Why Some Short Sales Move Faster Than Others

When a short sale drags on for months, most agents and homeowners blame the bank servicing the loan. It’s an easy assumption — after all, the servicer is the one you’re talking to. But here’s the truth: it’s not always the bank that’s slowing things down.

In many cases, the real pace-setter is the investor who owns the mortgage behind the scenes.

If you understand who really calls the shots — and how their rules work — you can predict timelines more accurately, avoid frustrating delays, and even help approvals happen faster.

Servicer vs. Investor: Who’s Really in Charge?

The bank or servicer (like Mr. Cooper, PHH, Wells Fargo, etc.) is the middleman. They collect payments, handle customer service, and process your short sale paperwork.

But the investor — the entity that actually owns the mortgage — is the one that sets the guidelines and ultimately approves or denies the short sale.

Think of it like a property manager vs. landlord: the property manager may be who you deal with, but the landlord makes the final decision.

Why Timelines Vary So Much

Different investors have different rules for reviewing and approving short sales. Here are some of the most common examples and how they impact speed:

1. FHA & VA Loans – The “Waterfall” Requirement

If the investor is FHA or VA, the process is rarely quick. That’s because they require the homeowner to first go through a waterfall process — a series of “retention options” to see if the homeowner can keep the property before they’ll even consider a short sale.

Retention options might include:

Loan modification

Forbearance

Partial claim

Repayment plan

Only after the homeowner is found ineligible for these options can the short sale review begin. Translation: you’re looking at built-in delays before the real work even starts.

2. Fannie Mae – The HomePath Advantage

When Fannie Mae owns the loan, your offer will likely go through their HomePath system.

Here’s the upside:

The platform gives you direct access to Fannie Mae’s approval process.

You can often bypass some of the traditional back-and-forth with the servicer.

In many cases, this speeds up the review compared to other investors because you’re communicating closer to the decision-maker.

3. Mr. Cooper – Equator-Driven Process

Mr. Cooper requires short sale files to be managed through Equator — a platform built specifically for short sales and other loss mitigation processes.

Pros:

Clear, trackable task list.

Built-in messaging for quick updates.

Cons:

You must complete every single task in the system before the file moves forward.

Missing or delaying one step can stall the whole process.

For agents and negotiators who know how to work Equator efficiently, this system can keep things organized and moving.

4. PHH – Reverse Mortgage Specialists

PHH handles a large volume of reverse mortgage short sales.

These can be much more straightforward because:

The homeowner usually isn’t making payments.

The lender already expects to be paid from the sale or claim.

As a result, PHH can sometimes offer a streamlined review process — but only if you know their documentation requirements up front.

The Big Takeaway: Know the Process, Win the Timeline

A short sale’s speed has less to do with whether you’re working with “Bank A” or “Bank B” and more to do with:

Who owns the loan (the investor)

What their approval process looks like

How quickly you can get them what they need

The more you know about your specific investor’s playbook, the more you can:

Set realistic expectations with your client.

Gather the right documents early.

Push the right buttons to keep the file moving.

How Crisp Short Sales Keeps Deals Moving

We’ve worked with just about every type of investor out there — FHA, VA, Fannie Mae, Freddie Mac, private portfolios, hedge funds, you name it. That means we don’t just submit paperwork and hope for the best.

We tailor our approach to each investor’s process, anticipate their requests, and sidestep unnecessary delays.

The result? More approvals, faster closings, and happier agents and sellers.

If you’ve got a short sale that’s stalling — or you just want to make sure the next one moves as quickly as possible — reach out to Crisp Short Sales and let’s get it moving.

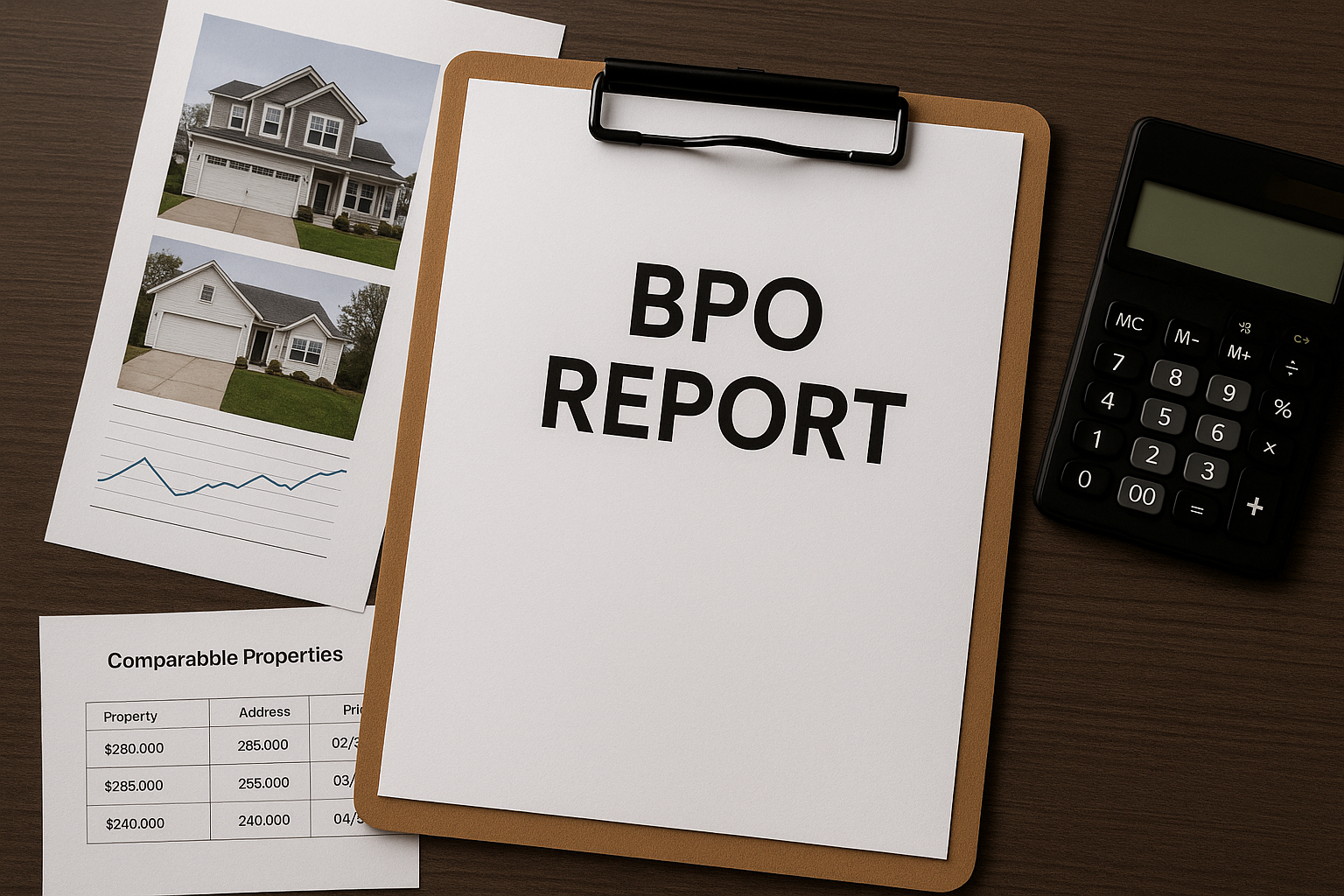

Why BPOs Can Make or Break Your Short Sale Approval

Lender valuations are the most critical part of the short sale process—and listing agents have more control than they realize. Learn how to influence the BPO and get your deal approved.

If there’s one part of the short sale process that has the power to move your deal forward—or sink it entirely—it’s the lender’s valuation.

Whether it’s a Broker Price Opinion (BPO) or a full appraisal, this step determines how the bank views the home’s worth, and more importantly, what they’re willing to accept to release the lien. And while many homeowners and agents assume this part is out of their control, that couldn’t be further from the truth.

Why the Valuation Matters So Much

The bank’s entire decision to approve or reject your short sale hinges on one thing: net proceeds. And how do they calculate what’s acceptable? By comparing your offer to what their assigned agent or appraiser says the property is worth.

If that valuation comes in close to your offer, your deal has a solid shot. If the value comes in too high, expect a rejection—or worse, a counter that scares off your buyer.

So what can you do? A lot more than you might think.BPOs vs. Appraisals: What’s the Difference?

Short sales typically involve one of two valuation methods:

• BPO (Broker Price Opinion): Completed by a local real estate agent chosen by the lender.

• Appraisal: Ordered by the lender and conducted by a licensed appraiser.

The good news? BPOs are easier to challenge if the number comes in too high. If you believe the valuation is off, you can submit comps, condition reports, and market data—and the bank may accept a revised opinion or order a second BPO.

Appraisals, on the other hand, are harder to dispute. Most lenders simply go back to the original appraiser to confirm their comps. Even if you spot glaring issues, you’re unlikely to see a significant change.

That’s why it’s so important to set the stage before the valuation even happens.

The Listing Agent’s Hidden Power

You might not realize it, but the listing agent has a huge role in influencing the lender’s valuation. Here’s how to do it right:

1. Price the Home at Current Market Value

This is not the time to anchor to the original mortgage balance. Banks don’t care what’s owed— they care what the home is worth today. Listing at market value signals to the BPO agent (and the bank) that you’ve done your homework.

2. Get the Strongest Offer You Can

A solid, well-qualified offer close to list price strengthens your case and sets the bar for what the bank might accept. It also adds legitimacy to your valuation argument.

3. Support the Valuation with Evidence

Before the BPO or appraisal visit, provide the evaluator with:

• Recent comparable sales (especially distressed or as-is comps)

• A brief condition report noting repairs or damage

• Market trends (DOM, price reductions, etc.)

• Your logic for the listing price

Make it easy for them to include your narrative in the final report. In most cases, what you show them ends up on the bank’s desk—literally.

How We Help Smooth the Process

At Crisp Short Sales, we coach agents through this exact process on every file. We help identify the right list price, prepare supporting documentation, and even advise on how to talk to the BPO agent during the walk-through.

If the valuation still comes in too high, we know how to build a dispute that actually gets traction. Our goal is simple: get you to the closing table faster—without the headaches or delays.

If you want more short sale approval tips or need a second opinion on your short sale BPO, we’re here to help.

Want help on your next short sale? Reach out and let’s review the file together. We’ll make sure the valuation doesn’t stand in your way.

FAQs

What happens if the BPO value is too high?

The lender will likely reject the current offer or counter too high for the buyer. You may need to dispute the value with better comps or request a second BPO.

Can a short sale be approved if the offer is below the valuation?

Sometimes, yes—especially if other factors like condition or buyer strength come into play. But your chances are far better if the offer is close to or matches the valuation.

How do I challenge an incorrect appraisal or BPO?

Submit a dispute with supporting documentation: updated comps, contractor estimates, photos of needed repairs, and market analysis. BPO disputes are more likely to succeed than appraisals.

Can You Pay Off HOA Debt in a Short Sale?

HOA balances can be a major hurdle in a short sale—but the good news is, they can often be paid at closing. Here’s what to know about lenders, liens, and negotiating with your HOA.

If you’re behind on your HOA dues and facing a short sale, one big question always comes up: Can the HOA be paid off at closing? The answer is yes—often it can. But like most things in the short sale world, it depends on a few key details.

Let’s break down how HOA debt works in a short sale, who pays what, and how to avoid surprises that could derail your closing.

Yes, HOA Debt Can Be Paid Through the Sale

In a short sale, the lender agrees to accept less than what’s owed on the mortgage, and all other debts tied to the property—like HOA balances—must be negotiated as part of the deal.

The good news? HOA debt can usually be paid off through the proceeds of the sale.

But not all mortgages are created equal. Whether your lender will allow HOA balances to be paid depends on who owns your loan and their specific guidelines.

Investor Guidelines Matter (A Lot)

Behind every mortgage is an investor—the actual party that owns your loan—and they set the rules for what expenses can be approved at closing.

Here’s how it usually breaks down:

FHA and VA Loans: These government-backed loans are the strictest. They often limit how much can be paid to an HOA, and in many cases, the relocation incentive offered to the seller is the only approved source of HOA payoff funds. That means if you want the HOA paid, you may need to give up your relocation money to make it happen.

Privately-Owned Mortgages: These loans are more flexible. Private investors tend to care most about their net proceeds, not which party gets paid what. If paying off the HOA helps the deal close and the numbers work, they’ll usually allow it.

The key is to work with someone who knows how to structure the deal and present the right breakdown to the lender.

What If the HOA Balance Is Too High?

Sometimes the HOA debt is more than the lender wants to cover. That’s when negotiation becomes critical.

You have two potential paths:

If There’s a Lien: You’ll need to work with the HOA’s attorney. They’re the gatekeeper when a lien has been filed. Lien payoffs must be cleared before closing, and sometimes these include thousands in legal fees or penalties.

If It’s Just Unpaid Dues (No Lien): Then you’re dealing with the HOA board directly. These are often your neighbors—or at least people in the community—so outcomes can hinge on relationships and personalities. Some boards are understanding and willing to help; others… not so much.

It’s worth noting: HOAs do have the power to reduce or waive fees. While they’re not required to, many are open to it—especially if they know they’ll never recover the full balance otherwise.

A Real-World Tip

If you’re the homeowner, don’t panic if the HOA bill is larger than expected. Late fees, attorney costs, and special assessments can pile up—but you’re not automatically stuck paying them out of pocket.

Work with an experienced short sale processor (like us at Crisp) who can negotiate both with your lender and the HOA to find a resolution. We’ve seen massive balances get cut in half—or even eliminated entirely—when approached the right way.

The Bottom Line

Yes, HOA debt can be paid in a short sale—but success depends on the type of mortgage you have, the investor’s rules, and your processor’s ability to navigate the personalities and policies involved.

At Crisp Short Sales, we’ve helped homeowners close deals even when the HOA balance seemed impossible. If you’re unsure how to proceed, let us help you map it out.

We specialize in achieving short sale approval with HOA debt and can provide short sale help with HOA dues. Learn more about FHA rules for short sale HOA payoffs. For personalized assistance, work with a short sale processor.

FAQ

Can HOA attorney fees be included in a short sale?

Yes, but it depends on your lender’s guidelines. Privately owned loans are more likely to allow this, while FHA and VA loans may limit how much can be paid.

What if the HOA won’t reduce the amount owed?

If the HOA insists on full payment, we can still work with the lender to cover the balance—especially if the numbers work. If not, sometimes the relocation incentive can help bridge the gap.

Do I have to pay the HOA myself before the short sale can close?

Not necessarily. With the right strategy, that debt can often be paid out of the sale proceeds—even if you’re not contributing anything out of pocket.

Can I Still Sell My Home If I’m Behind on Payments?

Falling behind on your mortgage doesn’t mean you’ve lost the ability to sell. In fact, it’s often the reason short sales get approved. Here’s what to know.

Short answer? Yes, absolutely. In fact, being behind on payments is one of the biggest reasons short sales get approved in the first place.

If you’re struggling to make your mortgage payments and wondering whether you still have the option to sell your home, you’re not alone. A lot of homeowners think that missing payments disqualifies them from selling—but when it comes to short sales, that couldn’t be further from the truth.

Let’s clear up a few common misconceptions and walk through what really matters in these situations.

Falling Behind Signals Financial Hardship—And That’s the Point

Many homeowners think that in order to look responsible or show “good faith,” they need to keep paying their mortgage throughout the short sale process. But here’s the thing:

The bank isn’t looking for responsible. They’re looking for distressed.

Short sales are designed to help homeowners who are underwater and cannot afford to keep paying. If you’re current on your mortgage, the lender may question whether you truly need assistance. But if you’ve missed payments and can show a legitimate hardship—job loss, divorce, medical bills, relocation—you’re actually a much stronger candidate for approval.

So no, you don’t need to drain your savings to keep making payments just to try and “look good.” That won’t help your case—in fact, it might hurt it.

What About HOA Dues and Property Taxes?

Another common concern is falling behind on HOA fees or property taxes. But good news: you don’t need to panic about those either.

When we help facilitate a short sale, we typically negotiate those debts into the transaction, meaning the bank may agree to pay off back dues at closing. That includes:

• Past-due HOA balances (even with late fees or attorney costs)

• Unpaid property taxes

• Municipal liens or nuisance violations

This is one of the big advantages of working with an experienced short sale processor—we know how to structure the deal to clear all those obstacles so you walk away clean.

But Keep the Lights On, Please

While you don’t need to keep up with mortgage or HOA payments, there’s one area where staying current does matter: your utilities.

Keeping the power, water, and gas on helps ensure:

• The home is ready for showings and inspections

• Buyers don’t get spooked by disconnected services

• You avoid surprise liens from utility companies at closing

If utilities are shut off, it can delay the process—or worse, kill the deal entirely. So if possible, keep those services active until we close.

Selling While Behind Is Common—And Doable

Falling behind on mortgage payments can feel overwhelming, but it doesn’t mean you’re out of options. In fact, that’s usually the moment when a short sale makes the most sense.

You don’t need to be ashamed or afraid to ask for help. This is exactly what short sales are for—and we’re here to guide you through it every step of the way.

If you’re already behind on payments and considering a short sale, let’s talk. We’ll help you understand your options, navigate the process, and get to the closing table with as little stress as possible.

Learn more about your options: short sale options for homeowners in distress, help selling house with late mortgage, short sale while behind on mortgage, or work with a trusted short sale processor.

FAQs

Can I start a short sale even if I’ve missed several mortgage payments?

Yes. Being behind on your mortgage often strengthens your short sale case, as it shows the lender you’re truly experiencing financial hardship.

Do I have to catch up on HOA fees and taxes before I can sell?

No. In most cases, those debts can be paid at closing as part of the short sale. We negotiate those into the deal for you.

Should I still pay utilities during a short sale?

Yes. Keeping the utilities on helps the sale process go smoothly and avoids extra costs or liens.

Top 5 Short Sale Myths Homeowners Still Believe

Short sales are misunderstood—and costly myths are everywhere. Here are 5 of the most common ones homeowners believe, and what you actually need to know.

Top 5 Myths Homeowners Believe About Short Sales

And why they might be costing you money, time, and peace of mind

If you’re underwater on your mortgage and exploring options, you’ve probably heard of a short sale. But there’s a lot of misinformation floating around—especially online and even from well-meaning friends or agents who haven’t done one in a while.

At Crisp Short Sales, we hear the same myths again and again. Let’s set the record straight and make sure you have the facts before deciding what’s best for your situation.

Myth #1: "Short sales are fast—it’s right there in the name!"

We wish. Despite the name, there’s nothing "short" about the timeline. A short sale refers to the lender agreeing to take a short payoff, not a speedy process.

In reality, short sales often take 60–90 days (or longer) to get approved. Why? Because they involve:

• Submitting a full hardship package

• Bank review and BPO valuation

• Negotiations between lienholders, agents, and buyers

• Multiple signoffs, escalations, and paperwork

The good news? With an experienced short sale processor, a lot of that burden is taken off your shoulders—and approvals can happen faster.

Myth #2: "I need to list my home at the full payoff amount."

Actually, you should list your home at its current market value, even if that’s well below what’s owed. Listing at your loan balance doesn’t help—it usually just scares away buyers.

The goal of a short sale is to attract strong offers that reflect real market demand. From there, the lender reviews everything and decides whether to accept the short payoff.

Pricing too high just delays the process and hurts your chances.

Myth #3: "I’ll be stuck paying commissions and closing costs."

Nope. In nearly every short sale we process, the lender pays the agent commissions and seller closing costs—not the homeowner.

An experienced short sale professional will structure the deal to make sure you pay nothing out of pocket. That includes:

• Agent commissions

• Attorney/title fees

• Transfer taxes

• Settlement charges

If anyone tells you otherwise, it’s time to bring in someone who knows what they’re doing.

Myth #4: "There’s nothing in it for me."

This one’s especially painful because it’s just not true. A successful short sale can:

✅ Protect your credit from the damage of foreclosure

✅ Relieve financial and emotional stress

✅ Let you move on with your life

✅ Even get you relocation assistance (cash at closing), if you qualify

If you’re living in the property and meet the criteria, we’ve helped many homeowners receive $3,000–$10,000 in relocation funds at closing. It’s the lender’s way of incentivizing cooperation and helping you land on your feet.

Myth #5: "Short sale or foreclosure—it’s the same to my credit."

Not even close. While both impact your credit, a short sale is far less damaging than a foreclosure.

A foreclosure stays on your record longer, and signals a total failure to resolve the debt. A short sale, on the other hand, shows you took action to resolve things responsibly.

Plus, many homeowners can buy again in as little as 2–3 years after a short sale, compa

Final Thoughts

Short sales aren’t simple—but they’re often the smartest path forward if you’re upside-down on your mortgage. The key is working with someone who knows the ins and outs, can handle the paperwork, and keeps you informed every step of the way.

If you’re facing foreclosure or struggling to make payments, let’s talk. We’ll help you understand your options and take the next step—with clarity and confidence.

FAQ

How long does a short sale take to get approved?

Typically 60–90 days, depending on the lender, buyer, and number of liens.

Will I owe money after the short sale?

Most lenders waive the deficiency if the process is handled correctly. We’ll help you secure a full release.

Do I need to be behind on payments to qualify?

Not necessarily. What matters most is financial hardship and the fact that the home is underwater.

To learn more, explore our short sale closing service, relocation assistance for short sales, and discover how to avoid foreclosure with a short sale. Get help with your short sale today!To learn more, explore our short sale closing service, relocation assistance for short sales, and discover how to avoid foreclosure with a short sale. Get help with your short sale today! avoid foreclosure with a short sale. Get help with your short sale today!

How to Short Sale a House That's Already Vacant

Can you short sale a vacant house? Absolutely. In fact, being vacant can actually help your case. Here’s how to use that to your advantage and get the bank to say yes.

If you’ve already moved out of your house—or never lived in it to begin with—and you’re staring down the barrel of foreclosure, here’s some good news: yes, you can absolutely short sale a vacant property. In fact, sometimes being vacant can actually help your case.

At Crisp Short Sales, we help homeowners and agents navigate these types of situations every day. Vacant properties aren’t disqualifiers; they’re just part of the story we tell to the lender. Let’s walk through exactly how it works.

Step 1: Prove Your Hardship—Vacancy Helps

• You’re no longer using the property, but you’re still stuck paying for it.

• Empty homes can become targets for vandalism, squatters, or code violations.

• Carrying costs (taxes, insurance, utilities) become an unnecessary burden.

So yes—vacancy is not just acceptable, it’s often compelling.

Step 2: Don’t Fix It Up—Keep It “As Is”

One of the most common questions we get from homeowners is:

“Should I fix it up before the short sale?”

Nope.

This is not like a regular sale where you’re trying to impress buyers. In a short sale, the buyer is usually an investor or someone looking for a deal, and the bank just wants to recover some of their money—not top dollar.

In fact, the condition of the home plays a huge role in the appraised value, and that’s where your focus should be.

Step 3: Control the Appraisal—Don’t Over-Prepare

• Leave the home as-is. Don’t paint, stage, clean, or upgrade.

• Avoid fresh landscaping or curb appeal improvements.

• Make sure the appraiser sees the true condition. If there’s mold, leaks, or damage, don’t hide it—point it out.

A lower appraisal = lower minimum net the bank requires = higher chance of approval.

Step 4: Secure the Property, But Don’t Overdo It

Banks want to see the property is safe, not staged. So while you don’t need to beautify anything, it does help to:

• Board up broken windows

• Lock doors

• Remove obvious hazards (like exposed wiring or falling ceilings)

This shows the property is not a liability and can be sold “as is” to the right buyer.

Step 5: Let Us Handle the Rest

Once the home is listed and a buyer is on board, we take it from there. Our team works directly with the lender to package your hardship, negotiate with the bank, and get the deal to the closing table.

And remember, there’s no cost to you at any point—we’re only paid by the buyer at closing.

Whether your house is sitting empty in Georgia, Florida, or anywhere else, we can help.

Need Help With a Vacant Home?

If you’re sitting on a vacant house and falling behind on payments, reach out now. We’ll help you get out from under the mortgage—and possibly even negotiate a relocation Start Your Short Sale NowNohttps://www.crispshortsales.com/start-short-sal

eFAQ

Can I short sale a property that I inherited and never lived in?

Yes. Inherited properties are often vacant, and that’s completely fine. You’ll still need to show hardship (like estate expenses or unpaid taxes), but the fact that the home is empty won’t hurt your chances.

Does the condition of the vacant home affect the short sale?

Yes—and that’s a good thing. The more “fixer upper” the home appears, the lower the appraised value, which makes your short sale more likely to get approved.

Do I need to clean the house out before the sale?

Nope! In fact, most buyers of short sales expect some level of clean-out. You don’t have to do anything except secure it and provide access for valuation and showings./

What Is Relocation Assistance in a Short Sale?

Selling short doesn’t mean you leave empty-handed. Here’s how relocation assistance at closing can put real cash in your pocket.

What Is Relocation Assistance in a Short Sale?

Many homeowners assume a short sale means walking away with nothing. In reality, you may qualify for relocation assistance—cash paid at closing to help with moving costs.

💸 What Counts as “Relocation Assistance”?

Relocation assistance is money a lender pays after a successful short sale to reward a cooperative homeowner. It is not foreclosure cash-for-keys—it’s a negotiated benefit.

👋 Typical Payout Ranges

| Loan / Investor | Common Range |

|---|---|

| FHA | $3,000 |

| Fannie Mae / Freddie Mac | $3,000 – $7,500 |

| Private Conventional | $0 – $10,000 |

| VA | $1,500 |

💼 Who Qualifies?

- Owner-occupied property at time of offer

- No major damage or outside liens

- Full cooperation with showings & docs

- On-time move-out

🧾 How Is It Paid?

Payout happens at closing via check or wire. Unpaid HOA or utility balances are deducted first.

🎯 Tips to Maximize Your Payout

- Request the highest amount on day one.

- Keep the home clean and accessible.

- Respond to lender requests within 24 hours.

- Use an experienced short sale team.

✅ Bottom Line

Relocation assistance can put $3,000–$10,000 in your pocket. Start your short sale or learn how we streamline short sales today.

Short Sale vs. Foreclosure vs. Deed‑in‑Lieu: A 2025 Guide

Short Sale vs Foreclosure vs Deed‑in‑Lieu in 2025

Introduction

If you owe more on your mortgage than your home is worth, you might feel trapped. Should you list the property and hope the bank accepts a loss? Walk away and let it go to auction? Hand the deed back to the lender? Each of these options comes with real consequences for your credit, your finances and your future buying power. As Crisp Short Sales experts, we’ve processed thousands of distressed dealscrispshortsales.com. Here’s a simple, 2025‑focused breakdown so you can decide which path best fits your goals.

Three Paths Explained

Short Sale

A short sale lets you sell the home for less than what you owe with the bank’s blessing. It takes cooperation and paperwork, but it offers real benefits:

Better credit outcome – lenders report the account as settled instead of foreclosed, so you may qualify for a new mortgage in as little as two years.

You stay in control – choose the buyer, closing date and move‑out terms.

Relocation assistance – many programs pay $3,000–$10,000 at closing to help you move.

Less stigma – there’s no public auction or sheriff’s sale.

Short sales do require a complete package: financial statements, a hardship letter and a purchase offer. An experienced negotiator can speed approval and maximize your incentive.

Foreclosure

If you stop paying and do nothing, your lender will eventually foreclose. That might seem easier, but it’s the most punishing option:

Severe credit damage – a foreclosure stays on your report for seven years and can drop your score 100–160 points.

Zero control – the bank chooses the sale date and you must leave when told.

No cash – you get no relocation assistance and may even face a deficiency judgmentcrispshortsales.com if the sale doesn’t cover your debt.

The only benefit to foreclosure is that it requires no cooperation from you. Everything else – from your ability to buy or rent to your sense of dignity – suffers.

Deed‑in‑Lieu

A deed‑in‑lieu of foreclosure is a negotiated surrender. You sign the deed over directly to the lender instead of going through court. It’s less public than a foreclosure and sometimes includes a small incentive. However:

Credit impact is the same – credit bureaus treat a DIL exactly like a foreclosure.

Limited leverage – you don’t get to shop for a buyer or negotiate a price.

Minor relief – you may set the move‑out date and avoid an auction, but you still lose the home and any equity.

DILs can make sense when the property is damaged or there are no buyers, but they should be a last resort before foreclosure.

How Each Choice Affects Your Future

Credit & Buying Power

After a successful short sale, most homeowners can qualify for a mortgage again within two years. With a foreclosure or deed‑in‑lieu, you’ll wait at least five to seven years before lenders will work with you. That gap matters if you plan to buy another home or even rent; many landlords check for foreclosures.

Relocation Incentives & Control

Short sales often come with relocation assistance and let you control your timeline. Deed‑in‑lieu agreements sometimes include a modest incentive but not always. Foreclosures offer nothing. The ability to pick a buyer and closing date also affects how smoothly your move goes; only a short sale provides that flexibility.

Emotional & Legal Stress

Foreclosure involves court proceedings, sheriff notices and forced move‑outs. A DIL avoids some of the courtroom drama but is still a surrender. A short sale is handled like a regular listing. You maintain privacy and avoid the emotional toll of watching your home sell at auction.

Which Option Should You Choose?

If your goal is to protect your credit, stay in control and move on quickly, a short sale is usually the best path. It does require some paperwork and patience, but the payoff is a faster recovery and potential cash at closing.

A deed‑in‑lieu can be a fallback when the property is in very poor condition or there’s simply no buyer. Just remember the credit impact mirrors a foreclosure.

We almost never recommend letting a foreclosure run its course. The long‑term damage outweighs the short‑term convenience.

How We Streamline Your Short Sale

At Crisp Short Sales we handle every step for you. We prepare your complete file, submit it to the lender and follow up weekly. Our negotiators know each bank’s guidelines and when to push for better terms. To see how we streamline short sales, visit our process page. Curious about the clients we help? Check out examples from homeowners, agents and investors across the country. If you’re ready to act now, start your short sale and schedule a free consultation. Our short‑sale specialists at Crisp Short Sales experts are here to answer your questions and guide you from listing to closing.

Conclusion

Market downturns, job loss and life events can leave anyone underwater. When that happens, you have choices. A well‑executed short sale protects your credit, puts you in the driver’s seat and even puts money back in your pocket. A deed‑in‑lieu should only be used when there’s truly no buyer or the home is unlivable. Foreclosure, while simple, is the most damaging.

The good news: you don’t have to navigate this alone. Reach out today, and let’s figure out the right path for you.

Can You Short Sale a Home with a HELOC or Second Mortgage?

You can short sale a home even with a HELOC or second mortgage. Here’s what it takes to get all lienholders on board and close the deal.

If you’re dealing with a short sale and there’s more than one loan on the property—like a HELOC or second mortgage—you’re probably wondering: Can this even work?

Good news: yes, you can short sale a property with secondary liens on title. But there’s a catch (actually, a few). These deals are absolutely doable—but only if you understand the priorities, payoffs, and pitfalls.

Let’s break it down 👇

⸻

💡 First: Understand Which Loan Is “Short”

When a seller owes more than the home is worth, we call it underwater. But sometimes only one of the loans is actually underwater.

So here’s the first step:

• If there’s enough equity to pay the first mortgage off in full (after commissions and closing costs):

Then it’s not a short sale for the 1st. You’ll only need approval from the secondary lien holders (like a HELOC or 2nd mortgage).

• If there’s not enough to even pay off the 1st mortgage in full:

Then it’s a true short sale across the board—and all lien holders need to agree to reduced payoffs.

In either case, these deals require tight coordination. And if you’ve ever tried negotiating with a junior lienholder… you already know it can be slow, stubborn, and all kinds of messy.

⸻

🏦 How 2nd Mortgages Are Handled in a Short Sale

When the 1st mortgage is short, the 2nd typically becomes the lowest priority. That means they often get a nominal payoff—just enough to agree to release their lien.

📌 Typical payoffs for 2nd liens in a short sale:

• $3,000–$6,000 (most common range)

• Sometimes up to 10% of the loan balance

• Rarely the full amount (unless required, like with FHA partial claims)

But here’s the trick: if the 2nd mortgage refuses that amount, someone has to cover the gap—either the buyer, the seller, or an outside party (sometimes even a realtor or investor).

⸻

🧩 The Right Sequence: First Then Second

You don’t start by calling all the lienholders at once. There’s a method to the madness.

1. Begin with the 1st mortgage:

Get their short sale approval or estimated net sheet. This will outline how much they’re willing to pay toward any junior liens.

2. Then go to the 2nd lienholder:

With the 1st’s approval in hand, you show them the deal: Here’s what the 1st is allowing for your payoff. Are you in or out?

This sequence saves everyone time—and avoids promising payoffs the first won’t approve.

👉 Want help coordinating this? See how we streamline short sales and take the pressure off your plate.

⸻

🛑 Special Case: FHA Loans with HUD Partial Claims

If the loan is an FHA mortgage, there’s an entirely different rulebook. The second lien is often a HUD partial claim—essentially a silent 2nd held by the government.

In these cases:

• HUD requires the partial claim to be paid in full

• The 1st mortgage takes the full loss

• There’s no negotiation with the partial claim—it’s non-negotiable

That’s a key detail most agents and investors miss. If you’re unsure whether it’s FHA, check the loan type early or ask a short sale expert (that’s us 😉).

⸻

🧠 Final Thoughts: Multi-Lien Short Sales Take Precision

Short selling a property with a 2nd mortgage, HELOC, or judgment lien isn’t impossible—but it is a delicate process. Each lienholder has to agree. Each one has different guidelines. And the wrong step can kill your deal.

That’s where the Crisp Short Sales experts come in. We know how to structure these files, submit clean packages, and push approvals through—without drama.

Whether you’re an agent, homeowner, or investor, don’t let a second mortgage stall your deal. If you need backup, check out who we serve or start your short sale here. We’ll help you figure it out.

⸻

Thanks for reading,

Yoni Kutler

404-300-9526

yoni.kutler@ygkutler.com

Can You Sell an Inherited Property as a Short Sale?

Yes, you can short sale an inherited property—if it’s underwater and you’ve completed probate. Here’s what lenders look for and how to get started.

When a loved one passes away and leaves behind a home with a mortgage, the situation can get complicated—fast. If the property is worth less than what’s owed, heirs are often left wondering: Can I short sale an inherited property?

The answer is yes—but there are a few key conditions and steps to understand. Let’s break it down in plain English.

---

What Is a Short Sale—and When Does It Apply to Inherited Homes?

A short sale happens when a home is sold for less than the remaining mortgage balance, and the lender agrees to accept that lower amount to release the lien. It’s a common option when the home is underwater—meaning it’s worth less than the debt attached to it.

In inherited property situations, this often occurs when:

• The deceased owner refinanced heavily or had a reverse mortgage

• The home fell into disrepair

• The market value has dropped since the loan was originated

If the home’s current market value is lower than the total owed (including first mortgage and any other liens), a short sale can be a smart, clean exit—especially when you don’t want to keep the property.

---

Do You Need to Complete Probate First?

Yes. Probate must be completed before a lender will even look at a short sale offer. The lender needs to know who has legal authority to sell the home and sign off on the transaction.

Here’s what most lenders will ask for:

• A certified death certificate

• Proof that probate is complete, or Letters Testamentary showing you’re the legal executor or administrator

• A copy of the will (if available) or other legal documentation proving heirship

Until probate is resolved, you technically don’t have the right to sell the property—even if the bank is pressuring for resolution.

---

Why Inheritance Qualifies as a Verifiable Hardship

One of the pillars of short sale approval is proving that the seller has a legitimate hardship. The death of the original borrower (your family member) absolutely qualifies as one. In fact, it’s one of the most clear-cut examples of a hardship lenders recognize.

That hardship letter writes itself:

• You didn’t take out the mortgage

• You don’t have the financial ability to maintain the home or make payments

• You’re trying to avoid foreclosure and resolve the debt responsibly

Combine that with an underwater valuation, and you’ve got a strong short sale case.

---

What Else Matters?

Besides the value and the hardship, lenders will look at:

• Other debts or liens on the property (HOA, taxes, second mortgages)

• Whether the home is occupied or vacant

• Whether it’s listed with a licensed real estate agent and priced appropriately

• Whether you’ve submitted a complete short sale package

If there are multiple heirs, they’ll all need to sign the sales agreement and lender paperwork. Disagreements between heirs can delay—or derail—the process entirely.

---

How to Start a Short Sale on an Inherited Home

If you’re in this situation, here’s a quick roadmap:

1. Complete probate and obtain legal authority to act on the estate

2. Determine the home’s market value—get a CMA or BPO

3. Calculate total debts/liens against the home

4. Hire an experienced agent (preferably one who’s done short sales)

5. Work with a short-sale specialist to handle lender negotiations

We help people start a short sale on inherited homes all the time. Our process is fast, friendly, and takes the stress off your shoulders—especially when you’re dealing with grief and uncertainty.

---

Final Thoughts

Selling an inherited property via short sale might not have been your plan—but if the home is underwater, it can be a smart solution to prevent foreclosure and clear debt.

With the right paperwork, a clear hardship, and a good short sale processor, you can get through it with minimal stress and a clean slate.

Need help navigating the short sale process? Learn more about how we streamline short sales and support families in tough situations. Or reach out to see who we serve and whether we’re a fit

If you’re not sure where to begin, start your short sale with a free consultation. Learn more abou prot our short sale services or see the clients we help every day. If you’re new here, our short sale specialists are always ready to chat..

How to Convince a Bank to Postpone Foreclosure for a Short Sale

When you're facing foreclosure, the clock is ticking—and fast. But if there's a serious buyer on the table and a legitimate hardship, you can often get the bank to hit pause. The key? Submitting a clean, complete short sale package and knowing exactly how to ask for the postponement.

Start With a Complete Package—Not Just a Plea

Before you even think about asking the bank to delay a foreclosure, make sure you've submitted a full short sale package. That means:

• A signed purchase offer

• The seller’s short sale application

• All required financials and supporting hardship documents

Want to see exactly what needs to be included? Check out our short‑sale process guide.

Make the Ask—Twice

Once your full package is in, call the lender and follow up in writing. Be polite but firm. And don’t be afraid to escalate to a supervisor.

Lead With the Hardship

This is where you humanize the file. Share the seller’s story. Keep it brief but heartfelt—it makes a difference.

Work With the Foreclosure Attorney

Contact the foreclosure attorney directly to confirm they’ve been notified. Don’t assume the lender will pass along the message in time.

FHA and VA Loans? Use the Investor Angle

If it's an FHA or VA loan, elevate to the investor directly for help pushing through a postponement.

Wrap‑Up: Your Foreclosure Delay Checklist

• Submit a full short sale package

• Call and request a delay

• Follow up in writing

• Escalate if needed

• Highlight the hardship

• Coordinate with the foreclosure attorney

• Reach out to FHA/VA if applicable

Need help now? Start your short sale today—we’ll make it easy. And if you’re curious about who we serve, take a look at the clients we help. We work with homeowners, agents and investors across Georgia and beyond.

How to Avoid Deficiency Judgments After a Short Sale

A short sale can be a smart move — but only if the lender waives the remaining debt. Here’s how to make sure you’re protected.

❔What Is a Deficiency Judgment?

In a short sale, your lender agrees to let you sell the home for less than what you owe. That difference — between what you owed and what the home sold for — is called the deficiency.

In some states, lenders can come after you for that deficiency after the sale closes. That’s what’s called a deficiency judgment — a court order saying you still owe the unpaid balance.

Example:

If you owe $300,000 on your mortgage and your short sale is approved for $250,000, the deficiency is $50,000. If the lender doesn’t waive that amount, they could legally pursue you for it.

✅ Most of the Time, It Is Waived

Here’s the good news: In the vast majority of short sales we handle, the lender explicitly waives the deficiency. It’s right there in the approval letter — something like:

"Lender agrees to release the borrower from any further obligation on the remaining balance."

🚨 Watch Out: Sometimes It’s Not Clear

Some approval letters are vague. They might say something like:

“This short sale is approved, and the lender reserves the right to pursue remaining balances.”

If it’s not clearly waived, you can and should go back to the lender and ask for clarification — in writing.

Pro tip:

Always review the approval letter with someone who knows what to look for — ideally your agent, attorney, or short sale negotiator.

✋ Sellers Don’t Have to Accept Bad Terms

Just because the bank approves the short sale doesn’t mean you’re locked in. You’re not obligated to accept an approval letter that doesn’t protect you.

If the terms include:

A vague deficiency clause

A demand for a promissory note

Cash contributions you can’t afford

…you have every right to say no. You can counter, renegotiate, or even walk away. No one can force you to sell if the deal doesn’t benefit you.

🗑️ Promissory Notes: What You Should Know

Sometimes a lender will approve the short sale but ask the seller to sign a promissory note for part of the deficiency.

Here’s the catch:

These are often unsecured — meaning they’re not tied to any property or assets, and there’s no collateral behind them. They’re basically an “IOU.”

That might sound scary, but in many cases, they’re non-recourse — meaning the lender can’t garnish your wages or seize assets if you don’t pay.

Still, don’t sign anything blindly. If you’re asked to sign a note, talk to someone (like us) who’s seen hundreds of these and can help you weigh your options.

🛡️ How We Help Sellers Protect Themselves

At Crisp Short Sales, we review every approval letter carefully to make sure the seller isn’t left exposed. We’ve seen thousands of these — we know how different banks word things, when to push back, and how to get that clean release language that makes sure your short sale is a true fresh start.

💭 Final Thought

A short sale can be the smartest way out of a tough financial spot — but only if you do it right. That means making sure the lender fully forgives the unpaid balance and that you’re not left holding the bag months or years down the road.

If you or a client are navigating a short sale, let’s make sure it closes clean, clear, and final.

📞 Call Yoni at 404‑300‑9526 or

📧 Email yoni.kutler@ygkutler.com — we’re happy to help.

How to Spot a Short Sale Opportunity Before It Hits the MLS

Learn how to spot off-market short sale opportunities before they hit the MLS using 30-60-90 day Notice of Default lists, lis pendens filings, delinquent taxes, code violations and referral partners like bankruptcy attorneys and credit repair services. Discover why early outreach matters and how Crisp Short Sales can process and negotiate your short sale from start to finish.

Investors and agents don’t want to wait for a property to appear on the MLS before they act. The key to finding off-market short sale opportunities is knowing where to look—and who to talk to—before a foreclosure is filed.

Start with the Default Timeline: 30, 60, 90-Day NOD Lists

Many investors rely on Notice of Default (NOD) lists to spot distressed properties early. These lists show how far behind a borrower is on their mortgage:

• 30-day late: The earliest red flag.

• 60-day late: When lenders typically start making collection calls.

• 90-day late: The point where foreclosure proceedings may begin.

These lists are excellent for prospecting because homeowners in default are often open to a short sale when they realize foreclosure is imminent.

Look for Lis Pendens Filings

In judicial foreclosure states, watch for lis pendens filings. A lis pendens means a formal foreclosure lawsuit has been filed, and the clock is ticking. A homeowner may be open to a short sale if they are under water on their mortgage.

Track Tax Delinquencies and Code Violations

Another great lead source is property records. Unpaid property taxes and repeated code violations signal a homeowner in distress. A backlog of tax bills or code fines often points to someone who is overwhelmed or unable to maintain the property. Combined with negative equity, this creates a strong short sale prospect.

Build Referral Relationships With Bankruptcy & Divorce Attorneys

Real estate agents can find excellent leads by partnering with attorneys. Bankruptcy and divorce attorneys often represent clients who are experiencing financial hardship or an unexpected life event. If the client is upside-down on their mortgage, they may appreciate an agent who can handle a short sale and help avoid foreclosure.

Denied Loan Modifications or Forbearance Requests

Many homeowners try to stay in their homes by requesting a loan modification, forbearance or repayment plan. When a bank denies those requests, a short sale becomes the logical next step. Reaching sellers at this point lets you offer a dignified solution before foreclosure damages their credit further.

Credit Repair Services Can Be Great Referral Partners

Credit repair agencies work with people who are struggling with late payments or other financial issues. Building relationships with these professionals can lead to early introductions to homeowners who need to sell.

Final Thought

Finding short sale opportunities before they hit the MLS isn’t just about data—it’s about understanding the timeline of financial distress and connecting with the right people at the right time. Whether you’re an investor or a real estate agent, spotting these signals early helps you provide value and close deals.

If you’re ready to take action, see how our team can shelp you start a hort sale. To learn more about the types of clients we assist, visit our Who We Serve section, and explore How We Help to understand our proven process. We’re here to process, coordinate, and negotiate your short sale from start to finish.

Why Some Short Sales Get Denied — And How to Fix Them

Learn why short sales get denied and how to prevent it. Fix bad appraisals, manage buyer expectations, and catch title issues early.

If you’ve ever had a short sale fall apart, you know how frustrating it is. You do all the legwork—find a buyer, submit the offer, and wait weeks (or months)… just to hear the bank say no. But why does this actually happen? And more importantly—how can you avoid it?

At Crisp Short Sales, we’ve seen hundreds of these deals through to the finish line, and I can tell you—most short sale denials aren’t random. They’re preventable. Here are three of the most common reasons short sales get denied, and what you can do to fix them before it’s too late.

1. Bad Appraisals

This one kills more short sales than you’d think. The bank orders a BPO or appraisal, and it comes back too high. Suddenly, your deal gets denied—even though you know your offer was legit.

Here’s the fix: never let an appraiser go out to the home alone. Meet them there. Show them the home’s deficiencies—like a roof that’s shot, missing AC, or mold in the basement. Bring comps and walk them through your logic. Explain why the home was listed at that price and why you accepted that particular offer. When this context makes it into the appraisal report that goes to the bank, they’re far more likely to approve the deal.

2. Impatient Buyers

This one’s sneaky. You get a buyer, they submit an offer, and all seems good until week five rolls around and they start ghosting you. Next thing you know, they’re out, and your whole file goes cold. Most of the time, this isn’t the buyer’s fault—it’s ours. No one told them how this works.

Here’s the fix: educate your buyer before they go under contract. Make sure they understand that short sales can take 60–90 days (sometimes longer); just because their offer was accepted by the seller doesn’t mean the deal is done; and the bank may counter or request changes—this is normal. Buyers who are prepared for this process stick around. Those who aren’t will bail at the first sign of delay. Set the right expectations early and you’ll save yourself (and your seller) a lot of stress.

3. Unknown Title Issues

This is the silent killer. You do everything right—the bank approves the deal, the buyer’s ready to close—and then, boom, a last-minute lien shows up and derails the whole thing. Tax liens, code violations, old second mortgages… we’ve seen it all.

Here’s the fix: order title at the very beginning of the process—before you submit the offer to the lender. That way you can disclose known title issues in your initial package, the bank can bake those costs into the approval up front, and you avoid nasty surprises right before closing. Coordinate with the closing attorney or title company early—the sooner you know what’s lurking on title, the easier it is to build a deal the bank will actually approve.

The Bottom Line

Short sales don’t have to be a gamble. With the right prep, most of these deals can get approved—and closed. The key is anticipating problems before they happen.

If you’re an agent or investor dealing with a tricky short sale, I’m always happy to jump in, review the file, and help get it across the finish line. It’s what we do.

Let’s make sure your next short sale gets a yes.

Need help with a short sale right now? Call or text me at 404-300-9526 or visit www.crispshortsales.com

What Is a Short Sale? A Practical Roadmap for Homeowners, Agents & Investors

Short Sale Basics: Definition, Timeline & Key Players

A short sale lets a homeowner sell a property for less than the outstanding mortgage balance with the lienholder’s permission. Unlike a deed-in-lieu or foreclosure, the home is marketed on the open MLS, which means fair-market-value offers and a cooperative closing.

Typical timeline

1. Pre-Approval (1-2 weeks) – Gather seller hardship package, list the home, and submit preliminary docs to the lender.

2. Offer & Package Submission (2-4 weeks) – Once you have an offer at or near market value, the full short-sale package goes to the negotiator.

3. Valuation & Negotiation (30-60 days) – The bank orders a BPO/appraisal and counter-offers if needed.

4. Approval & Closing (2-4 weeks) – When terms are accepted, closing works like any other sale.

For a step-by-step overview, see How We Help.

What Homeowners Should Expect

Better for your credit, cash-back possibilities, total lien relief.

Credit Impact

A completed short sale usually shows as “settled for less than owed” on your report—far better than the 7-year stain of a foreclosure.

Possible Cash at Closing

Many major lenders allow relocation incentives—often $3,000–$10,000—when you cooperate and close on time.

All Liens, One Settlement

We negotiate every lien on title, not just the first mortgage, so you walk away free and clear.

Pro Tip: Work only with an experienced short-sale specialist who tracks every task, chases every negotiator note, and never charges you a dime—exactly what Crisp Short Sales does. Start here → Begin Your Short Sale.

What Real-Estate Agents Should Expect

Market-value pricing, full commissions, minimal extra work.

- Price at true market value – MLS exposure means you’re not stuck at an inflated payoff figure.

- 3 % + 3 % commission – Most lenders pay a full 6 % split—no haircut on your side.

- Paperwork off your plate – A specialist (that’s us!) uploads docs, follows up with the bank, and updates all parties weekly, so you focus on marketing and showings.

Agents who partner with us average 25 days faster approvals and zero out-of-pocket costs. See examples on our Who We Serve page.

What Investors Should Expect

"Name your price and shoot your shot."

Make Data-Driven Offers – Base your price on the likely BPO/appraisal. If you know the ARV will come in at $300k, an initial $210k offer gives room for a bank counter while preserving your margin.

Low Risk, Big Upside – The worst a lender can say is no. You never pay application fees and can walk away before earnest-money deadlines if approval drags.

Creative Solutions for Distressed Sellers – Adding short sales to your toolbox lets you solve more problems and win more deals.

Need the right negotiator on your side? Crisp handles the entire bank conversation and adds our 1,000-deal résumé to your credibility.

Why Choose Crisp Short Sales

- 20 Years + 1,000 Closings – We’ve seen every lender guideline, valuation dispute, and investor strategy.

- No Cost to Seller or Listing Agent – Our fee is paid by the buyer at closing—never your client.

- Start-to-Finish Communication – Weekly email summaries, milestone text alerts, and instant access to file status via our secure portal.

- Lien-Release Experts – We coordinate with IRS, HOA, municipal, and junior lienholders so nothing blows up at the closing table.

Ready to talk?

• Call 404-300-9526

• Email yoni.kutler@ygkutler.com

Final Thoughts

Whether you’re saving your home from foreclosure, listing a tough property, or hunting for your next deal, a short sale can unlock the best possible outcome—if you have the right specialist steering the ship. Let Crisp Short Sales carry the paperwork burden so you can focus on moving forward.

The #1 Mistake Investors Make When Submitting Short Sale Offers

/short-sale-investor-mistake

If you’re an investor looking to land profitable short sale deals, you’ve probably heard your share of horror stories. Deals that took months longer than expected, banks rejecting offers outright, or worse—the seller walking away halfway through.

What most investors don’t realize is that nearly every short sale pitfall can be traced back to two critical mistakes: not properly educating the seller about the short sale process upfront, and failing to accurately check comps before setting their offer price.

Mistake #1: Not Educating the Seller

Short sales aren’t like regular real estate transactions. They’re lengthy, complicated, and require sellers to be deeply involved throughout the process. The biggest misstep investors make is not clearly explaining to the seller exactly what’s involved from start to finish.

When an investor doesn’t set expectations early, the seller may feel blindsided by the constant document requests, long wait times, and overall uncertainty. That’s when they start checking out, stop responding, or even walk away entirely.

What to cover when you educate the seller:

- What a short sale involves and why it can benefit them

- The realistic timeline from listing to approval

- The financial documentation they’ll need to provide

- Why their active participation is essential for approval

If that sounds like a lot for a seller to handle, it is—but you don’t have to go it alone. Our team Crisp Short Sales haatndles the entire process, including seller education and full coordination with the lender.

Mistake #2: Not Checking Comps Correctly Before Setting Your Offer

Many investors use the ARV model—working backwards from the future value after renovation. But short sales don’t work that way. Banks don’t approve based on what the house could be worth—the value is what the house is worth right now.

The lender orders an appraisal or BPO to determine the home's value in its current, as-is condition. Your offer needs to reflect that number—not a number based on a future flip.

Here’s how to avoid this mistake:

- Check recent comps for homes in similar condition

- Base your offer on what the home will likely appraise for today

- Share this research with the appraiser or negotiator when possible

This simple shift in thinking can help you land stronger deals and speed up approvals.

Final Thoughts: Set Up to Win

To consistently succeed with short sales, focus on education and preparation. Set expectations with your seller early. Base your numbers on reality—not on ARV. And if you want a team that handles all the back-and-forth with the bank and seller, we’re here to help.

Want help closing your next short sale deal faster and with less friction? Start a file with us today.

Why Your Short Sale Offer Got Rejected—and What to Do Next

Why Your Short Sale Offer Was Rejected | Crisp Short Sales Blog

Spoiler alert: it probably wasn’t because the buyer lowballed.

(OK… sometimes that’s the case.) But more often, the deal dies for reasons nobody expects—reasons that can be totally avoided with the right short sale strategy.

I’ve been processing short sales for over 15 years. And after seeing hundreds of files, I can tell you the top 3 reasons a short sale offer gets rejected by the lender—and how you can fix them fast.

If you're a real estate agent, investor, or even a homeowner trying to sell short, this will save you time, stress, and frustration.

1. Bad Appraisal or Valuation (a.k.a. “Death by BPO”)

Let’s start with the big one. The most common reason a short sale offer gets denied is simple: the bank thinks the property is worth more than your offer.

Why? Because they got a bad valuation.

It might’ve been a drive-by BPO. Or maybe the appraiser walked through the house for five minutes, didn’t realize the HVAC is shot, and used that one flipped comp down the street as their baseline.

Here’s how to stop this from happening:

Make sure the appraiser or agent doing the BPO can't access the property without going through the listing agent first.

Seriously. This one small step can change everything.

- They can meet the appraiser on-site.

- They can bring their own comps and walk them through the pricing strategy.

- They can share where offers have been coming in.

- They can point out the condition issues that don’t show up in the MLS photos.

All of this helps anchor the final valuation close to your offer price—so the lender doesn’t come back and say “too low, denied.”

And let’s be real… once the value comes in too high, you’re in for weeks of fighting or the deal dies altogether.

So if you’re listing a short sale, or submitting an offer on one, lock down that access. It’s the best move you’ll make all month.

2. Missing Documents or Slow Turnaround

This one hurts because it’s 100% preventable.

A short sale doesn’t get approved just because you submitted an offer. It gets approved because the file is complete and the bank has everything they need—up front.

Yet I still see files sit in limbo for weeks because one form is missing. Or a seller didn’t sign the updated hardship letter. Or the buyer didn’t respond to an updated approval notice.

Here’s the deal: the review clock is always ticking. And once the bank sends a doc request, you’ve got a very small window to respond before the file is kicked back or closed altogether.

So how do you avoid this?

- Get all required documents in at the very start. Not 80%. Not “most of it.” Everything.

- If you know there’s a slow-moving client or an investor who likes to “ghost” their inbox, don’t wait—stay on them like clockwork.

- Don’t assume you’ll have time to collect more later. Because if you’re missing a pay stub or HOA doc when the file hits review, the underwriter’s just going to move on.

Short sale processing is a game of momentum. You want the file so clean and complete that when the lender opens it, they can’t help but keep moving it forward.

The less friction, the faster the approval. Period.

3. The Buyer or Seller Flakes Out Before the Finish Line

Here’s a truth nobody likes to admit: sometimes the short sale doesn’t fall apart because of the bank. It falls apart because someone gets tired of waiting.

Maybe the buyer finds something else. Maybe the seller doesn’t understand why it’s taking months. Or maybe both sides just stop caring and walk away.

That sucks—especially when you're already 60 days into the process.

So what’s the fix?

Overcommunicate.

I don’t mean blast them with hourly updates. I mean set expectations early and repeat them often:

- “Here’s where we are.”

- “Here’s what we’re waiting on.”

- “Here’s what happens next.”

- “And here’s how long it’ll likely take.”

Let the seller know you’ve got their back and that you're working the file. Let the buyer know that silence doesn’t mean the deal is dead.

And when there are updates—good or bad—share them quickly. Buyers and sellers are way more likely to stick it out if they feel informed and included.

Short sales don’t need to be stressful. But when nobody’s talking, people assume the worst. And assuming the worst usually leads to pulling out.

Final Thoughts

Short sales get rejected all the time—but most of the time, it’s avoidable.

If you’re serious about getting approvals, it comes down to 3 simple things:

- Control the valuation.

- Submit a full, clean file up front.

- Keep everyone updated.

That’s it.

If you can do those three things, I promise your approval rate will shoot up—and you’ll close way more deals than the average agent or investor.

And if you need help managing the back end of all this—I’m here for that too.

Need help with a short sale?

I’ve helped agents and sellers close over 100 short sale deals across the U.S.

Let me make your next one smoother, faster, and way less stressful.

Start a Short Sale

📞 Call/text me: 404-300-9526

📧 yoni.kutler@ygkutler.com

This post was written by Yoni Kutler of Crisp Short Sales, a short sale expert with 15+ years of experience helping homeowners, agents, and investors close deals fast.

You’re welcome to republish this post with credit and a link back to the original.