Why Banks Approve Short Sales Faster with the Right Negotiator

Learn how a skilled short sale negotiator speeds up approvals, prevents delays, and gets deals closed faster by leveraging lender relationships, preventing mistakes, and keeping everyone engaged.

When it comes to short sales, speed is everything. The longer a deal drags out, the more risk for everyone involved: sellers face mounting stress, agents risk losing commissions, and buyers may walk away in frustration. What most agents and investors quickly discover is that banks don’t always move fast on their own. That’s where having the right negotiator in your corner makes all the difference.

At Crisp Short Sales, we’ve seen firsthand how the right process, communication, and persistence can shave weeks—or even months—off a bank’s approval timeline. Here’s why having a skilled short sale negotiator can get your deal to the closing table faster.

Banks Aren’t Built for Speed

Banks are massive organizations with layers of departments, portals, and guidelines. Files often get passed from one rep to another, and the seller’s hardship package can sit untouched for weeks if nobody is pushing it forward.

Agents handling a short sale themselves often underestimate just how much time is lost waiting for responses. Even if you submit documents on time, lenders will often claim something is missing, outdated, or needs “resubmission.” Each back-and-forth costs precious days.

A dedicated short sale negotiator keeps the file alive, checking in daily with the lender and making sure the process doesn’t stall.

Direct Lender Relationships Save Time

Here’s a secret: banks often move faster for people who know the system. Skilled negotiators maintain direct lines to escalation teams, supervisors, and investor departments that most agents can’t reach.

Instead of waiting in the general queue, a negotiator can bypass delays and push files to the right person. This isn’t about cutting corners—it’s about knowing the lender’s workflow better than the average rep on the phone.

Preventing Costly Mistakes

Short sales get denied or delayed for simple, preventable errors:

- Missing signatures on hardship letters

- Incorrect HUDs or settlement statements

- Outdated paystubs or bank statements

- Valuation disputes left unchallenged

Each of these mistakes can set a deal back weeks. The right negotiator doesn’t just submit paperwork—he or she audits every detail to make sure the bank has exactly what it needs the first time.

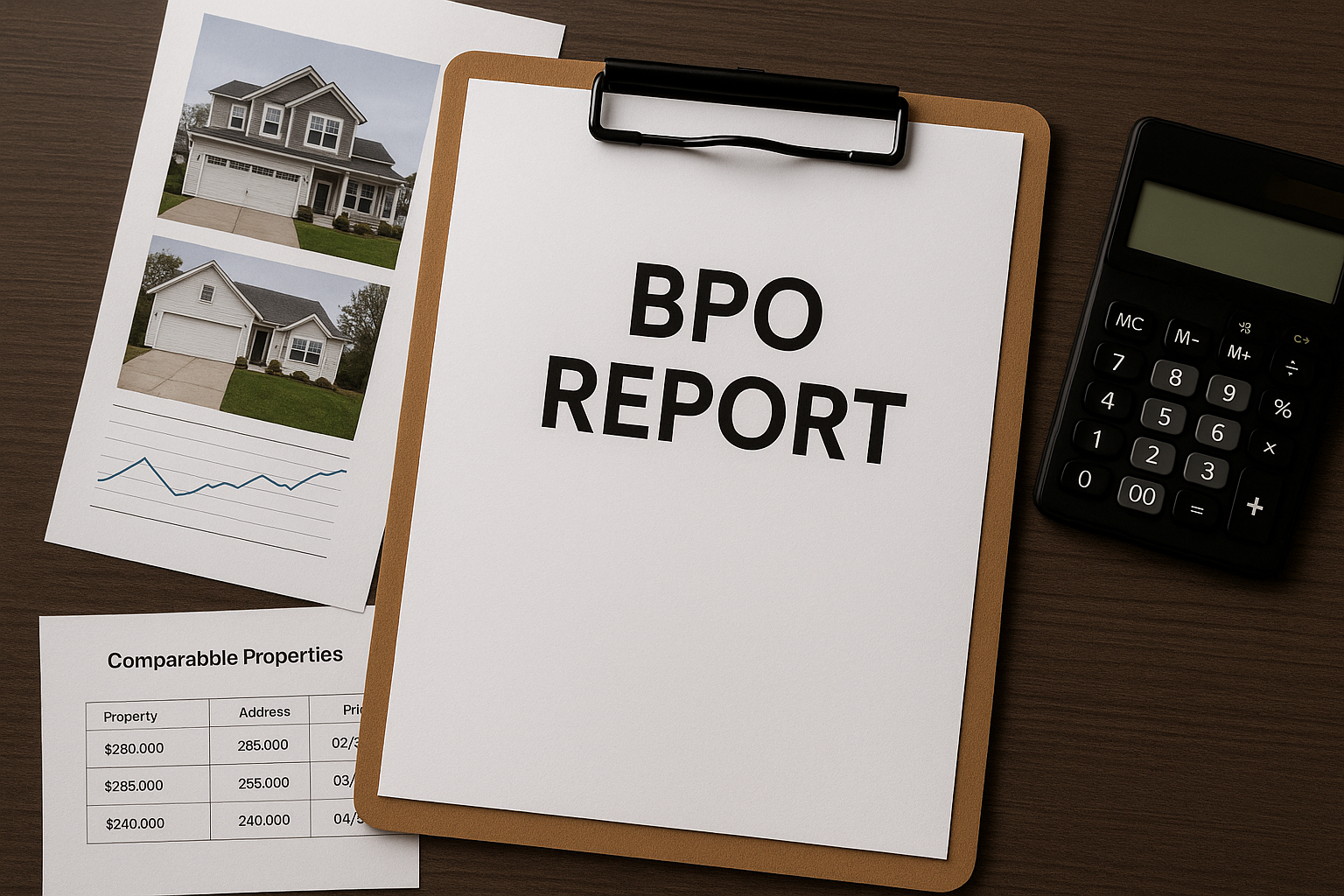

When valuation issues arise (like a BPO that comes in too high), a skilled negotiator can fight the number, provide comps, and argue for a realistic value that keeps the deal alive.

Keeping Buyers and Sellers Engaged

The longer a short sale drags on, the more likely buyers will walk away or sellers will give up. Every delay increases the risk of foreclosure. A negotiator’s job is not just dealing with the bank—it’s keeping communication flowing so everyone stays on board.

By setting expectations, giving weekly updates, and showing progress, a negotiator keeps confidence high. That consistency is often what saves a deal when nerves start to fray.

Agents Close More Deals with Less Stress

For agents, the value is clear: outsourcing negotiation means you can focus on what you do best—selling. Instead of chasing bank reps for status updates or re-submitting forms, you’re free to market properties, meet clients, and grow your business.

Meanwhile, the negotiator handles the behind-the-scenes battles that ultimately make your paycheck possible. Faster approvals mean smoother closings, happier clients, and more repeat business.

Why Crisp Short Sales Gets Faster Approvals

At Crisp Short Sales, we’ve spent more than 15 years fine-tuning the short sale process. We know which lenders need daily follow-ups, which ones require specific HUD formats, and how to escalate files before they hit a dead end.

Our near-perfect closing record isn’t luck—it’s the result of knowing how to keep banks moving. Agents and investors who work with us consistently see faster approvals, fewer surprises, and deals that actually get to the closing table.

Final Thoughts

A short sale without the right negotiator can feel like pushing a boulder uphill. With the right negotiator, the process becomes manageable, predictable, and—most importantly—faster.

If you’re an agent or investor staring down a complicated short sale, don’t let the bank’s delays kill your deal. Partner with a team that knows how to push files through and get them approved the first time.

👉 Learn more about how we help agents and investors

👉 See who we serve

👉 Start your short sale today

Short Sale Timelines: What Agents and Sellers Should Expect

Learn how long short sales take, from listing to closing. Get realistic timelines and tips for agents, sellers, and buyers.

If you’ve ever been involved in a short sale, you know one truth: patience isn’t optional. Short sales don’t close on the same timeline as traditional sales, and the waiting game can be tough on sellers, agents and buyers alike. But when everyone understands the process up front—and has realistic expectations—short sales can move far more smoothly.

In this post we’ll walk through the typical short sale timeline, highlight what each party should expect along the way and share insider tips to keep deals from dragging on longer than necessary.

Step 1: Listing and Offer (1–4 weeks)

The process begins like any other listing: the homeowner hires an agent, the property is marketed and buyers come through the door. But here’s the difference: instead of focusing on what’s owed on the mortgage, the home should be priced at true market value.

Banks won’t approve an unrealistic list price. If an offer comes in too high, the bank will reject it. If it comes in too low, the deal may stall. That’s why agents experienced in short sales often list properties right in line with local comps.

Pro tip for agents: Be upfront with buyers from the start—this deal won’t close in 30 days. Set expectations now and you’ll avoid headaches later.

Step 2: Submitting the Short Sale Package (1–2 weeks)

Once there’s an offer, the seller (with their agent’s help) must submit a short sale package to the lender. This package typically includes:

- Hardship letter from the seller

- Proof of income and expenses

- Bank statements

- Offer and purchase contract

- Listing agreement and MLS sheet

- Preliminary HUD or net sheet

Banks won’t even begin their review until this package is complete. Missing documents = automatic delays.

Pro tip for sellers: Be responsive. Every day you delay sending docs is another day the bank delays starting the file.

Step 3: Lender Review and BPO/Appraisal (3–6 weeks)

Here’s where the waiting really begins. Once the package is submitted, the lender assigns the file to a negotiator and orders a BPO (Broker Price Opinion) or appraisal. This valuation determines whether the bank believes the buyer’s offer is fair.

The agent often has influence here. By meeting the BPO agent at the property and providing comps that support the offer price, they can help ensure the valuation doesn’t come in unrealistically high.

Pro tip for agents: Prep your comps like you’re going into battle. The lender’s number will make or break this deal.

Step 4: Negotiation and Approval (4–8 weeks)

Once the valuation is in, negotiations kick off. The lender may counter the offer, request updated documents or ask for more information. If there are multiple lien holders (like a second mortgage or HOA lien), each one must be negotiated separately.

The approval process can be the most unpredictable part of the timeline. Some banks respond quickly, while others seem to move at glacial speed.

Pro tip for all parties: Keep communication consistent. Weekly check-ins with the lender are essential. Don’t assume silence means progress—it usually means your file is sitting at the bottom of the pile.

Step 5: Closing (2–4 weeks after approval)

Once the approval letter arrives, the rest of the process looks much more like a traditional sale. Buyers finalize financing, title orders payoff letters and closing is scheduled.

The lender’s approval letter will include strict timelines—often requiring the deal to close within 30 days or less. At this stage, everyone must move fast.

Pro tip for buyers: Have financing lined up before approval. If you wait until after the approval letter, you could miss the bank’s deadline and lose the deal.

The Typical Timeline: 60–120 Days

While no two short sales are exactly the same, here’s a realistic breakdown:

- Listing & Offer: 1–4 weeks

- Short Sale Package Submission: 1–2 weeks

- Lender Review & Valuation: 3–6 weeks

- Negotiation & Approval: 4–8 weeks

- Closing: 2–4 weeks

Total: 60–120 days from accepted offer to closing.

Yes, that’s longer than a traditional sale—but not endless. And when managed by an experienced short sale negotiator, the process often lands closer to the 60–75 day range.

Why Deals Drag Out Longer

Sometimes short sales stretch to six months or more. Why? Common culprits include:

- Incomplete or delayed document submission

- Lender backlog or staff changes

- Lowball offers far below market value

- Second lien holders refusing to compromise

- Buyers walking away mid-process

Pro tip for agents and sellers: Hire a short sale specialist early. An experienced negotiator can often anticipate lender hang-ups before they happen and push the file forward.

Final Word: Patience + Preparation = Success

Short sales may not be “short,” but they are absolutely doable with the right strategy and expectations. Sellers should understand that the process takes time. Agents should prep buyers to stay patient. And banks—well, they’ll always move at their own pace.

The good news? With preparation, persistence and an expert on your side, a short sale can close successfully—giving sellers relief, buyers a fair deal and agents a commission on what might otherwise be a lost cause.

Want to dive deeper into the short sale process? Check out our other resources on the Crisp Short Sales blog, including guidance on preventing short sale pitfalls and maximizing relocation assistance. If you’re ready to start your own short sale, contact our short sale specialists for hands-on help.

Why Banks Approve Short Sales: Inside the Lender’s Mindset

When most homeowners first hear the term “short sale,” they think of it as a last resort — a way to avoid foreclosure when the mortgage balance is higher than the home’s current value. But here’s the little-known secret: banks often want to approve short sales.

That might sound strange at first. After all, banks are in the business of lending money, not forgiving debt. So why would a lender agree to accept less than what’s owed? The answer lies in the numbers, timelines, and risk management. Once you understand how banks think about short sales, the process becomes much clearer — and easier to navigate.

1. Foreclosure Is Expensive for the Banke..

Foreclosure isn’t just tough on homeowners — it’s costly for lenders, too. When a borrower stops paying, the bank suddenly has a non-performing asset on its books. Every month that passes without payment costs them money.

Then there are the added expenses:

-Attorney fees and court costs (especially in judicial foreclosure states).

- Property preservation costs like lawn care, security, and repairs.

- Insurance and taxes that the bank often ends up covering.

- Holding costs while the home sits empty.

By the time a foreclosure is completed, a bank might spend tens of thousands of dollars on top of the loan loss itself. A short sale often looks like the cheaper, faster option.

2. Short Sales Save Time

Foreclosure timelines vary widely — a few months in some states, years in others. The longer it drags out, the more uncertainty (and expense) for the bank.

A short sale, by contrast, can resolve the situation in a matter of months. Instead of waiting for auctions, red tape, and post-foreclosure sales, the bank receives an immediate offer from a buyer who actually wants the property. That certainty of resolution is attractive to lenders.

3. Market Value vs. Paper Value

Banks understand that a loan balance doesn’t necessarily equal a home’s market value. If a borrower owes $300,000 but the home is only worth $240,000, the lender can either:

- Foreclose and maybe sell for around $240,000 (after months or years of costs).

- Approve a short sale for roughly the same amount, with no added holding expenses.

It’s a math problem — and most of the time, approving the short sale nets them more in the end.

4. Vacant and Distressed Homes Lose Value Fast

Every month a distressed home sits unsold, it usually loses value. Vacancies lead to vandalism, water leaks, and general neglect. The bank knows this. A quick short sale with a real buyer helps them lock in today’s value instead of taking the risk that the property will deteriorate further.

5. Short Sales Are Documented Losses They Can Justify

From a compliance perspective, lenders need clean files to explain losses to investors, regulators, or mortgage insurance companies. A short sale provides that:

- A broker price opinion (BPO) or appraisal shows the property’s fair value.

- A legitimate hardship letter explains why the borrower can’t pay.

- A signed purchase contract proves the market has spoken.

This makes it much easier for the bank to check the box, close the file, and move on.

6. Short Sales Can Improve Customer Relations

Surprisingly, banks also care about reputation. Foreclosures are seen as cold and predatory. Approving a short sale, on the other hand, gives the lender a chance to say they “helped” a borrower avoid foreclosure. That goodwill — however small — can matter in the eyes of regulators, the media, and future borrowers.

What This Means for Agents and Homeowners

If you’re a homeowner considering a short sale, or a real estate agent representing one, the takeaway is this: banks are not your enemy in the process.

They may be slow, they may be bureaucratic, and they may ask for piles of paperwork — but ultimately, they want to find a resolution that minimizes their losses. A clean, complete short sale package gives them exactly what they need to say yes.

Tips to Get the Bank on Board Quickly

1. Price at market value, not payoff value. Banks care about today’s value, not what the loan balance says.

2. Submit a complete package upfront. Missing documents are the #1 cause of delays.

3. Communicate clearly and often. Lenders want updates, not silence.

4. Anticipate valuation disputes. If a BPO comes in too high, have comps ready to challenge it.

5. Set realistic expectations with sellers. Remind them banks aren’t approving short sales out of charity — it’s a financial decision.

Final Thought

Short sales exist because they make sense for everyone involved: the homeowner avoids foreclosure, the buyer gets a property at fair market value, and the bank saves time and money.

When you step into a short sale negotiation, remember — you’re not asking the lender for a favor. You’re offering them a smarter alternative to foreclosure. And once you see it from their perspective, the path to approval becomes a whole lot clearer.

How Relocation Incentives Work in a Short Sale

If you’re facing a short sale, chances are money is already tight. Between missed mortgage payments, mounting bills, and the stress of moving, most homeowners feel completely tapped out. That’s why one of the most overlooked benefits of doing a short sale is the possibility of getting relocation assistance—cash in your pocket at closing to help you move on.

Sounds too good to be true? Let’s break it down.

What Is Relocation Assistance in a Short Sale?

Relocation assistance (sometimes called “cash for relocation” or “relocation incentive”) is money a bank offers the homeowner at closing of a short sale. Unlike myths about foreclosure “cash-for-keys” programs, this money isn’t about walking away quietly. It’s about helping you land on your feet after selling your home for less than you owe.

Instead of leaving you high and dry, lenders recognize that if you succeed in closing a short sale, they avoid the long, expensive foreclosure process. To encourage you to complete the sale, they’re often willing to sweeten the deal with a financial incentive.

How Much Can You Get?

The amount varies, but here’s a typical range:

- Government-backed loans (FHA, VA, USDA): relocation incentives usually fall between $1,000–$3,000.

- Fannie Mae & Freddie Mac loans: Up to $3,000 for approved short sales.

- Private lenders or investor-owned loans: sometimes $5,000–$10,000 or more depending on the situation.

Keep in mind—these incentives are only available if the short sale closes successfully. If the deal falls apart, the offer disappears.

Who Pays for It?

This isn’t money that comes from your buyer or your agent. It’s paid directly by the lender at closing. The bank essentially allocates a small piece of its loss to help you transition out of the property.

Do You Qualify?

Not every short sale automatically comes with relocation assistance, but here are the common requirements:

- You must be living in the property as your primary residence.

- The short sale must be approved and completed.

- You must not have caused “avoidable delays” in the process.

- The lender or investor must participate in the program (not all do).

If your home is vacant or you’ve already moved out, some lenders may reduce or deny relocation funds—but others still approve them. It’s case-by-case, and this is where having an experienced short sale negotiator makes all the difference.

Why Lenders Offer Relocation Incentives

Banks aren’t handing out money out of generosity. The math is simple:

- Foreclosure costs them tens of thousands in legal fees, repairs, and time.

- Short sales close faster and return more money to the lender.

- A small cash payment to you ensures you cooperate, move on, and complete the deal.

For them, it’s an investment in efficiency. For you, it’s much-needed breathing room.

How to Maximize Your Chances of Getting Paid

1. Ask upfront. Don’t assume your lender will offer it automatically. Put the request in writing.

2. Stay cooperative. Respond to document requests quickly and keep communication open.

3. Work with a pro. An experienced short sale negotiator knows which lenders offer relocation assistance and how to position your file to qualify.

4. Close cleanly. If the deal drags or collapses, the incentive disappears.

Bottom Line

Relocation assistance in a short sale is real—and it can make a huge difference during a tough transition. While it won’t erase all the stress of selling your home for less than you owe, it can help you cover moving trucks, security deposits, or even just give you a financial reset.

For more information about how we assist homeowners and the types of sellers we serve, read our How We Help and Who We Serve pages.

How Relocation Incentives Work in a Short Sale

If you’re facing a short sale, chances are money is already tight. Between missed mortgage payments, mounting bills, and the stress of moving, most homeowners feel completely tapped out. That’s why one of the most overlooked benefits of doing a short sale is the possibility of getting relocation assistance—cash in your pocket at closing to help you move on.

Sounds too good to be true? Let’s break it down.

What Is Relocation Assistance in a Short Sale?

Relocation assistance (sometimes called “cash for relocation” or “relocation incentive”) is money a bank offers the homeowner at closing of a short sale. Unlike myths about foreclosure “cash-for-keys” programs, this money isn’t about walking away quietly. It’s about helping you land on your feet after selling your home for less than you owe.

Instead of leaving you high and dry, lenders recognize that if you succeed in closing a short sale, they avoid the long, expensive foreclosure process. To encourage you to complete the sale, they’re often willing to sweeten the deal with a financial incentive.

How Much Can You Get?

The amount varies, but here’s a typical range:

- Government-backed loans (FHA, VA, USDA): Relocation incentives usually fall between $1,000–$3,000.

- Fannie Mae & Freddie Mac loans: Up to $3,000 for approved short sales.

- Private lenders or investor-owned loans: Can be more flexible, sometimes offering $5,000–$10,000 or more depending on the situation.

Keep in mind—these incentives are only available if the short sale closes successfully. If the deal falls apart, the offer disappears.

Who Pays for It?

This isn’t money that comes from your buyer or your agent. It’s paid directly by the lender at closing. The bank essentially allocates a small piece of its loss to help you transition out of the property.

Do You Qualify?

Not every short sale automatically comes with relocation assistance, but here are the common requirements:

- You must be living in the property as your primary residence.

- The short sale must be approved and completed.

- You must not have caused “avoidable delays” in the process.

- The lender or investor must participate in the program (not all do).

If your home is vacant or you’ve already moved out, some lenders may reduce or deny relocation funds—but others still approve them. It’s case-by-case, and this is where having an experienced short sale negotiator makes all the difference.

Why Lenders Offer Relocation Incentives

Banks aren’t handing out money out of generosity. The math is simple:

- Foreclosure costs them tens of thousands in legal fees, repairs, and time.

- Short sales close faster and return more money to the lender.

- A small cash payment to you ensures you cooperate, move on, and complete the deal.

For them, it’s an investment in efficiency. For you, it’s much-needed breathing room.

How to Maximize Your Chances of Getting Paid

- Ask upfront. Don’t assume your lender will offer it automatically. Put the request in writing.

- Stay cooperative. Respond to document requests quickly and keep communication open.

- Work with a pro. An experienced short sale negotiator knows which lenders offer relocation assistance and how to position your file to qualify.

- Close cleanly. If the deal drags or collapses, the incentive disappears.

Bottom Line

Relocation assistance in a short sale is real—and it can make a huge difference during a tough transition. While it won’t erase all the stress of selling your home for less than you owe, it can help you cover moving trucks, security deposits, or even just give you a financial reset.

If you’re considering a short sale, don’t leave money on the table. With the right guidance, you could walk away debt-free and with a check in hand.

For more information about how we assist homeowners and the types of sellers we serve, read our How We Help and Who We Serve pages.

Short Sale vs. Loan Modification: Helping Homeowners Choose the Right Path

Discover how short sales and loan modifications compare and learn which option can help homeowners avoid foreclosure and move forward with confidence.

When homeowners fall behind on their mortgage, the stress can feel overwhelming. Collection calls, past-due notices, and the looming threat of foreclosure create a sense of panic that makes it hard to see the options clearly. Two of the most common paths forward are a short sale and a loan modification. Both are designed to provide relief, but they work in very different ways.

So which is the right path? The answer depends on the homeowner’s situation, their goals, and the lender’s willingness to cooperate. Let’s break it down in plain English.

What Is a Loan Modification?

A loan modification is exactly what it sounds like: a permanent change to the terms of your existing mortgage. The lender may lower your interest rate, extend the length of the loan, or roll missed payments back into the balance. The goal is to make the monthly payment affordable so the homeowner can stay in the property.

Common features of loan modifications include:

– Interest rate reduction – dropping the rate to lower the payment.

– Extended term – stretching the loan out over more years.

– Forbearance of arrears – adding missed payments to the end of the loan.

– Principal reduction – rare, but sometimes lenders forgive part of the balance.

For homeowners who want to keep their house and have stable income going forward, a loan modification can be a lifesaver.

What Is a Short Sale?

A short sale happens when a homeowner owes more on the mortgage than the property is worth and negotiates with the bank to accept a sale for less than the balance due. The lender agrees to release the lien and forgive the deficiency (or at least not pursue it), allowing the homeowner to walk away from the property without foreclosure on their record.

Key features of short sales:

– The property is listed and sold on the open market.

– The lender must approve the contract before closing.

– Homeowners typically pay no out-of-pocket costs (commissions and closing fees are covered by the bank).

– Short sales usually take 60–120 days to process.

For homeowners who can’t afford the house anymore—or simply want a fresh start—a short sale provides closure and a path forward without the damage of foreclosure.

Comparing the Two

Factor | Loan Modification | Short Sale

--- | --- | ---

Goal | Keep the home | Transition out

Eligibility | Must show ability to pay going forward | Must show hardship and negative equity

Timeline | Usually 30–90 days | Usually 60–120 days

Impact on Credit | Negative, but less than foreclosure or short sale | Negative, but often less severe than foreclosure

Future Buying Power | Can usually refinance or buy again in 1–2 years | Can buy again in 2–3 years (Fannie/Freddie guidelines)

Emotional Factor | Relief of staying in the home | Relief of moving on cleanly

How to Decide

Choose loan modification if:

– You want to keep the property.

– You have steady income to support a reduced payment.

– You’re only behind due to a temporary setback (job loss, medical bills, etc.).

Choose short sale if:

– The house is too expensive even with lower payments.

– You’ve relocated, or the home is vacant.

– The property is worth significantly less than what you owe.

– You’re ready for a clean break and to move on.

The Role of the Lender

One thing homeowners don’t always realize: lenders don’t have to approve either option. A modification has to make financial sense for the bank, and a short sale has to net them at least as much—or more—than they’d get at foreclosure auction.

That’s where having an experienced negotiator makes all the difference. A strong package, clean documentation, and clear communication with the bank can mean the difference between approval and denial.

Where We Come In

At Crisp Short Sales, we specialize in making sure short sales actually close. Too many homeowners and agents try to go it alone, only to watch deals drag on for months or collapse completely. We streamline the process, deal directly with the lender, and make sure everything moves toward closing.

Whether you’re an agent representing a seller or a homeowner exploring your options, the first step is understanding which path fits your situation best. Sometimes a loan modification makes sense. Other times, a short sale is the smartest move.

Either way, the most important thing is not waiting until foreclosure is just days away. The earlier you take action, the more options you have—and the better the outcome.

Final Thoughts

A loan modification can give you breathing room and let you stay in your home. A short sale can help you avoid foreclosure and start fresh. Both are valuable tools, but the right one depends on your goals and your finances.

If you’re unsure which path is best, don’t try to figure it out alone. Talk to a trusted advisor who understands both processes and can guide you toward the solution that makes the most sense for you.

At Crisp Short Sales, we’re here to help homeowners and agents find that path—and get to the closing table with less stress and more certainty.

Why Cash Buyers Love Short Sales (and How Sellers Benefit)

When a homeowner is facing foreclosure, a short sale can feel like the only light at the end of a very long tunnel. But here’s a little secret: cash buyers—especially seasoned investors—absolutely love short sales. And that’s not a bad thing. In fact, when investors jump in, sellers often benefit in ways they didn’t expect.

Cash Buyers Thrive on Distress Deals

Investors make their living finding properties with built-in equity opportunities. A short sale is exactly that: a home being sold for less than what’s owed. Since banks are motivated to cut their losses rather than deal with foreclosure, these homes often hit the market below typical pricing.

For a cash buyer, it’s like walking into a clearance aisle. For a seller, this means your listing is far more attractive to investors, which increases the chances of getting an actual buyer under contract quickly. For more tips on keeping your short sale moving, check out our advice on why some short sales stall and how to keep yours moving.

Speed is the Name of the Game

Traditional buyers often need weeks (sometimes months) for loan approvals, appraisals, and underwriting. In a short sale, where every day counts, that delay can be deadly.

Cash buyers eliminate that problem. They don’t need mortgage approvals, so they can close faster once the bank issues its short sale approval. For homeowners, this can mean shaving weeks off the timeline—sometimes the difference between approval and foreclosure.

Banks Prefer Cash Buyers Too

Here’s something many agents and homeowners don’t realize: banks reviewing short sales love to see a cash offer. Why? Less risk.

Financing contingencies mean more opportunities for deals to fall apart. If a buyer’s loan is denied, the bank is back at square one. A cash buyer signals certainty—the deal is almost guaranteed to close once approved. That assurance can help push the file across the finish line, as explained in what happens after you accept a short sale offer.

Sellers Don’t Pay the Investor’s Discount

One common misconception is that if an investor gets a “deal,” the seller somehow loses out. Not true in a short sale.

Remember, the seller isn’t pocketing any money in the transaction—the lender is the one taking the loss. So when an investor buys at a discount, it doesn’t harm the homeowner’s bottom line. In fact, sellers still get the same benefits: avoiding foreclosure, wiping out debt, and potentially qualifying for relocation assistance.

Relocation Assistance is Still on the Table

Cash buyers don’t interfere with relocation incentive programs. In fact, a strong cash offer may make it more likely that the deal closes, which means the homeowner actually receives the relocation funds (instead of losing them if the short sale collapses).

The Win-Win Dynamic

At first glance, it might feel like investors are just hunting for bargains at a seller’s expense. But in reality, their motivation to buy fast and close reliably is exactly what makes short sales succeed.•.

• Investors win by securing a property below retail.

Homeowners win by avoiding foreclosure, protecting their credit, and moving forward with dignity.•

That’s the essence of a short sale: everyone gives a little, but everyone gains something too.

Final Thoughts

Cash buyers aren’t the enemy in short sales—their ability to pay cash and move quickly often turns them into the heroes. If you’re a homeowner considering a short sale, don’t shy away from investors. Their ability to pay cash and move quickly could be the very thing that saves your home from foreclosure and gives you the fresh start you need.

At Crisp Short Sales, we specialize in bringing these pieces together—negotiating with banks, connecting with serious buyers, and ensuring sellers walk away with the best outcome possible.

The Top 5 Myths About Short Sales—And the Truth Behind Them

Debunk five common myths about short sales and learn the truth behind each misconception to help sellers and agents navigate short sale transactions with confidence.

When it comes to short sales, misinformation is everywhere. Sellers hear one thing from a neighbor, agents read something online from ten years ago, and buyers assume short sales are just “foreclosure light.”

The truth? Short sales are a unique, highly strategic transaction that can benefit everyone involved—when handled correctly. Let’s break down the five biggest myths about short sales and uncover the reality behind each one.

Myth /#1: Short Sales Always Take Forever

It’s true—years ago, short sales had a reputation for dragging on for six months or more. Back then, lenders were still figuring out the process, and delays were common.

The Truth: With the right negotiator and proper file preparation, many short sales can be approved in 60–90 days, sometimes even faster. At Crisp Short Sales, we pre-package every file with exactly what the lender needs, cutting weeks off the timeline.

Myth #2: Short Sales Hurt Your Credit Just Like a Foreclosure

One of the scariest misconceptions is that a short sale damages your credit just as badly as losing your home to foreclosure.

The Truth: While any late mortgage payments will impact your credit, a completed short sale is typically far less damaging than foreclosure. More importantly, a short sale can allow you to recover financially faster—often making you eligible for a new mortgage in as little as two years, compared to seven after a foreclosure.

Myth #3: The Seller Has to Pay All the Costs

Many homeowners avoid short sales because they think they’ll be hit with big fees they can’t afford.

The Truth: In most cases, the lender pays the real estate commissions and negotiator’s fees. At Crisp Short Sales, there’s no cost to the seller or their agent—ever. Our fees are built into the transaction and paid by the buyer’s side at closing.

Myth #4: Short Sales Mean the Seller Is Walking Away With Nothing

There’s a common belief that in a short sale, the homeowner hands over the keys and walks away empty-handed.

The Truth: Many lenders offer relocation assistance at closing—sometimes thousands of dollars—to help sellers move. This incentive is especially common when the short sale is part of a government program or negotiated properly.

Myth #5: Any Agent Can Handle a Short Sale Without Extra Help

While any licensed real estate agent can technically list a short sale, that doesn’t mean they should try to manage the entire process alone.

The Truth: Short sales require specialized knowledge of lender processes, document requirements, and negotiation tactics. Without it, deals fall apart. That’s why experienced negotiators like Crisp Short Sales exist—to protect the deal, keep communication flowing, and make sure the closing actually happens.

Short sales are often misunderstood, but when done right, they can be a win-win for everyone involved—lenders avoid costly foreclosures, sellers avoid devastating credit damage, and buyers can secure great properties.

The key is working with someone who knows the process inside and out. At Crisp Short Sales, we’ve spent over 15 years perfecting our system so short sales close faster, smoother, and with less stress for everyone.

If you’re a seller or an agent with a short sale on your hands, start a short sale with us today. You might be surprised how quickly we can turn a “hopeless” situation into a done deal.

Why Some Short Sales Stall — And How to Keep Yours Moving

If you’ve ever been involved in a short sale, you know it’s not a straight shot to closing. In fact, a short sale can feel more like a winding road with a dozen stop signs — and a few unexpected detours. Why? Because there are so many moving parts, and so many different parties and stakeholders, that if just one person slows down, the whole transaction can come to a crawl.

That’s where an experienced short sale processor steps in. Think of a good processor as a transaction air-traffic controller — keeping all the planes (lenders, sellers, buyers, title companies, agents) from colliding or circling endlessly in a holding pattern. Without someone coordinating all of those moving pieces, it’s far too easy for one delay to snowball into a stalled deal.

The Usual Suspects: Why Short Sales Get Stuck

While every file is different, here are some of the most common reasons a short sale grinds to a halt:

Too Many Hands, Not Enough Coordination

You’ve got the listing agent, buyer’s agent, title company, lender, negotiator, and sometimes multiple lien holders. If no one is proactively managing the communication, files get buried and deadlines get missed.

Lender Delays

Banks are notorious for long response times. Your file could sit for weeks unless someone is calling, emailing, and escalating it up the chain. Without regular follow-up, the lender’s “inbox” can feel like a black hole.

Incomplete or Outdated Documentation

Missing pay stubs, expired bank statements, unsigned forms — any gap in paperwork can stop the approval process cold. Lenders won’t move forward without every box checked.

Special Program Rules (Looking at You, FHA)

FHA loans come with their own “waterfall” process for loss mitigation. Homeowners must first be evaluated for modification or other retention options before the bank will even look at a short sale offer. Skip that first step, and you’re in for weeks — or months — of delays while the bank “completes” the required process.

How to Keep a Short Sale Moving

The good news? Most stalls can be avoided — if you know what to watch for.

Assign a Dedicated Short Sale Processor

A short sale processor acts as the glue holding the transaction together. They coordinate between all parties, keep everyone updated, and push for next steps before bottlenecks appear.

Stay in the Lender’s Ear

If you’re not following up regularly, you’re leaving the timeline to chance. Persistent (and polite) calls, emails, and documented escalations keep your file on the radar — and often get it moved up the pile.

Front-Load Documentation

Gather, review, and submit all required documents upfront — and keep them updated. Expired paperwork is a surprisingly common reason for delays.

Understand the Rules Before You Start

If the loan is FHA, VA, or another program with special requirements, start by mapping out the exact steps the bank will require. Work the process instead of fighting it.

The Bottom Line

Short sales are complex. They have a lot of moving parts, and there are plenty of opportunities for things to get stuck along the way. But with an experienced short sale processor coordinating the process, staying on top of the lender, and making sure all the required steps are followed — even tricky ones like FHA’s waterfall — you can avoid the most common roadblocks and keep your deal moving forward.

In other words: don’t let your short sale stall out. Keep the momentum, and you’ll keep the closing date on track.

Ready to start a short s ale? Visit our How We Help page to get started.

What Happens After You Accept a Short Sale Offer?

Learn the steps to navigate the short sale process after accepting an offer, with guidance for both homeowners and agents.

Accepting a short sale offer is an exciting step—but it’s really just the beginning. Whether you’re a homeowner trying to avoid foreclosure or a real estate agent guiding a client through the process, knowing what happens after the seller says “yes” can make the difference between a smooth approval and a stressful delay.

The Seller Chooses the Offer

In any real estate transaction, the sale of your home is a contract between the buyer and the seller, so the seller decides which offer to accept—not the bank. You’re not obligated to take the highest offer or meet any specific criteria. The decision is yours, based on what’s best for your situation.

Buyer Documentation: Proof They Can Perform

After acceptance, the buyer must show they have the ability to close. For cash buyers this means proof of funds; for financed buyers it means a pre‑qualification or pre‑approval letter. If the buyer is purchasing through an LLC, the lender will also require articles of organization listing all members and documentation that the person signing has authority to do so.

Ordering Title & Checking for Liens

Once the offer and buyer documentation are ready, work with your local title company or closing attorney to order title. The title report will list all liens, mortgages, and judgments on the property. Disclosing everything upfront prevents last‑minute surprises that could derail approval.

The Preliminary Closing Statement

Next, the title company or attorney will prepare a preliminary closing statement (also called an estimated settlement statement) outlining all of the costs on the seller side of the transaction. This includes mortgage payoff amounts, property taxes owed, title and attorney fees, HOA dues or special assessments, and transfer taxes. For homeowners, this is your first look at the numbers. For agents, it’s a required part of the short sale submission.

Submitting the Package to the Lender

Finally, your short sale negotiator will submit the executed purchase contract, buyer’s proof of funds or pre‑qualification, LLC documentation if applicable, the full title report, and the preliminary closing statement to the lender. From here, the bank will begin its review process, which may include ordering a valuation, verifying the buyer’s qualifications, and reviewing the seller’s hardship documentation.

Why This Process Matters

For homeowners, knowing what to expect keeps you in control and reduces stress, and providing complete documentation early helps speed up bank review. For agents, a well‑organized submission positions you as a professional who makes the bank’s job easier—which can lead to faster approvals and fewer deal‑killing delays.

The Bottom Line

Once a short sale offer is accepted, it’s not time to sit back—it’s time to move quickly. Each step, from collecting buyer documents to ordering title and preparing the preliminary closing statement, sets the stage for lender approval. When sellers, agents, and negotiators work together to get a complete package to the bank early, short sales can move surprisingly fast—and everyone gets to the closing table with less stress.

Ready to navigate your own short sale? Start a Short Sale or learn How We Help with Crisp Short Sales.

Why Banks Take So Long to Approve Short Sales (And How to Speed It Up)

Learn the 3-step short sale process, why banks delay approvals, and how to speed it up with one simple strategy.

If you’ve ever been involved in a short sale, you know the process can feel like waiting in the world’s slowest line — except instead of coffee at the end, you’re hoping for lender approval. While the delays can be frustrating, understanding how banks work behind the scenes can help you navigate the process more effectively (and maybe even shave off a few weeks).

The 3-Step Short Sale Process

Step 1: Qualifying the Homeowner

This is where most delays happen. Before the bank will even think about the offer on the table, they have to confirm that the homeowner qualifies for a short sale. This means proving a legitimate financial hardship — think job loss, medical expenses, divorce, or other life events that make it impossible to keep up with the mortgage.

The lender will also require a hefty stack of documents, which can include:

- Hardship letter

- Recent pay stubs (or proof of unemployment)

- Bank statements

- Tax returns

- Mortgage statements

- HOA statements (if applicable)

The challenge? Many files stall here because the bank won’t move forward until every single document they request is in their hands. Missing one form or an outdated bank statement can send you right back to the start.

Pro Tip: Gather all the required documents before you submit anything to the lender. Sending a complete package from day one can dramatically speed up Step 1.

Step 2: The Valuation

Once the bank agrees the homeowner qualifies, they order a valuation to determine what the property is worth in today’s market. This is usually done via a Broker Price Opinion (BPO) or a full appraisal.

Valuations are important because they set the lender’s expectations for what they’ll accept. If the valuation comes back close to your offer, you’re in good shape. If it comes in high, you might need to challenge it with better comps.

The good news? This stage usually moves faster than Step 1. A BPO can be completed in a few days, and a full appraisal might take a week or two.

Step 3: Offer Review and Decision

Finally, the lender reviews the offer. They’ll weigh the net proceeds against the property’s value and decide whether to accept, counter, or reject it.

If everything’s in order, this step can wrap up surprisingly quickly — sometimes in a matter of days. But if there are multiple lienholders, HOA debts, or unresolved title issues, you could be looking at more delays.

Why Each Step Gets Faster

The reason things usually speed up as you go is simple: the bank has more invested in the file. Once they’ve confirmed hardship and spent money on a valuation, they want to see it through. Plus, later steps involve fewer moving parts — no more chasing down pay stubs or hardship letters.

How to Keep the Process Moving

If you want to avoid the dreaded “file under review” limbo, here are my top tips:

1. Get organized early. Gather every document the bank might ask for before you even start.

2. Double-check everything. Make sure forms are complete, signatures are in place, and nothing is outdated.

3. Respond quickly. If the bank asks for an update or additional info, send it the same day whenever possible.

4. Work with someone experienced. Short sales are full of small details that can cause big delays if missed.

Bottom Line

Short sales can be slow, but they don’t have to feel endless. By preparing a complete file upfront, you can get through the toughest part — Step 1 — faster, which sets the pace for the rest of the process.

If you’re tired of waiting on hold with the bank and chasing paperwork, that’s exactly what I handle every day. I make sure short sales move from start to finish as smoothly (and quickly) as possible — so you can focus on the deal, not the delays.

The One Document That Can Make or Break Your Short Sale Approval

Learn how to write a strong hardship letter that can make or break your short sale approval, including what to include, common mistakes, and final tips.

When it comes to short sales, there’s one document that can make the difference between a smooth approval and a flat-out denial — and it’s not the contract, the HUD, or the bank’s net sheet.

It’s the hardship letter.

This simple, 1‑2 paragraph statement can be the deciding factor in whether your lender agrees to accept less than what’s owed on your mortgage. And yet, it’s often the most rushed, under-thought, or misunderstood part of the short sale package. Let’s change that.

### What is a Hardship Letter?

A hardship letter is a short, personal statement explaining why you can no longer afford your mortgage and must sell the home in order to avoid foreclosure.

At one point, you were able to make the payments. Then something changed — a job loss, medical emergency, divorce, relocation, or another life event — and now you can’t.

Your hardship letter connects the dots for the lender, showing them there’s a valid, long-term financial hardship that justifies approving the short sale.

### Why It Matters So Much

Banks and mortgage investors don’t approve short sales just because a homeowner *wants* to sell — there has to be a verifiable reason you can’t continue paying the loan.

Your hardship letter:

- Sets the tone for your entire short sale review.

- Humanizes the file, turning a stack of paperwork into a real story.

- Supports other documents like pay stubs, bank statements, and tax returns.

- Helps the lender check a key approval box: “Is there a valid, ongoing hardship?”

Without a convincing hardship letter, even the best-priced offer and cleanest file can stall.

### How to Write a Strong Hardship Letter

You don’t need to be a professional writer. In fact, the best hardship letters are straightforward and honest. Keep it to 1‑2 paragraphs and include:

1. **Your situation before the hardship** – Briefly explain that you could afford the mortgage when you bought the home.

2. **What changed** – State the specific event or events that caused your income to drop or expenses to rise.

3. **Why selling is the only option** – Make it clear that a short sale is the only way to avoid foreclosure, and the hardship is long-term.

**Example:**

"When I purchased my home in 2016, I was fully employed and able to comfortably afford the monthly payments. In January of this year, I lost my job due to company downsizing. While I have been actively seeking new employment, my current income is not enough to cover the mortgage, utilities, and basic living expenses. I have depleted my savings and fallen behind on payments. Selling the home through a short sale is the only option to avoid foreclosure and further damage to my credit."

### Common Mistakes to Avoid

- Being vague — “I just can’t afford it anymore” isn’t enough.

- Over-explaining — Don’t turn it into a life story; stick to the facts.

- Blaming the lender — Keep it professional, not emotional.

- Forgetting to sign and date — Most lenders require a wet signature.

### Forms vs. Free-Written Letters

Some lenders require you to complete their specific hardship affidavit form instead of a free-written letter. Others will accept either. Always check your short sale package requirements — sending the wrong format can delay the file.

Even on a form, your written explanation should follow the same structure above.

### Final Tips for Success

- Sign and date the letter in ink unless your lender specifically allows electronic signatures.

- Be truthful — lenders can and will verify your financial hardship.

- Submit it early with your short sale package to avoid delays.

The hardship letter may be short, but it’s a make-or-break document. Done right, it shows the lender you’ve experienced a legitimate, lasting change in circumstances — and that approving the short sale is the most reasonable outcome for everyone involved.

For more on boosting your reputation as an agent, check out our pos on **5 Ways Short Sales Can Actually Boost an Agent’s Reputation (and Repeat Business)**.

And if you’re looking to keep your sale on track, don’t miss **How to Win Over a Short Sale Buyer**.

5 Ways Short Sales Can Actually Boost an Agent’s Reputation (and Repeat Business)

Learn how mastering short sales boosts your reputation, attracts referrals and repeat business, and even earns lender referrals.

When most agents hear the words short sale, they think headache. But done right, short sales are one of the fastest ways to stand out, earn trust, and create a steady stream of referrals. In today’s market, more homeowners are underwater or slipping behind on payments. The agents who can confidently guide them through a short sale don’t just save deals — they build reputations that attract the next listing.

Below are five practical ways mastering short sales grows your brand and book of business.

1) Position yourself as a problem-solver with tools others don’t have

Anyone can put a sign in the yard. Far fewer can structure a file, prep a seller, and shepherd a bank approval on a tight timeline. When you can explain—in simple terms—how you’ll guide a homeowner from “we owe more than it’s worth” to an approved closing, you’re no longer just a salesperson. You’re the pro who brings an extra toolbox: packaged financials, clean hardship letters, correct valuations, and tight buyer terms. That reputation sticks.

Tip: In your listing consult, outline your process with a one-page checklist. Show the seller you already have a path that works.

2) Market yourself as the trusted short sale expert—while others avoid them

Distressed homeowners get bombarded by wholesalers and sketchy “debt relief” mailers. You can be the professional alternative. Publish simple explainers, share recent wins, and speak in plain English about timelines, approvals, and what the bank actually cares about (net). You’ll attract sellers directly—and other agents who want help—but you’ll also build a brand as the calm problem‑solver who gets complex deals closed the right way.

Reinforce that positioning on your site’s How We Help page and point sellers to our secure Start a Short Sale form.

3) Set yourself up for referrals directly from lenders

Quietly, some servicers and third‑party platforms maintain “go‑to” lists of agents who’ve proven they can close. When your files are clean, your updates are timely, and your approvals convert to closings, you get remembered. That can lead to inbound referrals—listings you didn’t spend a dollar to acquire. It’s simple: make the bank’s job easier, and they’ll want more of you.

Tip: After a smooth closing, send a short thank‑you recap to the negotiator with bullet points of what went right. Professional, concise, unforgettable.

4) Represent both sides—earn double commission (ethically and by the book)

Short sales reward preparation. If you’ve done the work to price correctly, educate buyers, and keep everyone aligned, you’re in a strong position to bring the buyer, too. With proper disclosure and compliance with local rules and brokerage policy, dual agency or designated agency can be permissible—and it often streamlines the path to approval. Smoother file, fewer surprises, faster closing—and yes, potentially both sides of the commission.

Tip: Set expectations early with buyers about lender timelines and required terms (as‑is, realistic inspection windows, proof of funds). Fewer re‑trades, happier lender.

) Partner with local bankruptcy and divorce attorneys

Many attorneys have clients who are stuck—behind on payments, overwhelmed, and unsure of options. A short sale can be the cleanest exit, but it’s not always on their radar. Build relationships with BK and family‑law attorneys. Offer to be their “short sale on‑call” resource, and you’ll become part of their solution set. That’s not just lead flow—it’s credibility that multiplies over time.

Tip: Create a one-page “Attorney Partner Sheet” explaining how your process protects clients, timelines to expect, and what documents you’ll need.

The bottom line

Short sales aren’t just rescue missions. They’re reputation makers. When you show up as the pro who can turn complexity into progress—ethically, transparently, and efficiently—you win listings, earn referrals (sometimes from the lender), and become the agent people call when the deal looks tough. Don’t run from short sales. Lean in, build the muscle, and watch your pipeline grow.

Helpful resources on our site

• How we help agents & homeowners

• Start a short sale (secure intake)

• Who we serve

How to Win Over a Short Sale Lender: Proven Negotiation Tips

If you want to get a short sale approved quickly, you’ve got to make life easy for the lender. These negotiation tips help you secure approvals faster and with better terms.

If you want to get a short sale approved quickly, one thing is certain: you’ve got to make life easy for the lender. The faster they can review, the sooner your file moves forward — and the better your odds of getting the terms you need.

Here are my proven tips for m

aking lenders say "yes" more often.

1. Start With a Complete Package

One of the biggest mistakes I see is sending the lender bits and pieces of the short sale file. Every missing document means another delay, another round of emails, and another chance for the file to get buried on someone’s desk.

Send a completehardship letter, financials, offer, preliminary HUD, HOA statements, tax records, and anything else the lender needs. The goal is to make it as easy as possible for the negotiator to finalize their review and push the file to the next stage.

2. Control the Valuation Process

When the lender orders a valuation, make sure it’s an interior appraisal or Broker Price Opinion (BPO), not just a drive-by. Drive-bys miss critical details and often inflate values because the appraiser never sees the inside condition.

And here’s the most important part: don’t let the homeowner open the door. The listing agent should be the one who meets the appraiser or broker, goes over the comps, and walks them through the property’s true condition.

Take the time to explain market dynamics, the repairs needed, and anything else that justifies your pricing. Why? Because when this makes it into the appraisal or BPO report, it becomes part of the lender’s official record — and that can make all the difference in negotiations.

3. Negotiate Closing Costs Smartly

When you send the preliminary HUD, ask for everything up front — transfer taxes, HOA fees, attorney’s fees, repairs, and other legitimate costs.

Here’s a pro tip: slightly overestimate certain costs like property taxes if possible. If the lender comes back asking you to cut somewhere to meet their net requirements, you’ve got room to give without touching the core deal terms.

4. Keep Commission Requests Reasonable

While it’s tempting to push for more, never ask for more than a 6% total commission. Many lenders see a higher number as an open invitation to negotiate — and that often means they come back with something even lower than you wanted. Keep it simple, keep it standard, and avoid the risk of triggering unnecessary cuts.

5. Always Ask for Relocation Assistance

Many lenders will pay the seller a relocation incentive at closing to help with moving costs. It’s not guaranteed, but if you don’t ask, you won’t get it.

This can be a win-win: the homeowner gets help moving on, and the lender knows they’ve smoothed the way for a clean, on-time closing.

Final Word

Winning over a short sale lender isn’t about magic words or secret back channels — it’s about preparation, control, and smart negotiating. Give them a complete file, make sure the valuation reflects reality, and position your numbers so you’ve got room to move.

Follow these steps, and you’ll see more approvals, faster timelines, and fewer headaches for everyone involved.

Why Some Short Sales Move Faster Than Others

When a short sale drags on for months, most agents and homeowners blame the bank servicing the loan. It’s an easy assumption — after all, the servicer is the one you’re talking to. But here’s the truth: it’s not always the bank that’s slowing things down.

In many cases, the real pace-setter is the investor who owns the mortgage behind the scenes.

If you understand who really calls the shots — and how their rules work — you can predict timelines more accurately, avoid frustrating delays, and even help approvals happen faster.

Servicer vs. Investor: Who’s Really in Charge?

The bank or servicer (like Mr. Cooper, PHH, Wells Fargo, etc.) is the middleman. They collect payments, handle customer service, and process your short sale paperwork.

But the investor — the entity that actually owns the mortgage — is the one that sets the guidelines and ultimately approves or denies the short sale.

Think of it like a property manager vs. landlord: the property manager may be who you deal with, but the landlord makes the final decision.

Why Timelines Vary So Much

Different investors have different rules for reviewing and approving short sales. Here are some of the most common examples and how they impact speed:

1. FHA & VA Loans – The “Waterfall” Requirement

If the investor is FHA or VA, the process is rarely quick. That’s because they require the homeowner to first go through a waterfall process — a series of “retention options” to see if the homeowner can keep the property before they’ll even consider a short sale.

Retention options might include:

Loan modification

Forbearance

Partial claim

Repayment plan

Only after the homeowner is found ineligible for these options can the short sale review begin. Translation: you’re looking at built-in delays before the real work even starts.

2. Fannie Mae – The HomePath Advantage

When Fannie Mae owns the loan, your offer will likely go through their HomePath system.

Here’s the upside:

The platform gives you direct access to Fannie Mae’s approval process.

You can often bypass some of the traditional back-and-forth with the servicer.

In many cases, this speeds up the review compared to other investors because you’re communicating closer to the decision-maker.

3. Mr. Cooper – Equator-Driven Process

Mr. Cooper requires short sale files to be managed through Equator — a platform built specifically for short sales and other loss mitigation processes.

Pros:

Clear, trackable task list.

Built-in messaging for quick updates.

Cons:

You must complete every single task in the system before the file moves forward.

Missing or delaying one step can stall the whole process.

For agents and negotiators who know how to work Equator efficiently, this system can keep things organized and moving.

4. PHH – Reverse Mortgage Specialists

PHH handles a large volume of reverse mortgage short sales.

These can be much more straightforward because:

The homeowner usually isn’t making payments.

The lender already expects to be paid from the sale or claim.

As a result, PHH can sometimes offer a streamlined review process — but only if you know their documentation requirements up front.

The Big Takeaway: Know the Process, Win the Timeline

A short sale’s speed has less to do with whether you’re working with “Bank A” or “Bank B” and more to do with:

Who owns the loan (the investor)

What their approval process looks like

How quickly you can get them what they need

The more you know about your specific investor’s playbook, the more you can:

Set realistic expectations with your client.

Gather the right documents early.

Push the right buttons to keep the file moving.

How Crisp Short Sales Keeps Deals Moving

We’ve worked with just about every type of investor out there — FHA, VA, Fannie Mae, Freddie Mac, private portfolios, hedge funds, you name it. That means we don’t just submit paperwork and hope for the best.

We tailor our approach to each investor’s process, anticipate their requests, and sidestep unnecessary delays.

The result? More approvals, faster closings, and happier agents and sellers.

If you’ve got a short sale that’s stalling — or you just want to make sure the next one moves as quickly as possible — reach out to Crisp Short Sales and let’s get it moving.

Why BPOs Can Make or Break Your Short Sale Approval

Lender valuations are the most critical part of the short sale process—and listing agents have more control than they realize. Learn how to influence the BPO and get your deal approved.

If there’s one part of the short sale process that has the power to move your deal forward—or sink it entirely—it’s the lender’s valuation.

Whether it’s a Broker Price Opinion (BPO) or a full appraisal, this step determines how the bank views the home’s worth, and more importantly, what they’re willing to accept to release the lien. And while many homeowners and agents assume this part is out of their control, that couldn’t be further from the truth.

Why the Valuation Matters So Much

The bank’s entire decision to approve or reject your short sale hinges on one thing: net proceeds. And how do they calculate what’s acceptable? By comparing your offer to what their assigned agent or appraiser says the property is worth.

If that valuation comes in close to your offer, your deal has a solid shot. If the value comes in too high, expect a rejection—or worse, a counter that scares off your buyer.

So what can you do? A lot more than you might think.BPOs vs. Appraisals: What’s the Difference?

Short sales typically involve one of two valuation methods:

• BPO (Broker Price Opinion): Completed by a local real estate agent chosen by the lender.

• Appraisal: Ordered by the lender and conducted by a licensed appraiser.

The good news? BPOs are easier to challenge if the number comes in too high. If you believe the valuation is off, you can submit comps, condition reports, and market data—and the bank may accept a revised opinion or order a second BPO.

Appraisals, on the other hand, are harder to dispute. Most lenders simply go back to the original appraiser to confirm their comps. Even if you spot glaring issues, you’re unlikely to see a significant change.

That’s why it’s so important to set the stage before the valuation even happens.

The Listing Agent’s Hidden Power

You might not realize it, but the listing agent has a huge role in influencing the lender’s valuation. Here’s how to do it right:

1. Price the Home at Current Market Value

This is not the time to anchor to the original mortgage balance. Banks don’t care what’s owed— they care what the home is worth today. Listing at market value signals to the BPO agent (and the bank) that you’ve done your homework.

2. Get the Strongest Offer You Can

A solid, well-qualified offer close to list price strengthens your case and sets the bar for what the bank might accept. It also adds legitimacy to your valuation argument.

3. Support the Valuation with Evidence

Before the BPO or appraisal visit, provide the evaluator with:

• Recent comparable sales (especially distressed or as-is comps)

• A brief condition report noting repairs or damage

• Market trends (DOM, price reductions, etc.)

• Your logic for the listing price

Make it easy for them to include your narrative in the final report. In most cases, what you show them ends up on the bank’s desk—literally.

How We Help Smooth the Process

At Crisp Short Sales, we coach agents through this exact process on every file. We help identify the right list price, prepare supporting documentation, and even advise on how to talk to the BPO agent during the walk-through.

If the valuation still comes in too high, we know how to build a dispute that actually gets traction. Our goal is simple: get you to the closing table faster—without the headaches or delays.

If you want more short sale approval tips or need a second opinion on your short sale BPO, we’re here to help.

Want help on your next short sale? Reach out and let’s review the file together. We’ll make sure the valuation doesn’t stand in your way.

FAQs

What happens if the BPO value is too high?

The lender will likely reject the current offer or counter too high for the buyer. You may need to dispute the value with better comps or request a second BPO.

Can a short sale be approved if the offer is below the valuation?

Sometimes, yes—especially if other factors like condition or buyer strength come into play. But your chances are far better if the offer is close to or matches the valuation.

How do I challenge an incorrect appraisal or BPO?

Submit a dispute with supporting documentation: updated comps, contractor estimates, photos of needed repairs, and market analysis. BPO disputes are more likely to succeed than appraisals.

Can You Pay Off HOA Debt in a Short Sale?

HOA balances can be a major hurdle in a short sale—but the good news is, they can often be paid at closing. Here’s what to know about lenders, liens, and negotiating with your HOA.

If you’re behind on your HOA dues and facing a short sale, one big question always comes up: Can the HOA be paid off at closing? The answer is yes—often it can. But like most things in the short sale world, it depends on a few key details.

Let’s break down how HOA debt works in a short sale, who pays what, and how to avoid surprises that could derail your closing.

Yes, HOA Debt Can Be Paid Through the Sale

In a short sale, the lender agrees to accept less than what’s owed on the mortgage, and all other debts tied to the property—like HOA balances—must be negotiated as part of the deal.

The good news? HOA debt can usually be paid off through the proceeds of the sale.

But not all mortgages are created equal. Whether your lender will allow HOA balances to be paid depends on who owns your loan and their specific guidelines.

Investor Guidelines Matter (A Lot)

Behind every mortgage is an investor—the actual party that owns your loan—and they set the rules for what expenses can be approved at closing.

Here’s how it usually breaks down:

FHA and VA Loans: These government-backed loans are the strictest. They often limit how much can be paid to an HOA, and in many cases, the relocation incentive offered to the seller is the only approved source of HOA payoff funds. That means if you want the HOA paid, you may need to give up your relocation money to make it happen.

Privately-Owned Mortgages: These loans are more flexible. Private investors tend to care most about their net proceeds, not which party gets paid what. If paying off the HOA helps the deal close and the numbers work, they’ll usually allow it.

The key is to work with someone who knows how to structure the deal and present the right breakdown to the lender.

What If the HOA Balance Is Too High?

Sometimes the HOA debt is more than the lender wants to cover. That’s when negotiation becomes critical.

You have two potential paths:

If There’s a Lien: You’ll need to work with the HOA’s attorney. They’re the gatekeeper when a lien has been filed. Lien payoffs must be cleared before closing, and sometimes these include thousands in legal fees or penalties.

If It’s Just Unpaid Dues (No Lien): Then you’re dealing with the HOA board directly. These are often your neighbors—or at least people in the community—so outcomes can hinge on relationships and personalities. Some boards are understanding and willing to help; others… not so much.

It’s worth noting: HOAs do have the power to reduce or waive fees. While they’re not required to, many are open to it—especially if they know they’ll never recover the full balance otherwise.

A Real-World Tip

If you’re the homeowner, don’t panic if the HOA bill is larger than expected. Late fees, attorney costs, and special assessments can pile up—but you’re not automatically stuck paying them out of pocket.

Work with an experienced short sale processor (like us at Crisp) who can negotiate both with your lender and the HOA to find a resolution. We’ve seen massive balances get cut in half—or even eliminated entirely—when approached the right way.

The Bottom Line

Yes, HOA debt can be paid in a short sale—but success depends on the type of mortgage you have, the investor’s rules, and your processor’s ability to navigate the personalities and policies involved.

At Crisp Short Sales, we’ve helped homeowners close deals even when the HOA balance seemed impossible. If you’re unsure how to proceed, let us help you map it out.

We specialize in achieving short sale approval with HOA debt and can provide short sale help with HOA dues. Learn more about FHA rules for short sale HOA payoffs. For personalized assistance, work with a short sale processor.

FAQ

Can HOA attorney fees be included in a short sale?

Yes, but it depends on your lender’s guidelines. Privately owned loans are more likely to allow this, while FHA and VA loans may limit how much can be paid.

What if the HOA won’t reduce the amount owed?

If the HOA insists on full payment, we can still work with the lender to cover the balance—especially if the numbers work. If not, sometimes the relocation incentive can help bridge the gap.

Do I have to pay the HOA myself before the short sale can close?

Not necessarily. With the right strategy, that debt can often be paid out of the sale proceeds—even if you’re not contributing anything out of pocket.

Can I Still Sell My Home If I’m Behind on Payments?

Falling behind on your mortgage doesn’t mean you’ve lost the ability to sell. In fact, it’s often the reason short sales get approved. Here’s what to know.

Short answer? Yes, absolutely. In fact, being behind on payments is one of the biggest reasons short sales get approved in the first place.

If you’re struggling to make your mortgage payments and wondering whether you still have the option to sell your home, you’re not alone. A lot of homeowners think that missing payments disqualifies them from selling—but when it comes to short sales, that couldn’t be further from the truth.

Let’s clear up a few common misconceptions and walk through what really matters in these situations.

Falling Behind Signals Financial Hardship—And That’s the Point

Many homeowners think that in order to look responsible or show “good faith,” they need to keep paying their mortgage throughout the short sale process. But here’s the thing:

The bank isn’t looking for responsible. They’re looking for distressed.

Short sales are designed to help homeowners who are underwater and cannot afford to keep paying. If you’re current on your mortgage, the lender may question whether you truly need assistance. But if you’ve missed payments and can show a legitimate hardship—job loss, divorce, medical bills, relocation—you’re actually a much stronger candidate for approval.

So no, you don’t need to drain your savings to keep making payments just to try and “look good.” That won’t help your case—in fact, it might hurt it.

What About HOA Dues and Property Taxes?

Another common concern is falling behind on HOA fees or property taxes. But good news: you don’t need to panic about those either.

When we help facilitate a short sale, we typically negotiate those debts into the transaction, meaning the bank may agree to pay off back dues at closing. That includes:

• Past-due HOA balances (even with late fees or attorney costs)

• Unpaid property taxes

• Municipal liens or nuisance violations

This is one of the big advantages of working with an experienced short sale processor—we know how to structure the deal to clear all those obstacles so you walk away clean.

But Keep the Lights On, Please

While you don’t need to keep up with mortgage or HOA payments, there’s one area where staying current does matter: your utilities.

Keeping the power, water, and gas on helps ensure:

• The home is ready for showings and inspections

• Buyers don’t get spooked by disconnected services

• You avoid surprise liens from utility companies at closing

If utilities are shut off, it can delay the process—or worse, kill the deal entirely. So if possible, keep those services active until we close.

Selling While Behind Is Common—And Doable

Falling behind on mortgage payments can feel overwhelming, but it doesn’t mean you’re out of options. In fact, that’s usually the moment when a short sale makes the most sense.

You don’t need to be ashamed or afraid to ask for help. This is exactly what short sales are for—and we’re here to guide you through it every step of the way.

If you’re already behind on payments and considering a short sale, let’s talk. We’ll help you understand your options, navigate the process, and get to the closing table with as little stress as possible.

Learn more about your options: short sale options for homeowners in distress, help selling house with late mortgage, short sale while behind on mortgage, or work with a trusted short sale processor.

FAQs

Can I start a short sale even if I’ve missed several mortgage payments?

Yes. Being behind on your mortgage often strengthens your short sale case, as it shows the lender you’re truly experiencing financial hardship.

Do I have to catch up on HOA fees and taxes before I can sell?

No. In most cases, those debts can be paid at closing as part of the short sale. We negotiate those into the deal for you.

Should I still pay utilities during a short sale?

Yes. Keeping the utilities on helps the sale process go smoothly and avoids extra costs or liens.

Top 5 Short Sale Myths Homeowners Still Believe

Short sales are misunderstood—and costly myths are everywhere. Here are 5 of the most common ones homeowners believe, and what you actually need to know.

Top 5 Myths Homeowners Believe About Short Sales

And why they might be costing you money, time, and peace of mind

If you’re underwater on your mortgage and exploring options, you’ve probably heard of a short sale. But there’s a lot of misinformation floating around—especially online and even from well-meaning friends or agents who haven’t done one in a while.