How to Negotiate a Short Sale When the BPO Comes in Too High

BPO too high? Learn how to negotiate a short sale when the bank's price opinion is unrealistic and keep your deal alive.

# How to Negotiate a Short Sale When the BPO Comes in Too High If you’ve been in the short sale world long enough, you’ve seen it happen. You submit a clean file. The hardship is solid. The buyer is qualified. The offer makes sense. Then the bank orders a BPO… and it comes back $40,000 too high. Suddenly your short sale approval is “under review,” your buyer is nervous, and everyone is looking at you for answers. Here’s the good news: a high BPO does not kill a deal. It just changes the strategy. Let’s walk through how to negotiate a short sale when the valuation comes in above reality — and how an experienced short sale negotiator handles it. ## Step 1: Understand What the BPO Really Is A Broker Price Opinion is **not** an appraisal. It’s a quick, often surface-level valuation done by a local agent who may or may not understand distressed property value, short sale urgency, or market conditions. Common problems include: - Using retail comps instead of distressed comps - Ignoring condition issues - Overlooking neighborhood declines - Not entering the property This is where professional short sale processing makes a difference. Instead of arguing emotionally, you respond strategically. ## Step 2: Audit the BPO Like a Prosecutor When a BPO comes in high, the first move is not panic. It’s analysis. An experienced short sale specialist will: - Request a copy of the BPO - Compare every comp used - Check for square footage mismatches - Verify sale dates - Confirm condition adjustments - Identify superior vs. inferior properties If the BPO agent used renovated comps while your seller’s home needs a roof and HVAC, that’s leverage. If they used sales from six months ago while prices have softened, that’s leverage. Every error becomes negotiation material. ## Step 3: Submit a Proper Rebuttal Package This is where most deals fall apart. A short sale rebuttal is not a casual email saying, “We disagree.” It is a structured package that includes: - 3–5 better comps (with detailed adjustments) - A revised net sheet - Repair estimates - Updated photos documenting condition - Market trend commentary - Days-on-market data - Active competition analysis You are not just negotiating price. You are building a case. When we handle short sale approval assistance, we format rebuttals the way asset managers expect to see them. Clean. Organized. Data-backed. Banks respond to numbers, not frustration. ## Step 4: Escalate the Right Way If the negotiator refuses to adjust value, escalation may be necessary. But escalation is delicate. Push too hard and you stall the file. Push too soft and nothing changes. An experienced short sale coordinator knows: - When to request a second valuation - When to escalate to a supervisor - When to wait for updated comps - When to reposition the buyer Sometimes the solution is requesting a new BPO. Sometimes it’s asking for a formal appraisal review. Sometimes it’s adjusting the offer slightly while preserving buyer incentives. Negotiating a short sale is part art, part math. ## Step 5: Protect the Buyer While You Negotiate Here’s the real danger of a high BPO: The buyer walks. This is why communication matters. When we provide short sale assistance for realtors, we make sure: - Buyers understand the timeline - Agents understand strategy - Everyone knows we have a plan Transparency prevents panic. If you can confidently explain how you’re challenging the valuation, buyers are far more likely to stay in the deal. ## Step 6: Know When the Bank Is Bluffing Sometimes the bank pushes back hard on price simply to test the file. If there’s only one offer and it’s market-supported, lenders often adjust after sufficient documentation. But if there are multiple offers close to the BPO value? That’s different. A true short sale negotiator understands lender psychology. Some asset managers anchor high expecting pushback. Others genuinely rely on the BPO as gospel. Reading the room matters. ## Why This Is Where Deals Are Won or Lost Most short sales don’t die because the seller doesn’t qualify. They die because valuation disputes drag on too long or are handled poorly. When you’re helping real estate agents close short sales faster, you have to anticipate the valuation battle before it happens. That means: - Pre-pulling comps before submission - Preparing condition documentation early - Pricing strategically from day one This is exactly how we approach files inside our short sale processing system. We assume scrutiny. We prepare for it. If you’re an agent managing this alone, you’re juggling listing duties, buyer communication, and lender negotiation simultaneously. That’s a lot. That’s why many agents choose to outsource the negotiation side entirely. If you want to see exactly how we structure our approach, you can review how we handle valuation challenges and approvals here: 👉 [How We Help](https://www.crispshortsales.com/how-we-help) If you’re an investor or brokerage looking for structured short sale support, you can see who we typically work with here: 👉 [Who We Serve](https://www.crispshortsales.com/who-we-serve) And if you have a file right now that’s stuck because of a high BPO, you can start the short sale process here: 👉 [Start Short Sale](https://www.crispshortsales.com/start-short-sale) ## Final Thought A high BPO is not a rejection. It’s an invitation to negotiate. Handled correctly, it becomes leverage. Handled incorrectly, it becomes a dead deal. Short sale negotiation is not about arguing with the bank. It’s about presenting better data, controlling the narrative, and staying persistent without being reckless. That’s the difference between a file that sits… and a file that closes.

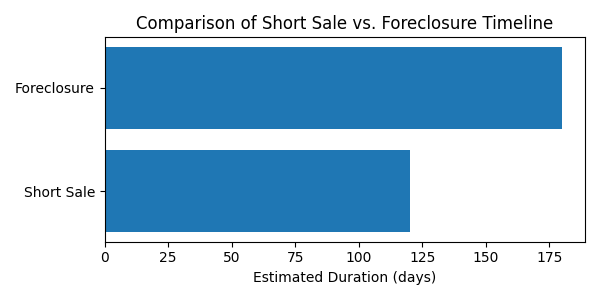

Short Sale vs. Foreclosure Timeline: What Homeowners Don’t Realize Until It’s Too Late

A breakdown of short sale vs. foreclosure timelines explaining how early short sale assistance helps homeowners maintain control, avoid delays, and minimize credit damage.

When homeowners fall behind on their mortgage, the conversation almost always centers on one question:

“How much time do I have?”

Unfortunately, that’s the wrong question.

The real difference between a short sale and a foreclosure isn’t just the final outcome—it’s who controls the timeline, the decisions, and the damage along the way. And most homeowners don’t realize how fast control slips away once foreclosure momentum starts.

Let’s break down what actually happens in each scenario, and why early short sale assistance can completely change the outcome.

The Foreclosure Timeline: Faster Than You Think

Foreclosure feels slow—until it isn’t.

Most homeowners assume they’ll receive plenty of warning before anything serious happens. In reality, the foreclosure timeline accelerates quickly once key deadlines pass.

Here’s what typically unfolds:

- Missed payments trigger default notices

- Legal filings begin (often before homeowners fully understand their options)

- Fees, legal costs, and interest stack up

- Decision-making shifts from homeowner to lender

- Sale dates get scheduled—even while homeowners are still “figuring things out”

Once foreclosure is in motion, options narrow fast. Loan modifications get denied. Buyers hesitate. And homeowners often discover too late that a short sale is still technically possible—but now much harder to execute cleanly.

This is where many deals fail: not because a short sale wasn’t allowed, but because it was started too late and without structure.

The Short Sale Timeline: Slower, but Strategic

A short sale doesn’t stop time—it replaces panic with process.

When started early and handled correctly, a short sale gives homeowners breathing room while maintaining control over key decisions like:

- Who buys the home

- When the sale closes

- How relocation is handled

- What the final credit impact looks like

Unlike foreclosure, a short sale timeline is driven by documentation, valuation, and lender review—not court schedules.

But here’s the catch: banks don’t wait forever.

Delays, missing documents, or sloppy communication can quietly push a short sale past the point of no return. That’s why experienced short sale processing matters far more than most homeowners realize.

What Homeowners Don’t Realize Until It’s Too Late

This is where timelines collide—and mistakes become permanent.

1. Waiting Does Not Buy Time

Many homeowners delay action because they’re overwhelmed or hopeful something will change. Unfortunately, waiting usually reduces options instead of preserving them.

By the time foreclosure notices feel “real,” lenders may already be less flexible.

2. Short Sales Are Front-Loaded

The most important work in a short sale happens early:

authorizations, hardship review, document accuracy, and valuation strategy.

If those pieces aren’t handled properly from the start, approvals stall—or get denied outright.

This is where a dedicated short sale coordinator or short sale negotiator makes a measurable difference.

3. Foreclosure Narrows Buyer Interest

Buyers get nervous when foreclosure timelines tighten. They worry about auctions, title issues, and approval risk.

That reduces leverage and limits offers—exactly the opposite of what homeowners need.

4. Relocation Help Is Time-Sensitive

Relocation assistance (often called “cash for keys”) is far more likely when a short sale is organized early and presented correctly. Once foreclosure progresses, those opportunities often disappear.

At Crisp, this kind of homeowner support is built directly into how we help distressed sellers navigate the process.

Control Is the Real Difference

A short sale isn’t just about avoiding foreclosure—it’s about preserving agency.

Foreclosure is something that happens to homeowners.

A short sale is something homeowners participate in.

When structured correctly, a short sale allows families to:

- Exit with dignity

- Avoid last-minute chaos

- Minimize long-term credit damage

- Move forward on their own timeline

That’s why we focus on short sale assistance that starts early, stays proactive, and doesn’t rely on hope or guesswork.

Whether we’re helping homeowners directly or supporting agents through the process, our role is to keep files moving, lenders engaged, and deadlines under control. You can see exactly who we work with on our who we serve page.

The Right Question to Ask

Instead of asking, “How much time do I have?” Homeowners should be asking:

“How much control do I want to keep?”

If foreclosure is already on the horizon, the window for a successful short sale hasn’t necessarily closed—but it is narrowing.

Starting the short sale process early, with experienced guidance, is often the difference between an orderly transition and a forced one. If you’re considering next steps, this is the moment to start the short sale process before decisions get made for you.

Maryland Short Sales & Foreclosures: Q2–Sep 2025 Update

Maryland’s distress market is shifting—filings up YoY, short sales rising from a low base, and county hot spots around Baltimore/PG. Here’s the data and what it means.

Maryland’s distress market is moving—but not spiraling. The newest reports show measured, data-driven shifts that buyers, sellers, and agents should understand as we head into year‑end.

Bottom line: filings are up year over year, short sales ticked higher off a small base, and county-level pressure remains concentrated around the Baltimore metro and Prince George’s County. If you’re deciding between loan mod, short sale, or riding it out, the facts below will help you choose the right lane.

The signal in the noise: five stats worth watching

1) Foreclosure filings are up YoY, but context matters. Maryland recorded 3,398 total foreclosure filings in Q2 2025, a +15.5% year-over-year increase. That’s meaningful, but it’s not a wave; it suggests a steady normalization from ultra-low pandemic levels rather than a sudden shock.

2) Monthly momentum nudged higher into summer. New foreclosure filings hit 565 in June 2025, up 10.8% month over month. Nearly half came from Prince George’s County, Baltimore County, and Baltimore City, reinforcing a long-standing geographic pattern: distress concentrates where affordability is stretched and household budgets are sensitive to rate and price changes.

3) Short sales rose—but remain a small share of sales. Maryland recorded 23 short sales in June 2025, up 53.3% from Q1. As a share of all sales, that’s around 0.34%—still a sliver of the market. Translation: short sales are increasing from very low levels, which creates opportunities in individual transactions without defining the overall market.

4) Mid-summer ranking looked elevated… In July 2025, ATTOM ranked Maryland 3rd‑worst foreclosure rate nationally, at 1 filing per 2,566 housing units. That put the state on watch lists and likely contributed to an uptick in investor and servicer activity.

5) …but early fall improved. By September 2025, Maryland’s rank improved to #11 with 768 filings (about 1 in 3,314 housing units). Top counties by rate were Caroline, Charles, and Baltimore City. That month-to-month drift reminds us not to over-read any single print; trends matter more than headlines.

What this means if you’re a homeowner

• If your monthly payment is unsustainable, start the conversation sooner rather than later. Lenders generally offer more options when you’re early. If selling makes more sense than modifying, a well-run short sale can cap losses and avoid a foreclosure mark. If you need a playbook for timelines, net sheets, BPO challenges, or escalation routes, here’s how we handle short sale approval assistance day-to-day.

• Expect more documentation, not less. Investor rules (FHA, VA, GSE, and portfolio guidelines) continue to evolve. Clean packages and clear hardship narratives still drive outcomes. If your file involves junior liens, HOA arrears, tax liens, or solar/UCC filings, plan your release strategy early—the first-lien approval window is not the time to start searching for contact info.

• A short sale is not a fire sale. The “discount” is determined by the investor’s net-proceeds math, property condition, and market comps—not by arbitrary percentages. Market-accurate pricing is the fastest way to approval.

What this means if you’re a real estate agent

• Pipeline planning: With filings up YoY and short sales inching higher off a small base, you’ll likely see more “maybe short” scenarios at listing appointments. Screening for hardship, reinstatement feasibility, and second-lien complexity saves weeks later.

• Time is the currency. Faster approvals come from clean, proactive files: complete packages, correct third-party auths, repair photos, and valuation notes prepared in advance of the BPO. If you’d rather keep your energy on pricing, showings, and offers, we specialize in helping real estate agents close short sales faster—handling lender calls, escalations, value disputes, and lien releases behind the scenes while you stay front-of-house with the client.

• Offer strategy: Buyers can account for third-party fees (including short-sale facilitation) in their offer price and, in some programs, request seller-paid closing costs. The goal is a bank-approved net that works—without killing the deal structure.

Direction of travel (not doom)

• Direction: Up modestly YoY on filings; monthly prints fluctuate, and rankings eased by September.

• Short sales: Increasing from a low base; still a small share of total transactions.

• Takeaway: Prepare, don’t panic. The best outcomes still come from early planning, accurate pricing, and organized packages.

If you’d like a candid look at timelines, approval odds, and net-to-lienholder math for a specific property, start your short sale with a quick intake (no obligation).

Source notes: Maryland DHCD “Housing Beat,” Q2 2025 (foreclosure totals, monthly new filings, short-sale counts). ATTOM Foreclosure Market Reports, July 2025 and September 2025 (state ranking, rate per housing unit, county leaders).

The Top 5 Myths About Short Sales—And the Truth Behind Them

Debunk five common myths about short sales and learn the truth behind each misconception to help sellers and agents navigate short sale transactions with confidence.

When it comes to short sales, misinformation is everywhere. Sellers hear one thing from a neighbor, agents read something online from ten years ago, and buyers assume short sales are just “foreclosure light.”

The truth? Short sales are a unique, highly strategic transaction that can benefit everyone involved—when handled correctly. Let’s break down the five biggest myths about short sales and uncover the reality behind each one.

Myth /#1: Short Sales Always Take Forever

It’s true—years ago, short sales had a reputation for dragging on for six months or more. Back then, lenders were still figuring out the process, and delays were common.

The Truth: With the right negotiator and proper file preparation, many short sales can be approved in 60–90 days, sometimes even faster. At Crisp Short Sales, we pre-package every file with exactly what the lender needs, cutting weeks off the timeline.

Myth #2: Short Sales Hurt Your Credit Just Like a Foreclosure

One of the scariest misconceptions is that a short sale damages your credit just as badly as losing your home to foreclosure.

The Truth: While any late mortgage payments will impact your credit, a completed short sale is typically far less damaging than foreclosure. More importantly, a short sale can allow you to recover financially faster—often making you eligible for a new mortgage in as little as two years, compared to seven after a foreclosure.

Myth #3: The Seller Has to Pay All the Costs

Many homeowners avoid short sales because they think they’ll be hit with big fees they can’t afford.

The Truth: In most cases, the lender pays the real estate commissions and negotiator’s fees. At Crisp Short Sales, there’s no cost to the seller or their agent—ever. Our fees are built into the transaction and paid by the buyer’s side at closing.

Myth #4: Short Sales Mean the Seller Is Walking Away With Nothing

There’s a common belief that in a short sale, the homeowner hands over the keys and walks away empty-handed.

The Truth: Many lenders offer relocation assistance at closing—sometimes thousands of dollars—to help sellers move. This incentive is especially common when the short sale is part of a government program or negotiated properly.

Myth #5: Any Agent Can Handle a Short Sale Without Extra Help

While any licensed real estate agent can technically list a short sale, that doesn’t mean they should try to manage the entire process alone.

The Truth: Short sales require specialized knowledge of lender processes, document requirements, and negotiation tactics. Without it, deals fall apart. That’s why experienced negotiators like Crisp Short Sales exist—to protect the deal, keep communication flowing, and make sure the closing actually happens.

Short sales are often misunderstood, but when done right, they can be a win-win for everyone involved—lenders avoid costly foreclosures, sellers avoid devastating credit damage, and buyers can secure great properties.

The key is working with someone who knows the process inside and out. At Crisp Short Sales, we’ve spent over 15 years perfecting our system so short sales close faster, smoother, and with less stress for everyone.

If you’re a seller or an agent with a short sale on your hands, start a short sale with us today. You might be surprised how quickly we can turn a “hopeless” situation into a done deal.

What Happens After You Accept a Short Sale Offer?

Learn the steps to navigate the short sale process after accepting an offer, with guidance for both homeowners and agents.

Accepting a short sale offer is an exciting step—but it’s really just the beginning. Whether you’re a homeowner trying to avoid foreclosure or a real estate agent guiding a client through the process, knowing what happens after the seller says “yes” can make the difference between a smooth approval and a stressful delay.

The Seller Chooses the Offer

In any real estate transaction, the sale of your home is a contract between the buyer and the seller, so the seller decides which offer to accept—not the bank. You’re not obligated to take the highest offer or meet any specific criteria. The decision is yours, based on what’s best for your situation.

Buyer Documentation: Proof They Can Perform

After acceptance, the buyer must show they have the ability to close. For cash buyers this means proof of funds; for financed buyers it means a pre‑qualification or pre‑approval letter. If the buyer is purchasing through an LLC, the lender will also require articles of organization listing all members and documentation that the person signing has authority to do so.

Ordering Title & Checking for Liens

Once the offer and buyer documentation are ready, work with your local title company or closing attorney to order title. The title report will list all liens, mortgages, and judgments on the property. Disclosing everything upfront prevents last‑minute surprises that could derail approval.

The Preliminary Closing Statement

Next, the title company or attorney will prepare a preliminary closing statement (also called an estimated settlement statement) outlining all of the costs on the seller side of the transaction. This includes mortgage payoff amounts, property taxes owed, title and attorney fees, HOA dues or special assessments, and transfer taxes. For homeowners, this is your first look at the numbers. For agents, it’s a required part of the short sale submission.

Submitting the Package to the Lender

Finally, your short sale negotiator will submit the executed purchase contract, buyer’s proof of funds or pre‑qualification, LLC documentation if applicable, the full title report, and the preliminary closing statement to the lender. From here, the bank will begin its review process, which may include ordering a valuation, verifying the buyer’s qualifications, and reviewing the seller’s hardship documentation.

Why This Process Matters

For homeowners, knowing what to expect keeps you in control and reduces stress, and providing complete documentation early helps speed up bank review. For agents, a well‑organized submission positions you as a professional who makes the bank’s job easier—which can lead to faster approvals and fewer deal‑killing delays.

The Bottom Line

Once a short sale offer is accepted, it’s not time to sit back—it’s time to move quickly. Each step, from collecting buyer documents to ordering title and preparing the preliminary closing statement, sets the stage for lender approval. When sellers, agents, and negotiators work together to get a complete package to the bank early, short sales can move surprisingly fast—and everyone gets to the closing table with less stress.

Ready to navigate your own short sale? Start a Short Sale or learn How We Help with Crisp Short Sales.

How to Win Over a Short Sale Lender: Proven Negotiation Tips

If you want to get a short sale approved quickly, you’ve got to make life easy for the lender. These negotiation tips help you secure approvals faster and with better terms.

If you want to get a short sale approved quickly, one thing is certain: you’ve got to make life easy for the lender. The faster they can review, the sooner your file moves forward — and the better your odds of getting the terms you need.

Here are my proven tips for m

aking lenders say "yes" more often.

1. Start With a Complete Package

One of the biggest mistakes I see is sending the lender bits and pieces of the short sale file. Every missing document means another delay, another round of emails, and another chance for the file to get buried on someone’s desk.

Send a completehardship letter, financials, offer, preliminary HUD, HOA statements, tax records, and anything else the lender needs. The goal is to make it as easy as possible for the negotiator to finalize their review and push the file to the next stage.

2. Control the Valuation Process

When the lender orders a valuation, make sure it’s an interior appraisal or Broker Price Opinion (BPO), not just a drive-by. Drive-bys miss critical details and often inflate values because the appraiser never sees the inside condition.

And here’s the most important part: don’t let the homeowner open the door. The listing agent should be the one who meets the appraiser or broker, goes over the comps, and walks them through the property’s true condition.

Take the time to explain market dynamics, the repairs needed, and anything else that justifies your pricing. Why? Because when this makes it into the appraisal or BPO report, it becomes part of the lender’s official record — and that can make all the difference in negotiations.

3. Negotiate Closing Costs Smartly

When you send the preliminary HUD, ask for everything up front — transfer taxes, HOA fees, attorney’s fees, repairs, and other legitimate costs.

Here’s a pro tip: slightly overestimate certain costs like property taxes if possible. If the lender comes back asking you to cut somewhere to meet their net requirements, you’ve got room to give without touching the core deal terms.

4. Keep Commission Requests Reasonable

While it’s tempting to push for more, never ask for more than a 6% total commission. Many lenders see a higher number as an open invitation to negotiate — and that often means they come back with something even lower than you wanted. Keep it simple, keep it standard, and avoid the risk of triggering unnecessary cuts.

5. Always Ask for Relocation Assistance

Many lenders will pay the seller a relocation incentive at closing to help with moving costs. It’s not guaranteed, but if you don’t ask, you won’t get it.

This can be a win-win: the homeowner gets help moving on, and the lender knows they’ve smoothed the way for a clean, on-time closing.

Final Word

Winning over a short sale lender isn’t about magic words or secret back channels — it’s about preparation, control, and smart negotiating. Give them a complete file, make sure the valuation reflects reality, and position your numbers so you’ve got room to move.

Follow these steps, and you’ll see more approvals, faster timelines, and fewer headaches for everyone involved.