Short Sales & Foreclosures in Oklahoma: What Title Companies, Agents, and Homeowners Need to Know Going Into 2026

Oklahoma’s housing market has always had pockets of volatility, but 2025 has been a different story altogether. Distress activity is rising, timelines are tightening, and both agents and homeowners are feeling pressure from lenders who are processing more defaulted files than they have in years. Title companies, too, are fielding more calls about postponed closings, lien complications, and files stuck in loss-mitigation limbo.

If you work in Oklahoma real estate, now is the time to understand what the numbers really mean — and why short sale expertise matters more than ever.

Let’s break down the current landscape using verified ATTOM data, and talk about how real estate professionals can protect their clients (and their closings) as filings continue trending upward.

Mid-Year 2025: Oklahoma Distress Activity Surges 26.53% Year‑Over‑Year

By the halfway point of 2025, 2,194 Oklahoma properties had received a foreclosure filing. That represents a foreclosure rate of 0.12%, or 1 in every 804 housing units, ranking Oklahoma 19th-highest in the country. More importantly, it marked a 26.53% increase compared with the first half of 2024.

This level of mid-year growth is the earliest indicator that lenders, servicers, and asset managers are processing more delinquent files — and, in many cases, are tightening tolerance on valuation variances and documentation issues.

For agents and homeowners, that means:

- Fewer approved price reductions

- Stricter valuation reviews

- Heavier document requests and longer processing queues

- More files falling apart months into negotiations

This is exactly where a specialized short sale coordinator becomes invaluable. When lenders get overwhelmed, precision and persistence are the only things that keep a file moving. If you’re an agent needing help helping real estate agents close short sales faster, this is where we step in.

Q3 2025: Month‑to‑Month Decline, But Year‑Over‑Year Increase

While Oklahoma saw a moderation in Q3 2025 — 944 properties with foreclosure filings, or 1 in every 1,868 housing units, down 15.79% from Q2 — the story doesn’t stop there. Compared with Q3 2024, filings were still up 11.98% year-over-year.

This is classic early-cycle distress behavior: month-to-month swings, quarterly moderation, but a steady, unmistakable upward trend year-over-year.

For title companies, this means an increase in:

- Files requiring lien cure

- Deals involving underwater sellers

- Closings dependent on HOA payoffs, second-mortgage negotiations, and partial releases

A well-managed short sale file can mean the difference between a closing that happens and a closing that evaporates. When a seller is underwater, the fastest path to the closing table starts with short sale document prep and negotiation support. That’s exactly how we help homeowners avoid foreclosure and keep deals alive.

October 2025: A Major Spike (+74.34% Month‑to‑Month)

Then came October.

Foreclosure filings jumped to 462 statewide, equal to 1 in every 3,816 housing units — a dramatic 74.34% increase vs. September 2025, and 40% higher than October 2024.

This kind of spike can signal seasonal catch-up by servicers, bank-initiated pushes on older delinquent files, and expedited foreclosure actions where alternatives weren’t pursued. For agents, this means more homeowners will call panicked — after ignoring the problem too long. For homeowners, it means fewer options the deeper they are into the foreclosure timeline.

If someone receives a Notice of Default or is more than 90 days behind, starting a short sale immediately is critical. Waiting 30–60 days often removes negotiation flexibility completely. If a homeowner isn’t sure where to begin, they can start a short sale.

September 2025: The Volatility Warning

Interestingly, just one month before the October spike, September saw Oklahoma with only 265 foreclosure filings, or 1 in every 6,653 housing units — a 10.47% decrease from August and 27% lower than September 2024.

This tells us something important: month-to-month foreclosure data is reactive, not predictive. For real estate professionals, the actionable trend is the year-over-year increase, not temporary dips. Lenders are clearly continuing to process more distressed files overall, even though certain months appear calmer.

National Context: Distress Rising Everywhere

Oklahoma’s trends don’t exist in a vacuum. Nationally, October 2025 marked the eighth consecutive month of year-over-year increases in foreclosure activity: 36,766 properties received filings, foreclosure starts were up 20% YoY, and REO completions up 32% YoY. When the national distress wave grows, states like Oklahoma — with large rural populations, older housing stock, and wide price variability — tend to feel outsized impacts.

Why Title Companies & Agents Are Seeing Tougher Files

With filing volumes rising, title companies and agents across Oklahoma are noticing:

- More properties with junior liens

- More unresolved judgments

- More utility liens and HOA arrears

- More sellers underwater due to repairs they can’t afford

A short sale keeps the closing viable — but only if it’s managed with:

1. Clean document collection

2. Accurate hardship analysis

3. Aggressive lender follow-up

4. Protection of commission and buyer incentives

The number one reason short sales fail is not value — it’s file mismanagement. That’s why more Oklahoma agents are partnering with dedicated coordinators to get approvals issued faster and prevent deals from collapsing months into the process.

The Bottom Line for Oklahoma Real Estate Professionals

Oklahoma isn’t in crisis — but it is stepping into a multi-year period of increasing foreclosure activity. The combination of rising mid-year filings, higher Q3 activity year-over-year, a large October spike, and national distress momentum all point to one thing: short sales will become more common heading into 2026.

Agents, title companies, and homeowners who prepare early will navigate this cycle smoothly. Those who wait risk deals falling apart, sellers losing homes unnecessarily, and buyers walking away frustrated.

If any agent or homeowner in Oklahoma needs guidance on whether a short sale is appropriate — or how to structure one that actually gets approved — we’re here to help.

Short Sales & Foreclosures in Ohio: What Title Agents, Realtors & Homeowners Need to Know Right Now

Ohio has quietly become one of the fastest-shifting foreclosure markets in the country — and for anyone working in real estate here (title companies, agents, investors, and especially homeowners), understanding what’s happening beneath the surface is essential.

In 2025, the Buckeye State consistently ranked among the top ten markets for foreclosure activity. And when foreclosure pressure rises, short sales almost always follow.

Ohio’s Foreclosure Numbers Tell a Clear Story

1. **October 2025 – 1 in every 3,079 homes** — Source: ATTOM — U.S. Foreclosure Rates by State (Oct 2025). This puts Ohio among the higher-distress states nationally, and it confirms a steady increase from earlier in the year.

2. **August 2025 – 1 in every 3,026 homes** — Source: SoFi — Foreclosure Rates for All 50 States (Aug 2025). Only two months earlier, filings were already high — a sign that foreclosure pressure was not a short-term spike.

3. **April 2025 – 1 in every 3,002 homes (ranking #6 worst in the U.S.)** — Source: Safeguard Properties — Foreclosure Rates by State (Apr 2025). This early-year ranking was the warning sign. Foreclosure filings placed Ohio firmly in the top tier of states experiencing homeowner distress.

Bottom line: Ohio homeowners have been navigating a difficult landscape throughout 2025. And when foreclosure pressure increases, the opportunity — and need — for well-executed short sales increases with it.

Why This Matters for Ohio Realtors

Short sales are no longer niche transactions here. They’re becoming a regular part of the market again. When handled correctly, a short sale can:

• Help your listing avoid foreclosure

• Salvage a deal that otherwise dies due to mortgage payoff challenges

• Protect your seller’s credit while giving them a clean exit

• Put you in control of the transaction rather than letting the bank dictate terms

The key phrase here, though, is “when handled correctly.” A short sale with no guidance, no follow-up, or no negotiation strategy becomes a 6-month headache. A properly managed short sale becomes a win for everyone — including you. If you ever need a partner specialized in helping real estate agents close short sales faster, you can learn more about how we support agents on the Who We Serve page.

What Title Companies Should Pay Attention To

Ohio title companies are feeling the pressure too — short sale files hit your desk with:

• Approval letters missing required language

• Payoff miscalculations

• Deadlines coming too fast

• Multiple mortgages or HOA balances

• IRS or state tax liens needing negotiation

• Miscommunication from servicers

When these files get messy, you get stuck chasing documents instead of clearing title. That’s exactly why we work directly with title teams — coordinating documents, correcting approvals, and making sure you receive lender-ready paperwork early rather than last-minute. If you'd like a clearer look at what that looks like, our How We Help page breaks down the entire process, from negotiations to approval letter cleanup.

For Ohio Homeowners: The Short Sale Is a Lifeline, Not a Last Resort

If you're a homeowner facing foreclosure in Ohio, the rising monthly filings aren’t just statistics — they’re stress points. A short sale can:

• Stop foreclosure

• Protect your credit far better than a foreclosure

• Wipe out mortgage deficiencies

• Offer relocation funds at closing (yes — real money to help you move!)

• Give you control over timing, move-out date, and transition

We even built a simple guide for homeowners who want to start their short sale today, available here: Start a Short Sale. When you’re in distress, the process needs to be simple, not overwhelming. That’s why we take on the negotiation, document coordination, and weekly communication — so homeowners don’t have to.

Why Short Sales Are Growing Again in Ohio

Here’s what’s driving the surge:

• Homeowners who bought in 2021–2022 are underwater

• Property taxes and insurance costs have jumped statewide

• Adjustable-rate mortgages adjusting upward

• Job disruptions and rising consumer debt

These macro-factors don’t just increase foreclosures — they increase short sale eligibility, especially when a homeowner tries to sell but the payoff is higher than the home’s value.

Ohio Agents: How to Know If Your Listing Qualifies for a Short Sale

You don’t need to guess. Quick checklist:

• Property value is lower than mortgage payoff

• Seller has a legitimate hardship

• Seller has missed payments — or will soon

• Multiple liens, HOA balances, or judgments are involved

• Appraisal disputes are likely

• Buyer needs faster approval than a large servicer usually provides

If any of these sound familiar, there’s a good chance the listing qualifies. And if you’re unsure, we’ll look at it with you — no commitment and no cost.

The Ohio Market Is Heading Toward More Short Sales in 2026

Foreclosure filings have been consistent for months, and unless something dramatic changes in the economy, short sale volume will continue rising. This is the moment for:

• Realtors to prepare

• Title companies to streamline processes

• Homeowners to explore options before foreclosure impacts long-term credit

A rising market doesn’t eliminate distress — it often just hides it. And Ohio’s data shows that distress is still very real. If you’re navigating a short sale or think one may be needed, we’re here to help — from the first phone call to the closing table.

Short Sales & Foreclosures in Minnesota 2025

If you live or work in Minnesota, you’ve probably noticed more “notice of default” and foreclosure headlines creeping back into the news. The good news: we’re nowhere near 2008 levels. The bad news: distress is clearly rising, and short sales are about to matter again for homeowners, agents, and title companies.

Let’s break down what’s happening in Minnesota right now—and how a well-run short sale can keep a problem file from turning into a full-blown foreclosure.

The Minnesota foreclosure numbers (and what they really mean)

- Foreclosure filings in Minnesota are up ~17% year-over-year, according to Realtor.com data reported by local Minnesota outlets.

- In September 2025, Minnesota had a foreclosure rate of 1 in every 9,031 housing units (279 filings out of ~2,519,538 units).

- For the first half of 2025 (Jan–June), Minnesota logged 2,197 properties with foreclosure filings, which works out to roughly 1 in every 1,147 housing units and a 2.04% increase vs. the same period last year.

- By October 2025, the pace ticked up again: ATTOM shows 1 in every 6,903 Minnesota homes had a foreclosure filing that month (365 filings).

So what does that mean in plain English?

- Minnesota is still mid-pack nationally, not a crisis state.

- But trend direction matters: filings are rising, and more homeowners are feeling payment pressure.

- For agents and title, that means more files with some level of distress, tighter timelines, and a higher chance that “normal” listings quietly morph into short sale situations.

Short sales sit right in the middle of this story: they’re often the off-ramp between “I’ve fallen behind” and “The bank is taking the house.”

For homeowners: when a short sale should be on your radar in Minnesota

Here are some signs you should at least have a short sale conversation:

- You’re 60+ days behind on your mortgage and can’t realistically catch up.

- You’ve had a job loss, income reduction, divorce, or medical issue, and your payment is now permanently unaffordable.

- Your home needs repairs you can’t afford and the as-is sale price won’t cover what you owe.

- You’ve tried to sell at a payoff price, had low showings or no offers, and your agent is telling you the market value is below your loan balance.

In those cases, a properly negotiated short sale can:

- Avoid a completed foreclosure and sheriff’s sale.

- Typically hit your credit less harshly than a full foreclosure.

- Give you a clear move-out date, with time to plan your next housing step.

- Potentially include relocation assistance at closing (money to help with your move) if your lender’s guidelines allow it.

At Crisp Short Sales, my focus is on helping Minnesota homeowners avoid foreclosure with a well-structured short sale, handling the lender paperwork, valuation disputes, and back-and-forth so you don’t have to live on hold. You can see exactly how we help homeowners and their agents through the short sale process and what that looks like step by step.

For real estate agents: how the MN market shift changes your job

A few practical implications of Minnesota’s rising foreclosure activity:

1. More listings will be quietly underwater.

That “priced aggressively” listing with very little equity may actually be a short sale candidate once you net out commissions, closing costs, and repairs.

2. Banks are getting busier again.

National foreclosure filings are up double-digits year-over-year, which means more files on fewer desks at the servicers. This can slow approvals—unless someone is on the lender side all day, every day, pushing.

3. You can’t afford a blown deal right now.

A failed short sale is months of work ending in “foreclosure sale cancelled the closing.” Not fun for you, your client, or the buyer.

This is where partnering with a short sale specialist becomes a leverage play, not an expense. My role is helping real estate agents close short sales faster and with fewer surprises, while you stay the face of the deal and keep the relationship with your client. If that’s something you want in your back pocket for Minnesota listings, take a look at who we serve and how we work with agents and investors.

In practice, that looks like:

- Reviewing the net sheet early to confirm it’s truly a short sale.

- Helping you set realistic list pricing based on investor guidelines and recent approvals, not fantasy comps.

- Handling the BPO/appraisal disputes when the bank’s value comes in high.

- Keeping everyone updated weekly so your client isn’t blowing up your phone asking, “Have you heard anything yet?”

For title & closing companies: why short sale files are a different animal

If you’re on the title or settlement side in Minnesota, your work gets harder when foreclosures and short sales increase:

- Approval letters drive everything. Every fee, credit, and net has to match the lender’s written approval. One stray admin fee or incorrect prorate can trigger a last-minute re-approval request.

- Second liens, judgments, and HOAs show up more often. As homeowners fall behind, you’ll see more junior liens and delinquent HOA balances that must be negotiated and approved in writing before closing.

- Timelines are tighter and less flexible. Approval letters often have firm expiration dates, especially when foreclosure sale dates are already scheduled.

Working with a dedicated short sale processor means:

- You get clean, lender-approved settlement statements on time.

- You’re not stuck tracking down addenda or updated letters the morning of closing.

- You have a clear point person to coordinate when something changes at the last minute.

Crisp Short Sales routinely coordinates with title companies nationwide to keep short sale approvals in sync with the final Closing Disclosure or ALTA. If you want a go-to contact for short sale coordination and document prep in Minnesota, start with the overview on how we help title and settlement teams stay in compliance with lender approvals and feel free to reach out.

How to stay ahead of Minnesota’s rising foreclosure & short sale activity

Here’s a simple game plan tailored to each group.

Homeowners

- Talk to your servicer early if you’re falling behind. Ask about forbearance, modification, and other options.

- If the numbers don’t work, discuss a short sale with your agent and a short sale specialist before a foreclosure sale date is set.

- Gather your financials, hardship letter, and listing agreement early so your file can be submitted quickly.

- When you’re ready, you can start a short sale with Crisp online in just a few minutes—we’ll take it from there.

Real estate agents

- Add a quick “equity check” to every listing consult: What’s owed? What are realistic net proceeds? Is this actually a short sale?

- Flag any Minnesota listing where delinquency + low equity + needed repairs are all present. That’s short sale territory.

- Build a relationship with a short sale manager who will own the lender side so you can focus on pricing, marketing, and negotiations.

- Keep a simple script ready: “We can sell, but it’ll need to be as a short sale. I have someone who handles that process all day—let’s bring them in.”

Title & settlement

- Create a short sale checklist: approval letter on file, all payoffs in writing, HOA/judgment approvals, commission/fee structure matches approval, expiration dates tracked.

- Ask upfront: “Is this a true short sale with a lender approval letter, or just a tight equity file?”

- Make sure you have a single point of contact on the short sale side who can quickly update approvals if something changes.

At Crisp Short Sales, we provide short sale processing, negotiation, and closing support so these deals actually get to the table.

Missouri Short Sales in 2025: What Rising Foreclosures Mean for Agents & Homeowners

Missouri foreclosures are up 20–90% in 2025. Learn how short sales help agents and homeowners avoid foreclosure amid rising zombie properties.

Missouri doesn’t usually make national headlines for distressed real estate—but 2025 has been a very different kind of year. After a long stretch of relative stability, the state is now seeing noticeable spikes in foreclosure activity, zombie properties and distressed listings popping up across both St. Louis and Kansas City. For agents, homeowners and investors, that shift means one thing: short sales are going to play a much bigger role in the months ahead.

Let’s break down what’s happening—and why understanding the short‑sale option now can protect equity, prevent foreclosure and help more deals reach the closing table.

## Foreclosures Are Rising Again in Missouri

Missouri’s foreclosure numbers have been trending upward throughout 2025—and the pace is accelerating.

### Key 2025 stats

- **September 2025:** Missouri reported **1 in every 7,433 housing units** facing foreclosure—a total of **378 filings**, which is **down 10 % from August** but **up 90.91 % year‑over‑year**.

- **January 2025:** The year started with **1 in 9,272 units** in foreclosure and **303 filings**.

- **First half of 2025:** Foreclosure filings hit **2,086 properties**—a **20.58 % increase** over 2024.

These numbers tell a clear story: while Missouri started the year with manageable distress levels, filings rose steadily and are now significantly outpacing last year.

For distressed homeowners—and the agents representing them—a short sale is often the only option that avoids foreclosure without forcing the owner into bankruptcy or a deed‑in‑lieu. When the goal is avoiding foreclosure altogether, the best solution is walking the seller through the process with someone who handles the negotiation day‑to‑day. This is exactly the kind of support we provide when **[helping homeowners avoid foreclosure with a short sale](/how-we-help)** so they can walk away clean instead of facing credit damage that lingers for a decade.

## Zombie Foreclosures Are Surging—Especially in KC & St. Louis

Another major trend hitting Missouri is the rise in **zombie foreclosures**—properties stuck in limbo after owners move out but before the bank completes its foreclosure. This isn't just a neighborhood eyesore issue. Zombie properties drag down comps, discourage buyers and create legal headaches for owners who thought they were already out of the picture.

### Zombie foreclosure data for Missouri

- **Q4 2025:** **6.28 %** of all foreclosures in Missouri were zombie properties—**49 total**—primarily in **St. Louis City**, **St. Louis County** and **Jackson County**.

- **Q1 2025:** Kansas City saw a **10.9 % zombie rate**, while St. Louis reached **8.9 %**.

- Missouri saw an **85 % year‑over‑year increase in zombie foreclosures** in Q1.

These numbers indicate lenders have been slow to finalize foreclosure timelines—leaving owners confused, properties abandoned and neighborhoods declining. **Short sales prevent zombie foreclosures entirely** because the property transfers through a traditional real‑estate closing, not abandonment.

If you’re advising a homeowner who is thinking about “just walking away,” a short sale is almost always the safer alternative—and you can increase their odds of approval dramatically by **[working with a short‑sale coordinator who handles everything behind the scenes](/who-we-serve)** so the agent can focus on selling the home rather than managing lender bureaucracy.

## Why Missouri Agents Are Seeing More Short‑Sale Opportunities in 2025

As foreclosure filings rise and zombie properties increase, more homeowners fall into three key groups:

1. **Behind on payments but still living in the home**

These owners usually want to avoid foreclosure but don’t know their options. A short sale can give them a clean exit, credit recovery and potential relocation assistance at closing.

2. **Already moved out, unsure what to do next**

This is where zombie foreclosures tend to develop. Instead of waiting for the bank to take the home—sometimes for years—a short sale creates a clean, fast resolution.

3. **Underwater homeowners needing to sell quickly**

Inventory is higher, demand is softer and many houses need repairs. When the payoff exceeds value, a short sale avoids a financial hit.

Missouri’s numbers suggest all three groups are growing—and agents who respond quickly will win more listings and protect more homeowners from the worst‑case scenario.

## Where Short Sales Tend to Cluster in Missouri

Based on current foreclosure and zombie‑property patterns, the most common distressed markets in the state include:

- **St. Louis City**

- **St. Louis County**

- **Jackson County (Kansas City)**

- **Clay & Platte Counties (north Kansas City)**

- **Greene County (Springfield)**

These areas are already showing increased short‑sale opportunities due to aging housing stock, underwater mortgages and higher‑than‑average foreclosure rates. If you’re an agent working in any of these markets, now is the time to get ahead of the wave. With distressed filings surging, short sales will continue rising through 2026.

## Short Sales Are Complicated—But Agents Don’t Need to Handle the Process Alone

Short sales fall apart when lenders don’t respond, documents aren’t prepared correctly or negotiators drag the process out for months. That’s why many agents choose to outsource the lender negotiation so the listing can move forward smoothly.

At Crisp Short Sales, we take on:

- Full lender communication

- Document collection and submission

- Valuation disputes

- Weekly status updates

- Buyer, seller and title coordination

- Closing prep

So agents can focus on what they do best: selling the home and protecting their clients.

If you have a distressed listing—or expect to take one soon—you can start the process instantly through our secure portal: **[Start a short sale today](/start-short-sale)**.

Louisiana Foreclosures & Short Sales: What 2025’s Rising Trends Mean for Homeowners, Agents & Title Companies

If you work in real estate in Louisiana—or you’re a homeowner trying to make sense of a difficult financial situation—you’ve probably felt it already: foreclosure activity is picking up in 2025, and distressed properties are becoming more common.

In this post, we’ll break down what’s happening in Louisiana using current data, and then talk about how short sales can help homeowners, real estate agents, and title companies navigate this shift with fewer headaches and better outcomes.

## Louisiana Foreclosures in 2025: What the Numbers Are Telling Us

The recent reports on foreclosure activity paint a very clear picture: Louisiana is under growing pressure.

### 1. Foreclosure filings are rising nationwide—and Louisiana is part of that trend

In Q3 2025, U.S. foreclosure filings were up 16% year‑over‑year. Louisiana is not immune to that increase. Rising rates of delinquency and economic pressure are pushing more homeowners into default, which means more notices of default, more auctions, and more REO inventory working its way through the system.

### 2. Foreclosure filings in Louisiana jumped nearly 24% vs. 2024

For the first six months of 2025, Louisiana recorded 2,755 properties with foreclosure filings, representing about 0.13% of all housing units in the state. That’s a 23.88% increase compared to the same period in 2024. For homeowners, that means more competition among distressed sellers and more downward pressure on pricing. For real estate agents, it means more listings with some level of distress—late payments, loan modifications, or foreclosure timelines already in motion. For title companies, it means more files where liens, payoffs, and bank approvals are anything but straightforward.

### 3. Louisiana ranked 10th worst in foreclosure rate in April 2025

In April 2025, Louisiana posted one foreclosure for every 3,187 housing units, ranking 10th worst in the nation. That ranking matters. It shows Louisiana is not just seeing a mild uptick—it’s near the front of the pack in terms of foreclosure activity. If you’re an agent or title company in the state, this isn’t a future problem; it’s a right‑now problem.

## Why Short Sales Are So Important in This Environment

As foreclosure filings increase, short sales become an increasingly valuable tool for everyone involved:

- Homeowners trying to avoid a completed foreclosure

- Agents trying to turn distressed situations into closed transactions

- Title companies trying to close deals without dealing with half‑finished foreclosure actions and messy title chains

A short sale, when handled correctly, can resolve a distressed mortgage before it becomes a full‑blown legal and financial train wreck.

### How Short Sales Help Homeowners

For a homeowner who has fallen behind on payments, a short sale can:

- Prevent a completed foreclosure

- Lessen the long‑term credit damage versus foreclosure

- Provide a clear exit from an unaffordable property

- Potentially position them to buy again sooner in the future

Instead of ignoring bank letters or hoping things magically improve, a short sale gives homeowners a structured, lender‑approved way out. When we work with sellers, we walk them step‑by‑step through the process—from collecting documents to understanding the approval letter—so they know what to expect and what comes next. That’s part of how our short sale services help homeowners avoid foreclosure with a structured, fully‑managed process (/how-we-help).

### How Short Sales Help Real Estate Agents

Louisiana agents are seeing more leads that sound like:

- “I’m behind, but I still want to sell.”

- “The bank started something… I’m not sure what.”

- “I got a notice, but I don’t want to just let the house go.”

These are often short sale candidates, not traditional listings. The problem? Most agents don’t want to spend their days on hold with banks, chasing missing documents, or deciphering investor guidelines. That’s exactly where a specialist comes in.

At Crisp Short Sales, our focus is helping real estate agents close short sales faster by taking over lender communication, document collection, and negotiation—while the agent stays in full control of the client relationship and the listing (/who-we-serve). You handle pricing, showings, and contracts; we handle bank packets, updates, negotiations, and approvals. You get a closed transaction and a grateful client instead of a dead deal and a foreclosure on their record.

### How Short Sales Help Title Companies

Title companies feel the impact of rising foreclosures very quickly:

- More liens and judgments.

- More HOA delinquencies.

- More tax issues.

- More payoff surprises.

- More last‑minute changes from lenders.

When a file comes through as a short sale with no real structure, title ends up doing crisis management at the eleventh hour. When we’re involved, we focus on short sale document prep, bank approvals, and clear communication with all parties, so title receives a file that’s organized and lender‑ready—not a stack of half‑complete paperwork that needs to be rescued. Our job is to smooth the path so closers can do what they do best: close.

## What the Short Sale Process Looks Like in Practice

Here’s how a typical short sale works with our team involved:

1. **Intake & Review** – We review the homeowner’s situation, loan type, hardship, and property status. If it’s a fit, we move forward with a short sale strategy.

2. **List & Market the Property** – The listing agent markets the property, negotiates with buyers, and gets a purchase agreement in place.

3. **Short Sale Package & Submission** – We gather the required documents from the seller, prepare the full short sale package, and submit it to the lender.

4. **Negotiation & Updates** – We handle all lender communication—value disputes, counteroffers, file status checks—and keep the agent and title company informed with clear updates.

5. **Approval & Closing Coordination** – Once we receive the short sale approval letter, we work with the agent and title company to meet all conditions and get the deal closed.

If a homeowner or agent in Louisiana needs to start this process, they can kick it off in minutes by submitting a file through our Start a Short Sale page (/start-short-sale).

## What This Means for Louisiana Heading Into 2026

Given the 2025 numbers, a few things are likely:

- More distressed listings will hit the market.

- More homeowners will quietly fall behind before calling an agent or attorney.

- More complex files will land on the desks of title companies across the state.

The professionals who understand short sales—and have a trusted partner to manage them—will be in the best position to help.

For homeowners, a properly negotiated short sale is often the difference between years of financial fallout and a realistic fresh start. For agents, it’s the difference between walking away from a “problem lead” and turning that situation into a closed deal and a long‑term referral source. For title companies, it’s the difference between chaos and a controlled, lender‑approved closing.

If you’re in Louisiana and you’re starting to see more distress in your pipeline, now is the time to get ahead of it—not wait for the next round of foreclosure statistics.

Short Sales & Foreclosures in Virginia (2025 Update)

If you work Virginia real estate in 2025, you’re feeling the tension: inventory is tight, rates are stubborn, and distressed situations are inching up. In April 2025, Virginia posted **one foreclosure filing for every 5,747 housing units** (from ~3.65M total), ranking **29th** nationally for severity—hardly the worst, but meaningful for anyone with a deal on the line. At the national level, **foreclosure starts and completed foreclosures are trending upward** this year, and a specific pain point is emerging in VA-backed mortgages: **the VA-loan foreclosure inventory climbed to 0.84% in Q1 2025, its highest since 2019**.

Below is a practical field guide—how to read the tea leaves, when a **short sale** beats a foreclosure, and how agents, homeowners, and title teams can move files to the finish line without drama.

## Why Virginia’s “middle-of-the-pack” rank still matters

Being 29th doesn’t sound scary—until a single distressed file is *your* pipeline. Virginia’s rate suggests pockets of pressure instead of a tidal wave. That means:

- **Case-by-case diligence wins.** Every file’s math is different: arrears, repairs, investor overlays, and junior liens.

- **Timeline discipline is decisive.** Missed milestones (valuation rebuttals, buyer updates, docs refreshes) push files into avoidable foreclosure pathways.

- **Valuation friction is real.** Appraisals/BPOs may lag market condition or property condition—especially for homes needing significant work.

When valuations feel off, a short sale can be the release valve—if it’s structured cleanly, documented thoroughly, and escalated smartly.

## The VA-loan spike: what it means on the ground

The jump in **VA-loan (veteran) foreclosure inventory to 0.84%** is notable because VA servicing guidance and investor rules can differ from conventional loans. Practically, this means:

- **Extra attention to hardship documentation.** VA servicers tend to scrutinize feasibility and net sheets closely.

- **Clear, repair-based pricing rationale.** If a property needs work, you’ll want estimates, photo logs, and comps that separate “fixed and updated” sales from true “as-is” condition.

- **Early conversation about deficiency and relocation help.** Not every file qualifies, but properly packaged short sales often land a smoother outcome than a last-minute foreclosure defense.

## Short sale vs. foreclosure in VA: quick decision matrix

**Consider a short sale when:**

- Market value < indebtedness and foreclosure timelines are accelerating.

- Property requires repairs that retail buyers won’t finance at current list price.

- You need a cooperative path that preserves the seller’s dignity and minimizes post-sale complications.

**Foreclosure tends to loom when:**

- Communication stalls, buyer updates lag, or valuation disputes aren’t documented.

- There’s no realistic buyer within the servicer’s response window.

- Title clouds (liens, HOA, judgments) aren’t identified early and laddered into the net sheet.

Not sure where your file sits? Our **short sale coordination for agents and title teams** is built for exactly this fork in the road—packaging, negotiating, and keeping the lender’s to-do list empty.

## Virginia file playbook (fast, clean, lender-friendly)

1. **Get the paper right on Day 1.** Authorization, hardship, income/expense, two months statements, tax returns as needed, and a clean purchase contract with buyer proof of funds/DU.

2. **Pre-empt the valuation fight.**

- Prep an “as-is condition” packet: repair estimates + photo log.

- Use comps with *like condition* when possible; when not, explain adjustments clearly.

3. **Title preview early.**

- Order a preliminary search up front to surface HOA, municipal liens, UCCs, and solar/pace items.

- Map payoffs into a working net sheet so surprises don’t appear at CTC time.

4. **Buyer strength > buyer count.**

- One committed buyer with clean funding + flexibility on timelines beats a carousel of fall-throughs.

- Send weekly buyer updates to the lender to keep the file “warm.”

5. **Escalation ladder.**

- If the valuation misses the mark, rebut in writing with photos, estimates, and apples-to-apples comps.

- Calendar follow-ups. Silence is not a status—escalate politely, early, and with new facts (not just “checking in”).

## Title companies: where you make the difference

Virginia’s “not terrible, not great” ranking means *process* separates wins from write-offs. Title teams can:

- **Surface curatives early** (HOA, municipal fines, second liens).

- **Coordinate payoffs with realistic closing credits** so the lender sees a clean path to net.

- **Keep docs fresh** (buyer approvals, hazard insurance if required, HOA statements, tax certs) to prevent last-minute expirations.

Need a hand on complex curatives or lender escalations? We specialize in **short sale transaction management and negotiation**—you keep control of your client relationship; we keep the bank on schedule.

## Homeowners: options without shame

If you’re in Virginia and behind on payments, you’re not alone—and you’re not out of options. A well-run short sale can stop the clock, avoid the public sting of a foreclosure sale, and set you up for a more manageable next chapter. Start by sharing the basics (loan type, arrears, property condition, HOA status). We’ll outline the realistic paths, including **timeframes, potential relocation assistance,** and what documentation the lender will request. When you’re ready, you can **start your short sale here**.

---

### Bottom line for Virginia in 2025

- State severity is **moderate**, but **national trends are up**, and **VA-loan distress is rising**.

- The winners will be the teams that package clearly, rebut valuations with evidence, and protect the timeline.

- If your file needs experienced hands, we’re here—**helping real estate agents close short sales faster** while you stay in the driver’s seat.

Utah’s Foreclosure Activity Continues to Rise — What It Means for Short Sales in 2025

Utah’s housing market has been known for its resilience, but 2025 is shaping up to be a year of correction. While home prices remain relatively strong in some metro areas, data from recent months show a steady uptick in foreclosure filings — signaling that more distressed homeowners may soon need relief through alternatives like short sales.

According to new data from September 2025, Utah recorded 388 foreclosure filings, marking a 7.18% increase from August and a 15.82% jump compared to September 2024. That translates to one in every 3,075 housing units — a meaningful climb from earlier in the year when the rate stood at one in every 3,389 homes in April.

In short: over just five months, filings rose by about 10%, and the state’s foreclosure frequency worsened. This trend matters not only to homeowners but also to real estate agents and investors navigating more complex transactions as equity continues to shrink.

A Look Back: From Early 2025 to Today

To put things in perspective, February 2025 saw 337 total foreclosure filings across Utah, including 207 starts and 12 REOs (bank-owned repossessions). That was already 49.1% higher year-over-year, a clear early warning that distress was building.

Now, with September’s totals exceeding even those springtime highs, it’s evident that a slow and steady climb in delinquencies is translating into formal foreclosure actions. The takeaway? More homeowners are slipping behind — and many are looking for a way out before it’s too late.

Why the Trend Matters for Agents and Homeowners

Foreclosure doesn’t happen overnight. In most cases, it’s the final step after months of missed payments and lender notices. The steady rise in filings shows that economic pressure points — from rising consumer debt to stubborn inflation — are catching up with households statewide.

For real estate agents, that creates both a challenge and an opportunity. Agents may encounter listings where the seller owes more than the home is worth or where time is running short before the auction date. That’s where a short sale can save the deal.

- Prevent foreclosure and credit damage for the homeowner

- Secure a full lender release of the remaining balance

- Help the buyer purchase below market value

- Allow the agent to close a complex transaction that might otherwise fail

At Crisp Short Sales, we specialize in helping real estate agents close short sales faster by managing all lender communication, document collection, and negotiation. This keeps deals moving smoothly while agents focus on what they do best — marketing and selling.

Why Homeowners Should Act Early

For homeowners feeling the pressure, time is the most valuable asset. Waiting until the foreclosure auction date is posted severely limits your options. By starting the short sale process early, it’s possible to stop the foreclosure timeline, avoid long-term credit damage, and even qualify for relocation assistance — money paid at closing to help cover moving costs.

Our team handles the entire process from start to finish, including submitting all lender documents, negotiating with lienholders, and coordinating with title companies. For many homeowners, it’s a stress-free alternative that leads to a fresh start.

See how we help homeowners avoid foreclosure →

The Bigger Picture in Utah

While Utah’s foreclosure rate (1 in every 3,075 homes) is still below national hot spots like Illinois or New Jersey, its trajectory is what matters most. With filings up nearly 16% year-over-year, Utah’s trend line is pointing sharply upward — especially in suburban counties where pandemic-era appreciation has slowed but mortgage costs remain high.

As affordability tightens and adjustable-rate loans reset, many homeowners are finding that their equity cushion isn’t as deep as they thought. That’s why real estate professionals should prepare now — understanding short sale negotiation, loss mitigation, and lender timelines will be key to serving this next wave of clients.

Start a short sale or partner with our team today →

Final Thoughts

Utah’s foreclosure uptick isn’t a full-blown crisis — yet. But the consistent month-over-month increases in 2025 are worth paying attention to. Historically, when filings rise 10–15% over consecutive quarters, short sales become a more common (and necessary) tool to keep the housing market balanced.

At Crisp Short Sales, we’ve helped hundreds of agents and homeowners navigate this exact scenario — avoiding foreclosure, closing cleanly, and preserving relationships with lenders. Whether you’re an agent juggling multiple listings or a homeowner looking for answers, we’re here to simplify the process and get your file approved quickly.

South Carolina Short Sales & Foreclosures: What the 2025 Spike Means for Agents, Homeowners, and Attorneys

South Carolina has been on every serious foreclosure watcher’s radar in 2025—and for good reason. In September 2025, the state posted 1 foreclosure filing for every 2,883 housing units (833 filings), landing South Carolina in the top five worst foreclosure rates nationwide and marking a 17.82% year-over-year increase in activity.

That September snapshot isn’t a blip. Mid-year data shows the surge started earlier: in June 2025, South Carolina ranked #1 in the country, with 1 in every 2,426 housing units receiving a filing. The Columbia metro was especially hard-hit in Q2 with 1 in every 694 housing units—one of the worst rates among large metros.

Zooming out, national Q3 2025 reporting confirms the pressure is real: foreclosure filings rose 17% year-over-year, with starts and REOs both up—and South Carolina remained among the worst-performing states.

What’s driving the spike—and why it matters locally

Rising distress reflects a cocktail of factors: rate resets, stubborn insurance and tax costs, and stretched household budgets. When borrowers miss early resolution windows, files advance toward auction faster—especially in hot metros like Columbia. For agents and attorneys, this means more inbound “problem files,” tighter timelines, and higher odds that a deal falls apart if you don’t have a short-sale game plan.

Why short sales are surging back into relevance

A properly structured short sale can beat foreclosure to the finish line and preserve value for everyone involved:

- Homeowners avoid the long-tail damage of a completed foreclosure and can often access relocation assistance at closing (sometimes called “cash for keys”) when the lender approves—money intended to help them move, not to vacate for the bank. See how we structure it in our short sale help & incentives.

- Agents keep the listing and the relationship, while handing off the lender grind. If you’re focused on pricing, showings, and negotiations, we’re focused on timelines, escalations, BPO challenges, HUDs, and lien releases—helping agents close short sales faster.

- Attorneys & Title get a cleaner, fully documented file: clear approvals, settlement statements that match lender conditions, and coordination for tricky items (HOAs, judgments, seconds, solar/UCCs).

South Carolina signals you can’t ignore

1) Sustained elevation, not a one-off

September’s top-five ranking (1 in 2,883) confirms elevated activity late in the year, even after the June spike. Expect more filings to hit MLS as owners face sale dates, NODs, or resumed loss-mitigation timelines.

2) Metro concentration—Columbia as a bellwether

With Columbia’s Q2 rate at 1 in 694, agents in Richland and Lexington counties are likely to see repeat short-sale scenarios: deferred maintenance, rate resets, and payment shocks. Files in these corridors benefit from early short-sale intake—before the auction clock forces fire-sale pricing.

3) Worsening quarterly undercurrents

Q3 reporting shows starts and bank repossessions up year-over-year, which means more first touches and second looks from lender investors—and more opportunities to overturn low BPOs or mis-graded condition.

Tactics that win approvals in today’s SC files

- Beat the BPO with evidence, not emotions. Provide dated, line-item repair estimates (roof, HVAC, structural, moisture, sewer, electrical) plus as-is comps that truly match condition. This is where files get approved or stalled.

- Price with the end in mind. If your BPO target needs a 10–15% haircut for condition and “time-to-close,” list accordingly. Price reductions in week 1‑2 are more persuasive when paired with a buyer already in underwriting.

- Neutralize HOA/second liens early. Pre-clear payoff expectations; for stubborn UCCs (solar), request a written release pathway or assumption options before you submit the final HUD.

- Escalate on timelines. If valuation stales at day 90 or negotiator responsiveness dips, escalate to investor or supervisory channels with a documented timeline of unanswered requests.

- Stay buyer-ready. Clean purchase agreements, verified funds, and title-cleared HUD drafts shorten the investor’s risk horizon. Approvals follow certainty.

How we partner with South Carolina pros (and keep deals alive)

- Agents: You sell; we negotiate. We sequence the milestones—intake, valuation, BPO rebuttal, HOA/UCC clearances, and investor conditions—so you stay in front of the client while we do the lender work. Here’s how we’re helping agents close short sales faster.

- Attorneys & Title: We align early on vesting, judgments, and payoff logistics so your HUD meets investor conditions the first time—reducing redraws and last-minute denials.

- Homeowners: If you’re behind on payments or have a sale date set, a short sale may keep you in control and even provide relocation assistance at closing. Start here: avoid foreclosure with a short sale.

Given South Carolina’s late-2025 trajectory, proactive short-sale execution is the difference between a listing that languishes and a file that closes.

Ready to move a file today?

- Agents: Send the MLS link and any repair notes—we’ll do a same-day file review and outline your BPO target.

- Attorneys/Title: Email open liens and HOA contacts—we’ll prep the payoff/settlement roadmap.

- Homeowners: Use our secure intake to see if you qualify for a lender-approved short sale with possible relocation assistance.

Start here → avoid foreclosure with a short sale

The State of Foreclosures and Short Sales in Pennsylvania — Spring 2025

Foreclosure rates in Pennsylvania rose from one in every 4,304 homes in April 2025 to one in 4,093 in May, with 1,985 foreclosure starts in the Philadelphia metro. See what this means for homeowners, agents, and title companies and why short sales remain a smart option.

When it comes to distressed property trends in Pennsylvania, the spring 2025 data paints a story of gradual but steady change. After several years of relatively low foreclosure activity, filings have been creeping upward across much of the state — and that movement is starting to ripple into the short‑sale market.

The Numbers Behind the Headlines

Let’s start with the hard facts:

- **April 2025:** Pennsylvania saw one foreclosure for every 4,304 housing units, according to Safeguard Properties.

- **May 2025:** That figure tightened to one in every 4,093 homes, or about 1,412 filings statewide out of 5.78 million units (*ATTOM Data Solutions*).

- **Philadelphia Metro:** During Q1 2025, there were 1,985 foreclosure starts, marking one of the highest quarterly totals since 2022.

While these numbers don’t represent a full‑blown crisis, they do confirm a slow normalization of foreclosure activity following years of artificially low delinquency rates during and immediately after the pandemic.

Regional Hot Spots

Most new filings continue to concentrate around **Philadelphia**, **Allegheny County (Pittsburgh)**, and pockets of **Lehigh Valley**. Rising insurance premiums, higher interest rates, and the expiration of COVID‑era forbearance plans have all contributed to renewed distress in these markets.

Rural and smaller‑metro counties — such as **Luzerne, Berks, and Erie** — have seen smaller but notable upticks as well, suggesting that economic strain is broadening beyond the major metros.

What It Means for Homeowners

For homeowners facing mortgage delinquency or looming foreclosure notices, **time is now the most valuable resource**. The earlier a homeowner acts, the more options remain available — including a short sale, which allows the property to be sold for less than the mortgage balance **before** foreclosure completes.

Unlike foreclosure, a short sale can:

- Limit long‑term credit damage.

- Prevent deficiency judgments in many cases.

- Offer relocation assistance at closing (sometimes thousands of dollars).

If handled correctly, a short sale can bring real relief to a homeowner while still allowing the lender to avoid a lengthy, costly foreclosure process.

Learn more about how we help homeowners complete short sales and move with cash in hand.

What It Means for Real Estate Agents and Title Companies

Agents and title teams are often the first professionals to hear from a distressed homeowner — but these files can quickly stall without specialized guidance. Lenders’ approval processes remain unpredictable in 2025, and missing one document or deadline can mean weeks of lost progress.

That’s where experienced negotiators come in. At **Crisp Short Sales**, we focus exclusively on short‑sale processing — helping real estate agents close short sales faster and with fewer delays. Our team handles lender communication, document collection, and closing coordination from start to finish.

For title companies, partnering early ensures clear title, faster HUD approvals, and consistent communication throughout the transaction.

Looking Ahead

If current trends continue, Pennsylvania’s foreclosure rate could rise modestly through the second half of 2025 — especially in metro areas where adjustable‑rate mortgages are resetting. This uptick will likely drive more homeowners to consider pre‑foreclosure alternatives like short sales.

That means opportunity for proactive agents and title partners who understand the process, build trust with distressed sellers, and collaborate with experienced short‑sale processors.

For homeowners and professionals alike, early action remains the key to smoother outcomes — and that’s exactly what we’re here to facilitate.

Ready to explore your options? Start a short sale today and we’ll walk you through the next steps.

Short Sales & Foreclosures in Arizona 2025: What Title Companies, Agents, and Homeowners Should Know

Arizona’s housing market has long been a bellwether for national real estate trends — and in 2025, the data show a clear rise in distressed sales. Whether you’re a title company preparing files, a real estate agent juggling short sale listings, or a homeowner exploring your options, understanding what’s happening across the state can help you navigate this changing market more effectively.

Rising Distress Levels Across Arizona

According to the ATTOM Mid-Year 2025 Foreclosure Report, Arizona saw roughly 4,191 foreclosure filings between January and June 2025. That represents about 0.13% of all housing units — roughly one filing for every 750 homes statewide.

What’s more striking is the year-over-year jump: foreclosure activity is up 37.3% compared to the same period in 2024. While these numbers are far below the peaks seen after 2008, they indicate that more homeowners are beginning to struggle with higher mortgage rates, cost-of-living pressures, and post-pandemic financial resets.

In April 2025, data from Safeguard Properties show 675 Arizona properties entered foreclosure — translating to one filing for every 4,655 housing units. Counties like Maricopa, Pima, and Pinal have seen the largest concentration of new filings, reflecting both population density and home price growth that outpaced income in recent years.

Short Sales Are Quietly Returning

While foreclosure filings make headlines, short sales often tell the more nuanced story behind them. A short sale allows a homeowner to sell their property for less than what’s owed on the mortgage, with lender approval, avoiding foreclosure and its long‑term credit damage.

In Arizona, many lenders are again open to these negotiations — especially when there’s a cooperative borrower and a clean, well-managed file. For agents and title professionals, this means that short sale coordination is once again becoming a critical skill.

At Crisp Short Sales (https://www.crispshortsales.com/), we specialize in short sale negotiation and processing for homeowners and agents throughout Arizona and across the U.S. From document prep to approval, we manage the entire lender process so closings stay on track and stress stays low.

For Title Companies

If you’re a title or escrow professional, rising short sales can create added complexity in your closing pipeline — extra lien releases, payoff statements, and layered approvals. That’s where having a dedicated short sale partner can save days (and headaches).

Learn more about how we help title companies streamline short sale closings (https://www.crispshortsales.com/how-we-help) and reduce risk when files hit your desk.

For Agents

Agents facing new short sale listings need confidence that the deal will close. Working with a short sale processor like Crisp allows you to focus on marketing and negotiation while we handle the lender side.

We’re already helping real estate agents close short sales faster across Arizona — and because our service is paid by the buyer at closing, there’s no cost to the agent or seller. See who we serve here: https://www.crispshortsales.com/who-we-serve.

For Homeowners

If you’re a homeowner in financial distress, the best move is to act before foreclosure starts. A short sale can help you avoid foreclosure, protect your credit, and even receive relocation assistance at closing. Learn how our process works and what programs might apply to your situation here: https://www.crispshortsales.com/start-short-sale.

The Takeaway

Arizona’s uptick in foreclosure filings doesn’t necessarily mean another housing crisis — but it does signal that distressed sales are back on the radar. For title companies, agents, and homeowners, understanding and preparing for these scenarios is key.

By partnering with an experienced short sale processor, stakeholders can turn distressed deals into closed transactions — keeping clients protected, lenders satisfied, and communities stable.

Sources:

- ATTOM Mid-Year 2025 Foreclosure Report

- Safeguard Properties State‑by‑State Foreclosure Rankings (April 2025)

Short Sales in Nevada 2025: What Rising Foreclosures Mean for Agents, Title Companies & Investors

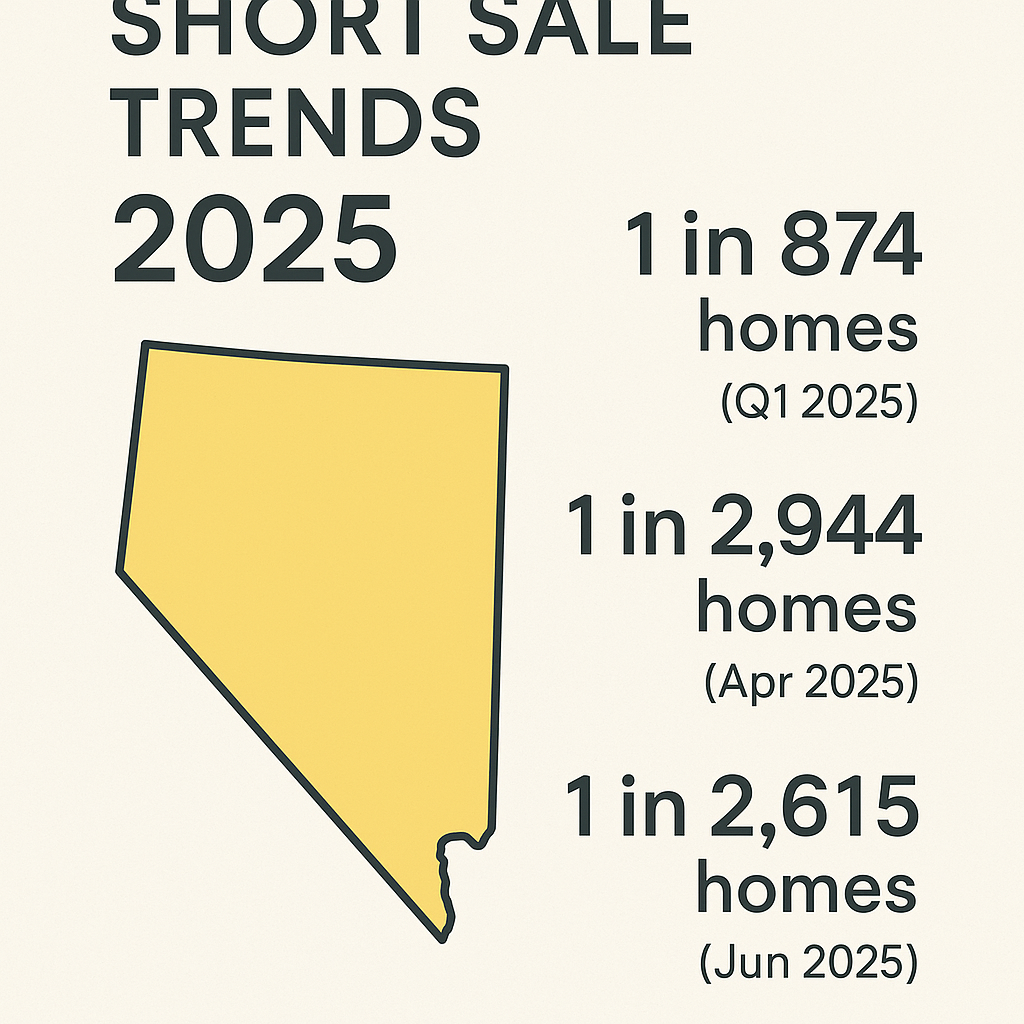

Nevada foreclosure rates are climbing in 2025, with one in 874 homes receiving filings in Q1 and continued distress through April and June. Learn how rising defaults create short sale opportunities for agents, title companies, and investors.

The Nevada real estate market is flashing early warning signs of distress in 2025. While home prices remain stable in many parts of the state, foreclosure filings are on the rise—creating both challenges and opportunities for agents, title companies, and investors who understand how to navigate short sales effectively.

According to ATTOM and The Mortgage Reports, roughly one in every 874 housing units in Nevada had a foreclosure filing in Q1 2025—the equivalent of a 0.114% foreclosure rate, one of the highest in the country. And by April 2025, Nevada still ranked 5th-worst nationally, with one foreclosure for every 2,944 housing units (Safeguard Properties review). Even by June 2025, the state continued to appear on national “worst-performing” lists, averaging one filing per 2,615 homes, according to PR Newswire.

A Rising Need for Short Sale Expertise

These numbers suggest a clear pattern: homeowners are starting to fall behind on payments again, and many may not have the equity cushion they once did. As property values level off and mortgage rates remain elevated, distressed owners who purchased during recent market highs are finding themselves upside-down.

That’s where short sales become critical. A properly managed short sale allows a homeowner to sell for less than what’s owed while avoiding foreclosure—a win for the seller, the lender, and the community at large. For real estate agents, it’s an opportunity to help clients preserve their dignity (and often their credit) while still earning a commission. For title companies, it’s about ensuring a complex closing gets done right, on time, and without last-minute surprises.

At Crisp Short Sales, we specialize in coordinating these transactions nationwide, working behind the scenes so that agents can focus on selling, not lender negotiations.

How Foreclosures and Short Sales Differ in Nevada

Nevada is a non-judicial foreclosure state, meaning lenders can foreclose without going through the courts as long as they follow statutory notice requirements. This often means the timeline from default to sale can move quickly—sometimes within 120 days after the Notice of Default is recorded.

That speed makes early intervention essential. Once a Notice of Default is filed, homeowners and their agents have limited time to pursue a short sale before the property heads to auction. In contrast to foreclosure, a short sale:

- Allows the seller to remain in control of the process.

- May qualify them for relocation assistance or cash incentives at closing.

- Minimizes damage to credit compared to foreclosure.

- Reduces the lender’s losses and keeps neighborhoods stable.

When handled correctly, short sales can prevent the ripple effects of foreclosure—abandoned homes, declining property values, and complicated title issues.

For Agents and Title Companies: Partner Early

The best results come when everyone involved acts early and communicates clearly. Listing agents who recognize signs of distress—such as mortgage delinquency or loan modification paperwork—should immediately reach out to an experienced short sale processor. Title companies can also play a proactive role by identifying encumbrances early and ensuring lien releases are coordinated before closing.

Crisp Short Sales partners with both groups to provide full short sale coordination, document management, and lender negotiation—ensuring a seamless closing for all parties. Learn more about how we help agents and title partners close short sales faster.

Investor Insight: Distressed Opportunities Ahead

For investors, Nevada’s foreclosure uptick may signal a renewed pipeline of short sale opportunities—properties where sellers need immediate solutions and lenders are motivated to approve discounted payoffs. However, working these deals successfully requires precision. Each servicer, investor, and insurer (FHA, VA, Fannie Mae, Freddie Mac, etc.) follows its own playbook. Delays or missteps in documentation can cost months—or worse, kill the deal entirely.

That’s why partnering with an expert short sale negotiator can mean the difference between a lost lead and a closed transaction. Our team at Crisp Short Sales ensures the process runs smoothly from start to finish, helping all parties avoid costly setbacks.

The Bottom Line

Nevada’s 2025 foreclosure data tells a clear story: default activity is climbing again. For real estate professionals who know how to respond, this isn’t just a warning—it’s an opportunity to serve clients better and grow business through short sales done right.

If you’re an agent, title company, or investor navigating distressed properties in Nevada, consider starting a short sale today. Acting early could mean the difference between a foreclosure on record and a fresh start at closing.

Short Sales in Washington (2025): What Agents, Title Companies & Investors Should Watch

Washington’s market is shifting in ways that matter for anyone working distressed real estate. Foreclosure activity is ticking, inventory is climbing, and transaction volume is cooling—conditions that historically set the table for more short‑sale opportunities. Here’s the state-of-play and what it means for your pipeline, negotiations, and timelines.

1) Foreclosure Distress Is Real—and Rising Pockets Mean Opportunity

In April 2025, Washington recorded 427 foreclosure filings across roughly 3.26 million housing units, a rate of 1 in every 7,641 homes. Why that matters: this is measurable distress—enough to generate a steady stream of upside-down homeowners, probate/estate sellers with liens, and investors who need a clean exit. For listing agents and title teams, the signal is clear: be short-sale ready.

If you’re not already lined up with a back-office partner for lender negotiations, valuations, and escalations, now’s the time. (We specialize in

—so you can stay focused on listings, showings, and closings while we do the heavy lifting with the bank.)

2) Transactions Down Sharply = More Pressure on Sellers

In Q1 2025, Washington saw 14,422 single-family transactions, down from 19,730 in the prior quarter and 18,710 in Q1 2024—declines of 26.9% and 22.9% respectively. Fewer closings + longer days on market means more sellers falling behind on payments, HOA dues, taxes, or junior liens. When equity is thin (or negative), owners start to consider options: price cuts, creative concessions, or a short sale.

For investors, this environment rewards speed and clarity. Clean offers with realistic timelines—and documented hardship support—help short-sale files move. For agents, tightening up your intake (hardship story, loan type, arrears, HOA, solar/UCCs, tax liens) before listing will save weeks later. For title companies, early lien discovery is gold—get HOA ledgers, municipal fines, and UCC filings on the table up front.

3) Supply Is Up Double-Digits—And That Tilts the Chessboard

As of September 2025, Washington had 34,199 homes for sale, up 16.9% year-over-year. More choices for buyers = more leverage on price and terms. Sellers who must move (job change, divorce, probate, investor debt stack) suddenly face a market that won’t forgive overpricing or deferred repairs.

Short-sale takeaway: When supply rises, lenders’ net-proceeds expectations get more realistic—especially once BPOs/appraisals reflect longer days on market and competitive price cuts. That’s your window to push for approvals that would have been tough a year ago.

Practical Plays for WA Short Sales Right Now

For Agents

- Pre-listing triage: Confirm loan type (FHA/VA/Conventional/USDA), investor (Fannie/Freddie/portfolio), arrears, forbearance history, HOA balances, solar/PACE/UCCs, and any municipal or tax liens.

- Price with precision: Use active competition, not just sold comps; DOM and price-cut velocity matter to bank BPOs.

- Contract hygiene: Clean offers, earnest money, and buyer commitment to short-sale timelines help you win approvals.

- Communication rhythm: Weekly cadence to lender, buyer, and seller avoids stalls. If you want us to run the lender side, start a file here: start a short sale.

For Title Companies

- Early lien sweeps: Order HOA estoppels, municipal/tax checks, and UCC searches as soon as a short-sale is contemplated. Surprises late = missed closings.

- Net sheet alignment: Sync the preliminary HUD with the lender’s required net (watch for investor minimums, MI contributions, and fee caps).

- Docs that de-friction: Get your short-payoff templates and authorization letters queued on day one. We’re happy to coordinate and handle the bank-side negotiation and document stack.

For Investors

- Underwrite the approval path, not just the ARV: Identify who truly calls the shots (servicer vs. investor vs. MI).

- Tighten timelines without being brittle: Offer flexibility at critical lender milestones: value dispute/BPO challenge, MI contribution asks, junior lien settlements.

- Junior liens: Have a plan (and budget) for small but stubborn seconds, HELOCs, solar liens, and HOA super-priority issues.

Washington-Specific Watchouts We’re Seeing

- Valuation disputes are winnable when you bring fresh comps that reflect current DOM and active inventory pressure. Include condition photos and repair bids—banks respond to specifics.

- HOA and municipal charges (utilities, code, fines) can derail the last mile. Surface them early and build them into the HUD so the investor guide rails aren’t surprised.

- MI contributions can be the hidden gatekeeper. Prepare the seller for hardship letters and supporting documentation that satisfies MI review.

- Escalations matter. When you hit a guideline wall, we escalate to investor or MI with a structured, data-forward case—often the difference between a declined file and a stamped approval.

How We Plug In (So You Don’t Lose Weeks to Phone Trees)

- Lender authorizations, intake, and document conditioning

- Valuation challenges (BPO/Appraisal rebuttals)

- Investor/MI escalations and junior lien settlements

- Weekly updates and HUD/fee alignment with title

Bottom Line for WA (Late 2025)

- Distress exists (documented filings)

- Transactions are down (sellers feel pressure)

- Inventory is up (buyers have options)

New Jersey Short Sales and Foreclosures 2025: What the Data Tells Us

NJ ranks among the top 10 states for foreclosures in 2025. Learn key stats, trends, and how short sales can help homeowners and agents.

New Jersey’s distressed property market is once again making headlines. As foreclosure filings rise nationwide, the Garden State remains among the hardest hit — and for homeowners, agents, and investors alike, that means opportunities and challenges ahead.

Foreclosures Rising Across New Jersey

According to ATTOM’s Mid-Year 2025 U.S. Foreclosure Market Report, 0.18% of all New Jersey housing units had a foreclosure filing in the first half of 2025 — placing the state among the ten highest in the nation.

While that number might seem small, it represents thousands of families and properties under financial stress. By September 2025, data from Safeguard Properties (via ATTOM) showed one in every 3,814 housing units statewide faced a foreclosure filing. The hardest-hit counties were Cumberland, Salem, and Sussex, where older housing stock and slower job growth have amplified economic pressure.

At the start of the year, New Jersey’s foreclosure rate was even higher — one in every 3,442 homes compared to the national average of one in every 4,618 (January 2025, ATTOM data via the New Jersey State Bar Association).

These figures show a steady pattern: New Jersey’s homeowners are experiencing distress at a faster pace than most of the country.

National Trends Help Explain Local Pressure

Nationwide, the third quarter of 2025 brought more concerning numbers. ATTOM’s Q3 2025 report showed foreclosure filings up 17% year-over-year, with foreclosure starts rising 16% and REO (bank-owned) repossessions jumping 33%.

This increase reflects a backlog of delinquent loans now moving through the system after several years of pandemic-era forbearance and legal slowdowns. For markets like New Jersey — where judicial foreclosures can take months or even years — those delayed cases are now catching up.

Short Sales as a Way Out

For homeowners facing default, a short sale remains one of the most effective alternatives to foreclosure. By selling for less than the loan balance (with lender approval), sellers can avoid the long-term damage of a foreclosure on their credit while often walking away debt-free.

Agents who understand this process can save deals that might otherwise fall apart. Working with a specialized short sale negotiation team can help ensure the lender approves the sale quickly and that all closing timelines are met.

At Crisp Short Sales, we handle the lender communications, document prep, and negotiation from start to finish — helping real estate agents close complex short sale transactions faster and with less stress.

For homeowners exploring their options, we also offer guidance on starting a short sale, including how to qualify, what paperwork is required, and how the approval process works.

Why This Matters for 2025

As foreclosure activity continues to climb, short sales are poised to make a comeback. Many lenders now prefer short sales over foreclosure because they minimize losses, keep properties occupied, and speed up recovery of non-performing loans.

New Jersey’s market — with its high home values, longer foreclosure timelines, and dense legal oversight — is uniquely positioned for this shift. That makes short sales not just a safety net for homeowners, but also a valuable strategy for agents and investors navigating a changing market.

For anyone seeing early signs of distress — missed payments, hardship letters, or default notices — acting early can make all the difference. Connecting with a trusted short sale expert before foreclosure proceedings begin can preserve more options and improve outcomes for everyone involved.

The Bottom Line

Foreclosure rates in New Jersey remain among the nation’s highest, but that also means opportunity — for homeowners to resolve debt with dignity, for agents to help clients through difficult transitions, and for investors to participate in rebuilding communities.

If you’re navigating any part of this process, reach out to Crisp Short Sales. Our team specializes in turning distressed situations into closed deals — with empathy, expertise, and proven results.

Maryland Short Sales & Foreclosures: Q2–Sep 2025 Update

Maryland’s distress market is shifting—filings up YoY, short sales rising from a low base, and county hot spots around Baltimore/PG. Here’s the data and what it means.

Maryland’s distress market is moving—but not spiraling. The newest reports show measured, data-driven shifts that buyers, sellers, and agents should understand as we head into year‑end.

Bottom line: filings are up year over year, short sales ticked higher off a small base, and county-level pressure remains concentrated around the Baltimore metro and Prince George’s County. If you’re deciding between loan mod, short sale, or riding it out, the facts below will help you choose the right lane.

The signal in the noise: five stats worth watching

1) Foreclosure filings are up YoY, but context matters. Maryland recorded 3,398 total foreclosure filings in Q2 2025, a +15.5% year-over-year increase. That’s meaningful, but it’s not a wave; it suggests a steady normalization from ultra-low pandemic levels rather than a sudden shock.

2) Monthly momentum nudged higher into summer. New foreclosure filings hit 565 in June 2025, up 10.8% month over month. Nearly half came from Prince George’s County, Baltimore County, and Baltimore City, reinforcing a long-standing geographic pattern: distress concentrates where affordability is stretched and household budgets are sensitive to rate and price changes.

3) Short sales rose—but remain a small share of sales. Maryland recorded 23 short sales in June 2025, up 53.3% from Q1. As a share of all sales, that’s around 0.34%—still a sliver of the market. Translation: short sales are increasing from very low levels, which creates opportunities in individual transactions without defining the overall market.

4) Mid-summer ranking looked elevated… In July 2025, ATTOM ranked Maryland 3rd‑worst foreclosure rate nationally, at 1 filing per 2,566 housing units. That put the state on watch lists and likely contributed to an uptick in investor and servicer activity.

5) …but early fall improved. By September 2025, Maryland’s rank improved to #11 with 768 filings (about 1 in 3,314 housing units). Top counties by rate were Caroline, Charles, and Baltimore City. That month-to-month drift reminds us not to over-read any single print; trends matter more than headlines.

What this means if you’re a homeowner

• If your monthly payment is unsustainable, start the conversation sooner rather than later. Lenders generally offer more options when you’re early. If selling makes more sense than modifying, a well-run short sale can cap losses and avoid a foreclosure mark. If you need a playbook for timelines, net sheets, BPO challenges, or escalation routes, here’s how we handle short sale approval assistance day-to-day.

• Expect more documentation, not less. Investor rules (FHA, VA, GSE, and portfolio guidelines) continue to evolve. Clean packages and clear hardship narratives still drive outcomes. If your file involves junior liens, HOA arrears, tax liens, or solar/UCC filings, plan your release strategy early—the first-lien approval window is not the time to start searching for contact info.

• A short sale is not a fire sale. The “discount” is determined by the investor’s net-proceeds math, property condition, and market comps—not by arbitrary percentages. Market-accurate pricing is the fastest way to approval.

What this means if you’re a real estate agent

• Pipeline planning: With filings up YoY and short sales inching higher off a small base, you’ll likely see more “maybe short” scenarios at listing appointments. Screening for hardship, reinstatement feasibility, and second-lien complexity saves weeks later.

• Time is the currency. Faster approvals come from clean, proactive files: complete packages, correct third-party auths, repair photos, and valuation notes prepared in advance of the BPO. If you’d rather keep your energy on pricing, showings, and offers, we specialize in helping real estate agents close short sales faster—handling lender calls, escalations, value disputes, and lien releases behind the scenes while you stay front-of-house with the client.

• Offer strategy: Buyers can account for third-party fees (including short-sale facilitation) in their offer price and, in some programs, request seller-paid closing costs. The goal is a bank-approved net that works—without killing the deal structure.

Direction of travel (not doom)