then, follow up in **24–48 hours** to confirm receipt and ask when you’ll get a response.

If the value still doesn’t budge, don’t give up — you can often **escalate the dispute to the investor level** (especially for Fannie Mae, Freddie Mac, or FHA loans). At that stage, professional short sale negotiators like our team at Crisp Short Sales can often intervene and reframe the file in a way that gets traction.

## Step 5: Stay Professional — Even When You’re Right

Banks get hundreds of files per day. Staying polite, persistent, and factual keeps your dispute from being dismissed as emotional or adversarial. Your professionalism not only helps you close this deal — it builds your reputation for future short sale listings, too.

If your file is stuck because of a bad valuation, we can help. Our team specializes in helping real estate agents close short sales faster — handling all negotiations, escalation requests, and investor communications on your behalf. When you’re ready to get started on a tough file, you can start a short sale with us anytime — we’ll make sure the value reflects the real market, not a guess from behind a desk.

For more tips on helping real estate agents close short sales faster, our specialists in short sale negotiation are here to support you. Ready to take action? Start a short sale with us today.

Short Sales in Georgia: What Homeowners Need to Know

Short sales in Georgia offer homeowners a chance to avoid foreclosure. Learn how the process works, Georgia-specific laws, and how Crisp Short Sales can help.

When you’re facing mortgage trouble in Georgia, a short sale can be a lifesaver — a chance to avoid foreclosure, minimize credit damage, and move on with dignity. But Georgia has some unique laws and timelines that make the process a little different from other states. Here’s what every Georgia homeowner should know before starting a short sale — and how Crisp Short Sales can handle the hard parts for you.

## What Is a Short Sale, Exactly?

A short sale happens when your lender agrees to accept less than the full amount owed on your mortgage so you can sell your home and avoid foreclosure. The lender reviews your financial hardship, the home’s market value, and the sale offer before approving the deal.

Once approved, the property sells just like any normal home sale — except the bank must sign off on the final numbers before closing. That’s where experienced short sale help makes all the difference.

## Georgia’s Foreclosure Timeline Moves Fast

Georgia is a **non-judicial foreclosure** state, which means your lender doesn’t have to take you to court to foreclose. Instead, they only need to follow state notice requirements, and they can move to sell your home at auction in as little as **four weeks** after filing.

That’s fast — and why homeowners in Georgia need to act quickly if they’re behind on payments. Waiting until you get a foreclosure notice often leaves very little time to negotiate with the bank. A short sale can stop the foreclosure clock, but only if you start the process early.

## Deficiency Judgments in Georgia

One of the most important differences between Georgia and other states is **deficiency judgments** — the lender’s ability to come after you for the unpaid balance after a foreclosure or short sale.

Here’s the good news:

When handled correctly, a short sale often results in the lender **waiving the deficiency**, meaning you walk away owing nothing further. But this has to be negotiated and written into your approval letter. That’s one of the key areas where **Crisp Short Sales** ensures you’re fully protected — by making sure your lender agrees, in writing, to release you from any future debt obligation.

## Tax Consequences and 1099-C Forms

If your lender forgives a portion of your mortgage, they’ll issue a **1099-C** for the canceled debt. Depending on your situation, that amount *might* be treated as taxable income.

However, many homeowners qualify for relief under the **Mortgage Forgiveness Debt Relief Act**, especially if the property was your primary residence. We’ll help you understand what to expect and refer you to the right tax professional if needed.

How Long Does a Short Sale Take in Georgia?

Every lender is different, but most short sales in Georgia close in about **60 to 120 days** once the home is under contract. Factors like investor approval, multiple liens, or HOA dues can add time — but with the right experience, those issues can be resolved.

At **Crisp Short Sales**, we manage the entire process from start to finish — handling communication with your lender, collecting documents, working with your agent, and keeping everyone updated weekly through our online portal at crisp.expert.

## What Crisp Short Sales Does for You