Short Sale vs. Foreclosure Timeline: What Homeowners Don’t Realize Until It’s Too Late

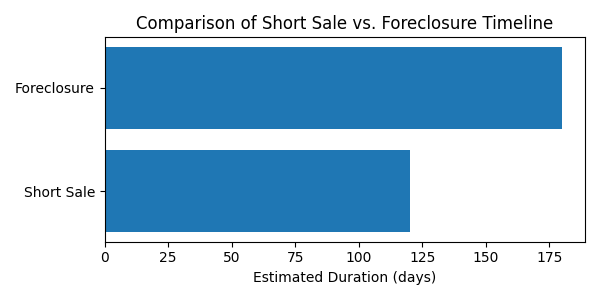

A breakdown of short sale vs. foreclosure timelines explaining how early short sale assistance helps homeowners maintain control, avoid delays, and minimize credit damage.

When homeowners fall behind on their mortgage, the conversation almost always centers on one question:

“How much time do I have?”

Unfortunately, that’s the wrong question.

The real difference between a short sale and a foreclosure isn’t just the final outcome—it’s who controls the timeline, the decisions, and the damage along the way. And most homeowners don’t realize how fast control slips away once foreclosure momentum starts.

Let’s break down what actually happens in each scenario, and why early short sale assistance can completely change the outcome.

The Foreclosure Timeline: Faster Than You Think

Foreclosure feels slow—until it isn’t.

Most homeowners assume they’ll receive plenty of warning before anything serious happens. In reality, the foreclosure timeline accelerates quickly once key deadlines pass.

Here’s what typically unfolds:

- Missed payments trigger default notices

- Legal filings begin (often before homeowners fully understand their options)

- Fees, legal costs, and interest stack up

- Decision-making shifts from homeowner to lender

- Sale dates get scheduled—even while homeowners are still “figuring things out”

Once foreclosure is in motion, options narrow fast. Loan modifications get denied. Buyers hesitate. And homeowners often discover too late that a short sale is still technically possible—but now much harder to execute cleanly.

This is where many deals fail: not because a short sale wasn’t allowed, but because it was started too late and without structure.

The Short Sale Timeline: Slower, but Strategic

A short sale doesn’t stop time—it replaces panic with process.

When started early and handled correctly, a short sale gives homeowners breathing room while maintaining control over key decisions like:

- Who buys the home

- When the sale closes

- How relocation is handled

- What the final credit impact looks like

Unlike foreclosure, a short sale timeline is driven by documentation, valuation, and lender review—not court schedules.

But here’s the catch: banks don’t wait forever.

Delays, missing documents, or sloppy communication can quietly push a short sale past the point of no return. That’s why experienced short sale processing matters far more than most homeowners realize.

What Homeowners Don’t Realize Until It’s Too Late

This is where timelines collide—and mistakes become permanent.

1. Waiting Does Not Buy Time

Many homeowners delay action because they’re overwhelmed or hopeful something will change. Unfortunately, waiting usually reduces options instead of preserving them.

By the time foreclosure notices feel “real,” lenders may already be less flexible.

2. Short Sales Are Front-Loaded

The most important work in a short sale happens early:

authorizations, hardship review, document accuracy, and valuation strategy.

If those pieces aren’t handled properly from the start, approvals stall—or get denied outright.

This is where a dedicated short sale coordinator or short sale negotiator makes a measurable difference.

3. Foreclosure Narrows Buyer Interest

Buyers get nervous when foreclosure timelines tighten. They worry about auctions, title issues, and approval risk.

That reduces leverage and limits offers—exactly the opposite of what homeowners need.

4. Relocation Help Is Time-Sensitive

Relocation assistance (often called “cash for keys”) is far more likely when a short sale is organized early and presented correctly. Once foreclosure progresses, those opportunities often disappear.

At Crisp, this kind of homeowner support is built directly into how we help distressed sellers navigate the process.

Control Is the Real Difference

A short sale isn’t just about avoiding foreclosure—it’s about preserving agency.

Foreclosure is something that happens to homeowners.

A short sale is something homeowners participate in.

When structured correctly, a short sale allows families to:

- Exit with dignity

- Avoid last-minute chaos

- Minimize long-term credit damage

- Move forward on their own timeline

That’s why we focus on short sale assistance that starts early, stays proactive, and doesn’t rely on hope or guesswork.

Whether we’re helping homeowners directly or supporting agents through the process, our role is to keep files moving, lenders engaged, and deadlines under control. You can see exactly who we work with on our who we serve page.

The Right Question to Ask

Instead of asking, “How much time do I have?” Homeowners should be asking:

“How much control do I want to keep?”

If foreclosure is already on the horizon, the window for a successful short sale hasn’t necessarily closed—but it is narrowing.

Starting the short sale process early, with experienced guidance, is often the difference between an orderly transition and a forced one. If you’re considering next steps, this is the moment to start the short sale process before decisions get made for you.

Zombie Foreclosures vs. Short Sales: Why Abandoning Homes Isn’t the Answer

/When most people hear the term “zombie,” they think of horror movies. In real estate, though, zombie foreclosures are a very real issue — and they can haunt communities long after the original owner has moved on.

Zombie foreclosures happen when a home enters the foreclosure process, but the owner vacates before the bank takes title. The property sits abandoned in legal limbo, often boarded up, vandalized, or falling apart. It becomes a neighborhood eyesore, dragging down nearby home values.

According to recent data, about 882,000 investor-owned properties nationwide are vacant — roughly 3.6% of the total. Many fall into this zombie category, especially in parts of the Midwest and Rust Belt.

But here’s the thing: most zombie foreclosures never needed to happen. In many cases, a short sale could have been the solution.

Why Zombie Foreclosures Happen

Owners and even investors sometimes think walking away is the only option when they can’t keep up with payments or when a property becomes a money pit. Common triggers include:

- Financing collapses: A deal falls apart and the owner doesn’t see a way out.

- Title or legal problems: Issues make resale seem impossible.

- Deferred maintenance: Costs spiral beyond what the owner can handle.

- Investor fatigue: A bad flip or rental project leads someone to abandon ship.

Unfortunately, abandonment usually makes things worse. The foreclosure drags on, the property deteriorates, and neighborhoods suffer.

The Short Sale Alternative

Short sales offer a very different path — one that keeps homes out of zombie status. With a short sale, the lender agrees to accept less than the balance owed on the mortgage, allowing the home to be sold to a new buyer before foreclosure completes.

Here’s why that matters:

- For homeowners/investors: Walking away may feel like escape, but it leaves behind liability, credit damage, and potential legal exposure. A short sale, on the other hand, offers closure and the chance to move on without an abandoned property hanging over you.

- For lenders: A zombie foreclosure is costly. The home deteriorates, value drops further, and foreclosure timelines stretch out. A short sale often nets a higher recovery than foreclosure.

- For neighborhoods: A short sale gets a new buyer into the home quickly, stabilizing property values and preventing the blight of a vacant, boarded-up house.

Why Investors Should Care

Investors sometimes see zombie foreclosures as “discount opportunities.” But the reality is: distressed inventory that never becomes zombie in the first place is healthier for everyone.

By working with agents, lenders, and specialists to process short sales, investors can still acquire discounted properties — but without the risks of abandoned homes:

- Clearer titles: Short sales resolve liens and legal issues upfront.

- Occupied until closing: Properties usually remain in better condition when not abandoned.

- Faster timelines: Negotiated short sales often close quicker than waiting for foreclosure backlogs.

- Community goodwill: Investors who buy through short sales help stabilize neighborhoods rather than profiting from their decline.

How to Prevent Zombie Foreclosures

If you’re a homeowner, agent, or investor staring down a potential foreclosure, here are steps to avoid the zombie trap:

1. Don’t walk away. Even if foreclosure seems inevitable, explore your options.

2. Contact a short sale specialist. Professionals like Crisp Short Sales work with lenders daily to negotiate approvals.

3. Move quickly. The earlier in the foreclosure timeline you start, the more likely you’ll succeed.

4. Educate sellers. Many don’t realize that short sales exist or that they can avoid foreclosure through one.

5. Keep communication open. With the lender, the agent, and any potential buyers. Silence is what creates zombie homes.

The Bigger Picture

Zombie foreclosures are a symptom of failed communication and abandoned responsibility. But they don’t have to happen. Short sales offer a structured, managed way out — one that protects owners, gives lenders better recoveries, and keeps neighborhoods intact.

At Crisp Short Sales, we’ve spent 15+ years helping agents, investors, and homeowners prevent deals from becoming zombie properties. When everyone works together, these “horror stories” can turn into smooth closings instead.

Final Takeaway

Zombie foreclosures are rising, but they don’t need to. With the right support, distressed homes can be transitioned through short sales — a win for sellers, lenders, investors, and communities alike.

Learn more about how we help and who we serve.